Ah, so that's why we need an AI lab IPO this year

Welcome to Cautious Optimism, a newsletter on tech, business, and power. Modestly upbeat.

Tuesday. While off, we missed the BitGo IPO fun, so expect notes on its offering tomorrow. York Space Systems is another interesting upcoming IPO that we need to interrogate.

Tech stocks are getting hammered along with the rest of the market. The American valuation edge that its capital markets long afforded it may be at risk. No one knows what to make of POTUS demanding foreign territory (more below), but the world of money doesn’t like the threat. To work! — Alex

📈 Trending Up: Domestic tariff costs … domestic tariff costs … token usage … yield on American debt … Anthropic … Humans& … ‘persona space’ … India-UAE ties … Canada-Qatar ties … ServiceNow’s AI push …

Trending Flat: Interest rates in China …

📉 Trending Down: Tech stocks … US-UK relations … US-EU relations … births in France, Turkey, China, everywhere … software stocks … US-France relations …

Things That Matter

NATO is creaking: In a series of late-night posts, POTUS shared several AI-generated images, including one of him holding an American flag on Greenland, and another of Canada and Greenland under US control, thanks to a poorly generated map.

As I write to you this morning, French President Macron is giving a speech about how we’re shifting to a world without rules. (Last night, Trump also shared what appear to be private messages from both Macron and Rutte.) Meanwhile, Europe is getting ready for a breakup with the United States as Canada aligns a little with China.

It’s not impossible to imagine a world in which Canada effectively joins the EU, the United States asserts partial ~control over South and Central America (or not?), and China dominates in Asia and Africa (with India doing its own thing). Such a setup would leave the United States less economically influential and militarily powerful.

I don’t understand how it’s ‘America first’ to cede global leadership, antagonise our allies, and retreat to our own hemisphere. But, then again, I’d get a NATO tattoo if it would help.

Recall our note yesterday that American tech companies are going to have a harder run in Europe? We’ve got Ursula von der Leyen name-checking EU, Inc, rising venture capital totals on the continent in 2025 (albeit modest), endless lists of EU-built tech products (and more). New unicorns are being minted on the continent. I don’t want to pre-call a trend, but I think that we’re going to see more EU folks buying from home.

Meanwhile, American tech companies are bending over backwards to reassure EU customers that their products really are safe. No, really, there’s no need for concern.

AI MAUs: OpenAI started the year by saying that its “Weekly Active User (WAU) and Daily Active User (DAU) figures continue to produce all-time highs.” Given that the AI lab had previously claimed some 800 million weekly active users, that’s impressive (and good news for its investors).

Industry isn’t letting OpenAI sit pat. Google’s late-2025 growth in Gemini usage is being mirrored in the enterprise, meaning the search giant is gobbling up AI market share on two fronts. (OpenAI claimed massive enterprise growth in 2025, recall.)

Other companies are seeing strong adoption. Baidu’s Ernie AI assistant has “surpassed 200 million monthly active users,” per the WSJ. Alibaba’s Qwen AI app “surpassed 100 million monthly active users within two months,” and Deepseek had 145 million monthly actives at last count.

There’s overlap, of course. I use several AI providers for different queries — usually hunting down an old article that I only partially remember — for example, meaning that I am actually counted several times in the above numbers. But it’s notable to see AI adoption rise so quickly around the world. The ‘AI is useless trash’ crowd has to come up with some sort of answer to realised demand, I reckon.

Are we still doing rules? You cannot regulate Elon Musk. The United States government is currently ruled by a party hoping for his financial support in the coming midterm election, so he’s off limits. A host of countries are mad that xAI’s Grok chatbot “let users easily create and distribute deepfake violent and sexualized images of women and even children,” as CNBC put it. But if you try to regulate xAI, the US government will bristle and shout.

It’s a good time to be xAI, with the White House working hard to ensure that you get a piece of the collective pie (more, more).

Depending on your politics, allowing business leaders to run the show is either a good thing or not. But I think in a moment where cross-Atlantic tensions are already high, telling the EU how to run their own countries won’t prove popular. For American tech companies. I don’t claim any particular prognosticatory skills, but I do think that there are people in Europe who can code and who may like to have a say in their own government and economy.

As an American, I thought it was pretty cool when American tech companies had untrammelled global reach. Losing that edge won’t help domestic tech shops.

