A time for choosing

Welcome to Cautious Optimism, a newsletter on tech, business, and power. Modestly upbeat.

📈 Trending Up: New AI models this week? … startups named Tandem (no, not that Tandem) … data center arguing … AI ad rates … Starship … layoffs at Amazon … state capitalism …

📉 Trending Down: Naming your startup ‘entropy’ … AI’s popularity … power …

Things That Matter

Nvidia serves CoreWeave $2B more: This morning, Nvidia said it bought $2 billion of freshly-issued CoreWeave stock for $87.20 per share, which sent the data center operator’s stock soaring nearly 17% to around $108 per share.

The companies plan to bring more compute online faster, and Nvidia is going to lend its “financial strength to accelerate CoreWeave’s procurement of land, power and shell to build AI factories.”

CoreWeave and Nvidia are confident enough about future demand to continue accelerating. Consider this the first entry into the 2026 ‘when do we reach compute saturation’ Olympics. We’ll learn a lot more when we get hyperscaler earnings (Microsoft reports on January 28, Alphabet on February 4, and Amazon on February 5).

Nvidia invested in CoreWeave’s Series B, and has continued to accumulate shares over time. It now holds some 47.2 million shares, or 11.5% of its equity.

Look, either the folks who see massive compute constraints ahead are right, or they are not. But given how quickly I ran out of Claude Code credits the other day, yeah, I can see it. (OpenAI is also an investor in CoreWeave, and Nvidia is also an investor in OpenAI.)

Quote of the Day:

The 2021 Fundraising Environment Was Absolutely Insane. 2025 Was Just as Insane. 2026 Will Be More Insane. — Jason Lemkin, SaaStr

Synthesia’s now worth $4B: Even before this $200 million Series E led by Google Ventures, Evantic, and Chamath Palihapitiya, the AI video tool maker’s business looked impressive.

The company reached annual recurring revenue (ARR) of $100 million last April, and it is now telling CNBC that it has reached ARR of $150 million, and “expects to pass the $200 million mark sometime in 2026.” Probably sooner rather than later.

Using a pre-made avatar (or one that you make), you can input text to Synthesia’s tools, and it will spit out a pretty solid video of a synthetic human saying what you wrote down. It also offers lots of controls for how the video should look and feel. It’s pretty neat.

Looking ahead, Synthesia “believes the next decade will be shaped by a transition from static, one-way content to interactive, conversational experiences powered by AI agents.” So, the videos will become interactive and thus far more useful and broadly applicable.

But Synthesia is more than just another fast-growing AI startup; it’s also a standout British company, garnering supporting quotes from the UK’s Chancellor of the Exchequer, Business and Trade Secretary, Secretary of State for Technology, and even the Mayor of London in its funding announcement.

The company was last valued at $2.1 billion when it raised a $180 million Series D last January.

Black Forest Labs in Germany, Synthesia in the UK, Lovable in Sweden, and Mistral in France? Not a bad set of companies for a supposedly dead continent.

Speaking up

Another American was shot and killed by the government over the weekend, this time an ICU nurse for the VA. The video of the killing was impossible to miss on the Internet, with recordings from various angles affording the public a chance to vet statements from government officials about what happened. Those statements did not match reality.

Indeed, the Department of Homeland Security lied about the event, and without ample video evidence, the killing might have been entirely misunderstood and perhaps quickly forgotten.

Why are we talking about this in Cautious Optimism? Because quite a lot of the people and companies that covered by this newsletter are very politically involved. From major lobbying dollars and backing candidates to gifting POTUS $25 million and overpaying for the First Lady’s film, the list goes on.

Trump’s tech backers have received some of what they’d hoped for: Crypto-friendly legislation, a (somewhat) new direction at the FTC (viz. M&A), massive government AI contracts, help to try and quash state-level AI regulations, TikTok delivered into the hands of regime allies, and more.

But when it comes to politics, you buy the whole cow. And what the right-aligned tech folks got alongside their wins is an administration that will kill you, lie about it, and brand you a terrorist.

Still, it’s far too quiet on X, despite death in the streets, assaults on basic liberties (more), the estrangement of critical allies, and a new patina of risk atop American tech.

We know that tech folks can be loud. The collective convulsions we saw on X over the potential wealth tax in California and the recent mayoral election in New York City are recent enough to remember. Remember the SVB crisis?

After Alex Pretti was killed, category VCs Villi Iltchev, early a16z GP John O’Farrell, seed investor Ihar Mahaniok, Y Combinator’s Paul Graham, Google DeepMind’s Jeff Dean, and others (Leslie Feinzag, etc.) made noise. But those are not new voices; these folks have been consistent.

What about the rest?

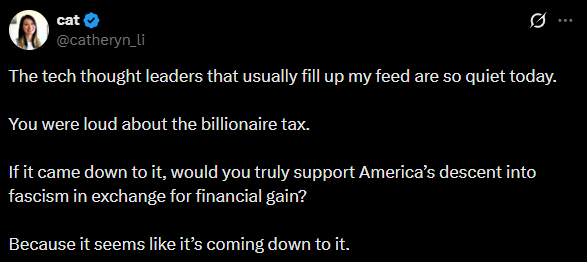

I think Catheryn Li (co-founder and CEO of Simple AI, YC S24) put it best:

Or as I put it while very angry over the weekend: “Hope the stablecoin bill was worth dissolving the bill of rights.”

I have spent enough time around business people to understand that winning in the realm of capitalism requires a bit of moral flexibility. But I keep being disappointed even while I know that. I would’ve thought that the events of these days would be enough for many folks who supported Trump to throw up their hands and say, no, the stablecoin bill was not in fact worth it, and there are lines we do not cross in the name of making money.

And yet. Some of the tech-right famous for speaking their mind on topics of all sorts have been quiet about the ICE killings (let alone the awful treatment of people in ICE custody). Meanwhile, others like Khosla Ventures’ Keith Rabois, argue that the people getting shot deserved it. (Rabois is smack-dab in the technology mainstream, even if his views are not shared by his coworkers — here’s Vinod and Ethan.)

The tech industry has recently learned that it has political heft. After discovering that influencing Congress costs less than a single 2025 Series C (you can do a lot with $100 million!), tech folks are calling legislative shots, for example.

Put simply, tech could very easily raise a stink about ICE and what the Federal government is trying to do. They’re just not doing so because it’s currently more profitable to do whatever this is:

Other attendees, per The Hollywood Reporter, included Zoom CEO Eric Yuan, AMD CEO Lisa Su, and New York Stock Exchange (NYSE) CEO Lynn Martin.

Consider me let down.

Back when the Washington Post had layoffs in 2023, we asked, “What’s the point of having a billionaire owner if you don’t get to avoid economics?” (History rhymes.)

Well, what’s the point of being the CEO of a multi-trillion-dollar corporation and holding all the power and influence that your role brings if you decide to do nothing but conserve near-term EPS? Sure, the administration is estranging international customers left and right while chipping away at the foundations of your country, but imagine if Trump posts a mean tweet!

Expect nothing and you’ll never be disappointed. I have yet to really learn that lesson.