JPMorgan wants to roleplay as SoftBank

Also: We’re getting close to self-driving cars

Monday. We’re still digesting the latest news from Israel and Palestine, but hostages held by Hamas in Gaza have been freed and it appears the ceasefire is holding. Big questions remain regarding the future of Gaza, but we can celebrate today.

CO was off last Friday due to what parents in the business call a childcare crisis. That meant we didn’t get a chance to talk about the massive equity selloff and constituent crypto chaos. The good news, at a few days’ remove, is that asset values are bouncing back. To work! — Alex

📈 Trending Up: Dutch-Chinese relations … IPOs in India … Lunar nuclear power … pop theology? … robotic elder care … more AI in Slack … Meta’s cost basis … domestic food prices … press freedom in India

Advanced Chinese manufacturing is sending Western executives into despair, per The Telegraph, though doubts remain about China’s overall economic health

📉 Trending Down: Microsoft’s stake in OpenAI … Russian coal miners … college towns … media consolidation on the cheap … global mental health

Things That Matter

JPMorgan wants to roleplay as SoftBank: As Beijing gatekeeps rare earth minerals (more here), the U.S. curbs semiconductor exports to China and Europe shows its teeth (see the first entry in Trending Up), financial powerhouse JPMorgan Chase is saying it wants to help fund American resilience.

The bank has pledged to invest $10 billion through “direct equity and venture capital investments” to limit the nation’s “relian[ce] on unreliable sources of critical minerals, products and manufacturing.”

So much for economies enjoying the fruits of comparative advantage. We’re entering a period of bloc-based inter-dependency, though there’s no intention to foster friendships.

JPMorgan’s not new to venture capital: Crunchbase counts 341 investments, though most of those are debt. The bank has long had close relationships with both venture capital firms and startups, according to Ron Miller over at boldstart, a venture firm based in Florida.

If you’re worried because this reminds you of SoftBank’s Vision Funds, you’re not entirely wrong — deploying lots of capital into startups can lead to misplaced investments, overly-high valuations, and lingering financial hangovers. But given that JPMorgan is targeting advanced manufacturing, defense, energy, and both AI and quantum, the bank won’t have a hard time finding $10 billion worth of startups to back.

One could put the entire $10 billion to work by giving it all to Sam Altman, but I suspect the capital will be spread around a host of late-stage companies that the bank will want to help take public in the future.

Self-interest aside, a flood of fresh capital for generally higher-risk, higher-capex technology startups is just what you’d want to see at the national level if the world’s storefront was becoming barer by the day.

A fun question: Will JPMorgan’s competitors also step up to the plate? What if POTUS demands similar outlays?

Strava is going public: The popular workout-tracking app intends to list in the United States, per the FT. Sensor Tower, an app tracking company, reports that the company’s subscription service brought in $180 million last year, but the company says the figure is higher.

Strava has pursued acquisitions in recent quarters to round out its feature set, a strategy that could become turbocharged with an IPO-scale cash haul. The company is a unicorn, valued at $2.2 billion in its most recent private round.

All IPOs are good IPOs, but Strava’s will be extra-good because I have so many questions about consumer subscription services in the current app store era.

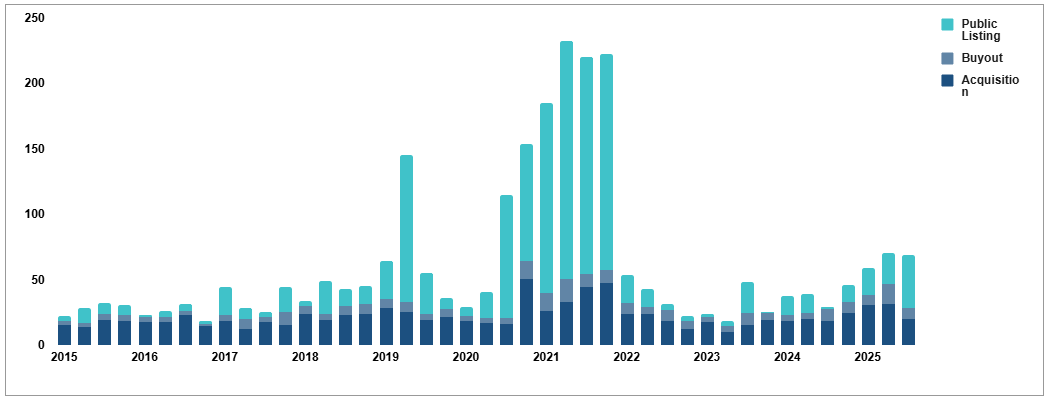

Also: while we’re seeing more IPO volume this year, the U.S. market is still far below its 2021 highs. Pulling from the PitchBook-NVCA Q3 Venture Monitor first look, we can see how IPOs saved third-quarter liquidity in Venture Land, and how far we have yet to go:

Yes, browsers are getting more interesting: Fortune has a good piece discussing the current browser war, which pits upstarts like The Browser Company (now part of Atlassian), Brave (recently crossed 100 million MAUs; our interview here), and offerings from AI-first startups like Perplexity. We’ve touched on the trend a few times, and will again in the future.

All eyes are on Chrome’s market share and everyone’s wondering when, if ever, a startup will be able to steal a material chunk away from Google. By this time next year? I’d take that bet.

We’re getting close to self-driving cars

Wayve, the U.K.-based self-driving startup, is in talks to raise as much as $2 billion from Microsoft and SoftBank. The company previously raised large amounts, including a $200 million Series B in 2022 (Microsoft participated) and a $1.05 billion Series C in 2024 (SoftBank led, Microsoft participated), which makes its new investment enormous but not shocking in scale.

What does Wavye do differently from Waymo and Tesla and other companies in the space? It’s putting AI to work. As co-founder Alex Kendall explained to Jason and me last December:

You’ve spoken tons on the show about large language models, but, I think that’s just the tip of the iceberg with AI. Bringing it into the physical world and, what we call building embodied AI, this is what’s going to enable self-driving to really scale and get us off the drug of LiDAR, of high-definition maps. So what we’ve built at Wayve is one end-to-end neural network, a single AI model capable of driving, in a very generalized sense, in different countries, different vehicle types, including on roads it’s never been to before. All with a camera-first solution using the equivalent of a single GPU. The really exciting part is that many consumer vehicles being produced today have that equipment on their vehicles.

After expanding into the United States and Germany, Wayve introduced a new video-generative world model (GAIA-2) and launched a project in June to “take a single model to 500 cities by the end of 2025.” Perhaps it will be able to get its tech into many, many more cars with a fresh truckload of caphttps://www.cautiousoptimism.news/publish/post/176032341ital.

Wayve certainly could win if its software approach bears out. As the CEO noted in the above quote, if it can get the code right, then there are millions of cars on the road today that could quickly take advantage of self-driving.

What I do know is that Waymo is making progress. As are Tesla and Baidu (with its Apollo Go program). And Wayve may unlock two billion dollars to continue its own approach to the self-driving problem. As a group, their progress is accelerating. Waymo is adding new cities, as Tesla does the same with its robotaxi effort. Chinese companies are expanding both domestically and abroad. You can almost draw a line to a future in which we don’t drive much.

I recently bought an EV and I won’t buy another ICE car in my life. Will I buy another car that I have to drive before I buy one that drives itself? Maybe. Not two, though.