The venture market is great for AI startups, poor elsewhere

Reading the NVCA/PitchBook Q4 2025 venture report is mostly an exercise in expectation-meeting regarding the United States’ private-market investment:

Yes, the 2025 American venture capital market was the second most active in history, only losing out to 2021’s excesses ($339.4 billion in 2025, $213.2 billion in 2024, $358.2 billion in 2021).

Yes, median pre-money valuations continue to rise as median deal sizes rise (excepting pre-seed notably).

Yes, AI startups raised the most with $222.1 billion worth of funding secured (65%) from 5,793 deals (35%).

And, yes, exits had their best year since 2021, with $297.6 billion returned compared to numbers between $117 billion and $155 billion from 2022 to 2024. (It’s worth noting that we saw a fraction of the $864.2 billion worth of exit value seen in 2021, and the more than $300 billion recorded in both 2019 and 2020.)

So what are the numbers that may surprise us?

Venture-backed startups bought an all-time high 38.4% of all sold startups in the year. However, the share of M&A value that those transactions were worth fell to 22.3%.

Venture debt squeaked out a new all-time high in 2025 ($62.4 billion compared to $61.1 billion in 2024) despite a falling deal count (943 deals compared to 1,168 in 2024). Nearly all the venture debt went to AI companies ($55.6 billion across 812 deals).

Female-founded companies are seeing their fundraising fortunes fade. Deal count into startups with at least one female founder continued a multi-year slide from 5,253 deals in 2021 to a new local minimum of 3,096 in 2025. All-female teams also set a new, multi-year low of 770 deals worth $3.9 billion, down from 1,234 deals in 2021 worth $7.8 billion.

Capital raised by all-female teams fell to just 1.1% in 2025 from 2.0% in 2024, while capital raised by mixed-gender teams soared. Shoutout Thinking Machines Lab and Anthropic for putting up big dollar results for companies that include women in the founding team.

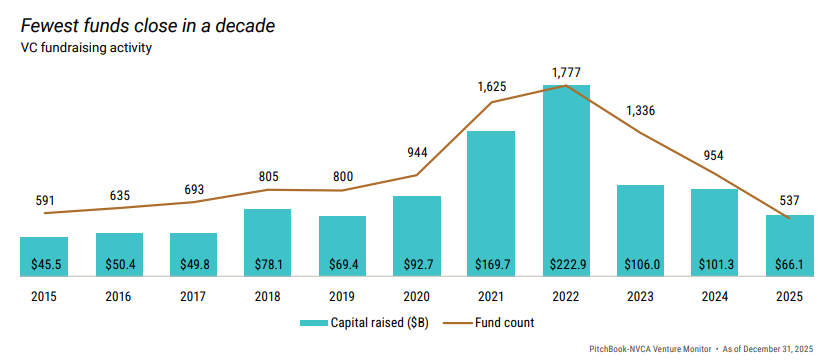

Venture capitalists had a miserable fundraising year, with just $66.1 billion raised across 537 funds. Just look at this:

Venture fundraising is down just under 70% in new fund terms, and just over 70% in dollar terms. Or, you’d have to go back to at least 2014 to find a year in which there were fewer venture funds raised, and 2017 to find a year with a lower fundraising total.

If you want to think broadly, the potential for an Anthropic or OpenAI IPO this year becomes existential to the venture market if we consider: VCs have been raising less than they’ve invested lately, implying a decline in available investable capital; LPs are not putting more cash up until they get some of their called capital back; the major AI labs have absorbed a huge portion of total venture dollars invested.

Therefore, if LPs will be able to recycle capital and if those same LPs can put more funds into venture pockets while not tripping their asset mix goals, then we need to see some of the invested funds into the largest AI bets become liquid.

The mix point is not small. In simple terms, major capital pools often have a target for exposure to exotics, like venture. If those same capital pools are stuck sitting on unrealised venture gains, they can’t put more of their funds into the venture market, because they are already fully-exposed. So, you need to convert IRR to DPI, else wallets can stay shut.

If you want to get scared, consider what would happen to those same LPs if the stock market fell by, say, 20%. Suddenly, the equity portion of their portfolios would be smaller, making their static venture investments appear larger. Good luck getting to a point of being under-exposed to venture in that case. In simpler terms, the stock market staying high is giving VCs a shot at fundraising. That they are struggling to capitalise on.