Microsoft’s cloud number, Meta’s capex push, and Tesla bets the farm

Welcome to Cautious Optimism, a newsletter on tech, business, and power. Modestly upbeat.

Thursday. We have earnings from Meta, Microsoft, and Tesla to discuss, but first, it happened. A Waymo ran into a child at six miles per hour; the NHTSA is opening a probe as it should. May the child heal quickly and entirely, may Waymo sort out needed changes to its technology on the double, and may self-driving continue to save lives. To work! — Alex

📈 Trending Up: Buybacks at Samsung … duh … layoffs … Chinese AI … oil prices … more AI labs … media assets trading hands … IP lawsuits … AI gross margins? … betting on the home team …

📉 Trending Down: Amazon’s soul … SAP shares … state capitalism? …

Things That Matter

Chrome cometh: What will the computing surface of the future be? Some folks think it’s voice+AI. Some AR+AI. Or it may be the humble browser, where we already live and work and play. There was a rush of new ‘agentic’ browsers last year from OpenAI, Perplexity, and others. They seemed to be popular amongst the tech set. Last year also saw Google start to bake its Gemini AI model line into Chrome, the world’s most popular browser and one of its crown jewels.

This week, Google added the same features to Chrome that the agentic browsers of 2025 brought to market: A sidepanel for AI chats and a tool for having the browser do work for you. If you are a Google AI stan, this is great news. If you are a Perplexity shareholder, it’s probably less welcome.

How is Perplexity doing? Once a font of news, the company has seemed quieter in recent months. No sin there, but search volume for Perplexity is in decline, potentially indicating falling user growth for the AI search and browser company.

Fuck it, $100B: The impending OpenAI funding round — pre-IPO round? — is growing in size. The Information reports (Bloomberg summary) that Nvidia, Microsoft, and Amazon are considering investing as much as $60 billion into a funding event for the AI lab that could now reach $100 billion. Recall that SoftBank is also hunting up more cash to invest in OpenAI, and private-market investors are hardly done backing it, either.

Nvidia could put as much as $30 billion into OpenAI, while Microsoft is on tap for less than $10 billion, and “Amazon, a new investor, could commit over $10 billion or even more than $20 billion, the Information said.”

If you were worried about the global AI push running out of money, this is great news. Even at its most cash-incinerating, $100 billion will get OpenAI a long, long way into its growth arc; far enough that it will either be able to raise infinite money thanks to then-current market-bending revenue scale, or get wound down after exhausting all its ideas. But Sam and friends will have the cash they need to test out their hypotheses in style. And that’s good news for the global economy.

Recall that Microsoft and Nvidia committed $10-$15 billion to Anthropic last year, a company that has closed the first $10 to $15 billion of a successor funding round. Yeah. It’s a lot of money.

Microsoft’s cloud number, Meta’s capex push, and Tesla bets the farm

First, the data. Microsoft earnings are here, Meta here, and Tesla here. This morning, shares of Microsoft are down 10%, Meta up 8%, and Tesla down 1.4%. So, what happened? Let’s find out.

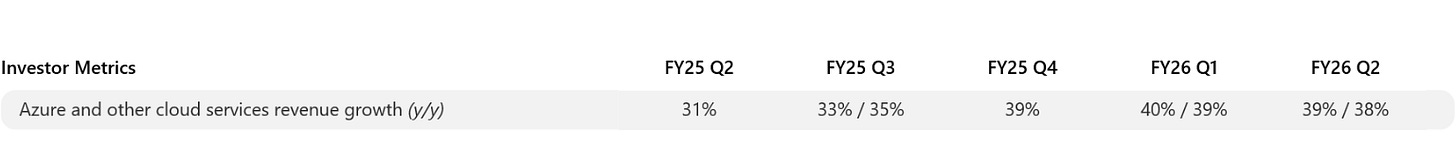

Yesterday, we wrote that the most important number from Microsoft would be the growth rate of Azure, its cloud platform responsible for a chunk of its AI-derived revenue. Microsoft reported 39% Azure growth (38% without currency fluctuations) in its most recent quarter. Here’s how that stacks up compared to trailing quarters (recall that Microsoft’s fiscal calendar is the normal calendar +two quarters):

Holding at 39%-40% for three quarters is pretty darn good for a major business line at an incumbent firm. Even more, the company reported that “Microsoft cloud surpassed $50 billion in revenue for the first time [in the quarter], up 26% year-over-year.” Even better, Microsoft beat both top (revenue) and bottom (profit) line expectations handily.

Other goodies from the earnings call: Microsoft added nearly a gigawatt of compute last quarter, Microsoft Foundry (AI apps/agents platform) has 250 customers that are on “track to process over one trillion tokens” this year, the Copilot app has seen its DAU count grow nearly 3x on a year-over-year basis, Microsoft Copilot proper has seen DAUs rise 10x on a year-over-year basis, GitHug Copilot now has 4.7 million paid subscribers, up 75% compared to the year prior, and Windows 11 reached one billion users.

Microsoft also cited Mistral (France) and Cohere (Canada) as “seeing increasing demand for region-specific models” thanks to “more customers [looking] for sovereign AI choices.” That matches our expectations.

Better-than-expected growth and profit, strong growth at Azure, and overall cloud success? What’s not to love? Well, the amount of money Microsoft intends to spend on its AI buildout. Here’s CFO Amy Hood discussing the trailing quarter’s capex results (emphasis added):

Capital expenditures were $37.5 billion, and this quarter, roughly two thirds of our capex was on short-lived assets, primarily GPUs and CPUs. Our customer demand continues to exceed our supply. Therefore, we must balance the need to have our incoming supply better meet growing Azure demand with expanding first-party AI usage across services like M365 Copilot and Github Copilot, increasing allocations to R&D teams to accelerate product innovation, and continued replacement of end-of-life server and networking equipment.

Hood also said that Microsoft expects “capital expenditures to decrease on a sequential basis due to the normal variability from cloud infrastructure buildouts and the timing of delivery of finance leases.” So, what’s the problem?

Well, Microsoft spent $37.5 billion (that’s a lot) on a single-quarter’s capex line-item while Azure growth slowed a hair from its preceding quarter growth rate. Even more, Microsoft guided down a single point worth of growth for the current quarter’s Azure rate of expansion.

An analyst asked about the big capex number and Azure’s growth rate. Here’s Hood in response:

I think you really asked [about] a very direct correlation that I do think many investors are doing, which is between the CapEx spend and seeing an Azure revenue number. [This may be a mistake, because Microsoft allocates compute capacity first to] sales and the accelerating pace of M365 Copilot, as well as GitHub Copilot, our first-party apps. Then we make sure we’re investing in the long-term nature of R&D and product innovation. […] with the remainder going towards serving the Azure capacity that continues to grow in terms of demand.

In other words, a lot of Microsoft's capex is going to power its own compute needs (i.e., serving customers) and not being invested into Azure to support third-party compute. Hood goes on to note that if she had simply put the last two quarters’ GPU purchases into Azure, it would have grown at a pace of more than 40% in the most recent quarter. But Microsoft needs GPUs, too.

Summary: Microsoft is having a blast with AI and is investing piles because it’s seeing piles of growth and demand. Investors are skittish about the company spending too much, because everyone likes to fret about OpenAI’s own future compute commitments. If you think Satya is right, the company is currently on sale.

While Microsoft was dinged by investors for its capex load, Meta is not. Indeed, here’s a headline: “Investors are giving Meta the green light to keep spending big on AI.”

The short is that Meta crushed revenue and profit expectations, and while the company did say that it expects 2026 capex“ in the range of $115-135 billion, with year-over-year growth driven by increased investment to support [its] Meta Superintelligence Labs efforts and core business,” investors seemed more excited about momentum in its core business than worried about its spending. (That Meta’s advertising success is partially thanks to AI-derived lift doens’t hurt, either.)

Even more, Meta CFO Susan Li said that her company will “generate sufficient cash to fund our infrastructure investments in 2026.” So, no debt rush for Meta, it can afford to finance its GPU buys with currency. (Perhaps that fact is predicated on cuts at Reality Labs.)

Summary: Meta is keeping its ship pointed where it was. Lots of AI investment in both human and hardware terms, and a focus on video primacy on the social side. Investors are happy.

Finally, Tesla. The company beat market expectations for both quarterly revenue and profit. Notably, Tesla’s full-year revenue was lower in 2025 than in 2024.

But, the company is really focused on its future and not what it got done last year. Here’s the key bits from Elon (transcript source, emphasis added):

As we increase vehicle autonomy and begin to produce Optimus robots at scale, we are making very big investments. This is going to be a very big CapEx year, as we will get into. That is deliberate because we are making big investments for an epic future. […] It's time to bring the Model S and X programs to an end with an honorable discharge. We are really moving into a future that is based on autonomy. […] We are going to take the Model S and X production space in our Fremont factory and convert that into an Optimus factory with a long-term goal of having a million units a year of Optimus robots in the current S and X space in Fremont. […] We will probably unveil Optimus 3 in a few months. I think it's going to be quite surprising to people. It's an incredibly capable robot.

The decision to end Model S and X production is not a ‘burn the ships’ moment. Not quite, but it is a move away from two premium car segments to make room for a less-than-proven robot technology. (406,585 Models 3 and Y were made in Q4 2025; Models S, X, and Cybercab were worth a combined 11,706 units).

By removing some of its auto-creating capacity to make room for robotic assembly, Tesla is reducing its automotive footprint and betting that pound of flesh on Optimus. Perhaps Optimus 3 will be good enough to sell thousands units right out the gate. Perhaps Figure is getting close, too. Perhaps not; we don’t know. That’s why the move by Tesla to deprecate two car lines to make room for Optimus construction is so fascinating.

Either Elon is further along than the market thought on building a general-use humanoid robot, or Tesla is cutting off a limb for little benefit by sunsetting its luxury SUV and faster sedan.

In fairness, Tesla is already evolving to become something other than a car company. Automotive revenues fell 11% at the company in Q4, while energy and storage (solar and batteries) grew 25%. That’s quite the mix shift, even if the latter revenue category is about a fifth the size of the former.

Summary: Tesla stock is basically flat despite falling car sales because investors believe in Musk’s ability to invent, produce, and deliver the future. That wager may come down to how strong the Optimus 3 robot is viz market needs, and how quickly they can be made and sold.