All eyes on Cyera

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Happy Wednesday! We’re counting down until Tesla’s self-driving robotaxis launch, which could come in a week or two. CNBC has the latest. I presume that about half of CO’s readership is hoping that Elon succeeds, and the other half praying that Tesla’s robotaxis crash on their first trip out. Putting aside a mountain of context, I’m rooting for Tesla’s autonomous ride project to go well. Why? Not because we all own Tesla in our index funds, but because if we want self-driving to advance as quickly as it can we need more competition.

Waymo has competed against the clock thus far — working to get as far as it can before rivals catch up and get into the market. Sure, Zoox is making progress, too, but the entry of Tesla with its vertically integrated car stack could quickly make the robotaxi game far, far more competitive. As more competition equals more good, this is to be encouraged. — Alex

📈 Trending Up: Deleveraging … abuse of state power … Alphabet staff in the United States? … honoring losers … nuclear power … Russian aggression … ICE protests … defense spending …

📉 Trending Down: Domestic inflation … open models? … net tariff progress? … FEMA … vaccine safety …

All eyes on Cyera

Cyera has returned to the fundraising well once again, this time raising $540 million at a roughly $6 billion valuation. The Journal reports that Georgian, Greenoaks, and Lightspeed led the investment. The cybersecurity startup plays in the data security posture management (DSPM) market, raising $300 million last August. Cyera raised another $300 million last November, pushing its worth to the $3 billion mark.

The reason for its rapid fundraising isn’t hard to find. In March of 2025 the company said that in two years it had grown its revenue by a staggering 26x. Sure, we always treat unanchored performance metrics with skepticism, but Cyera has kept the growth hot — or it wouldn’t be able to double its worth, again, this year from its rapid-fire capital formation 2024. Points.

In a TWiST interview with Cyera cofounder Tamar Bar-Ilan last August, I worked with him to understand what the fuck DSPM actually is. It’s this: A software service that tracks down all of corporation’s data, applies classifications to each piece, and then secures that information based on its classifiers so that data doesn’t get used, moved, or shared that shouldn’t.

Why does that matter? Because as co-founder Yotam Segev explained during a second interview with TWiST after Cyera raised its second $300 million round last year, how companies were handling the work before simply didn’t scale. And with more data, the problem was only getting larger (tidied for readability):

The [data security posture management approach of the] past was that every enterprise employee [would] manually classify sensitive documents by applying a tag to them. But people don't like to do that. People don't like to do anything, right? Especially not to tag their documents if they're top secret, restricted, confidential or not. That approach just didn't scale […] with the enterprise, with the duplications of data, with the amount of data being generated. And what DSPM is all about, DSPM is all about automating that [work].

I cannot say what percentage of Cyera’s growth is predicated on simple enterprise cybersecurity needs, and what fraction comes from customers coming to the startup for help getting their data sorted for use in AI, but I suspect the second category is pretty damn material. Therefore, while Cyera is hardly a foundation model company, it’s firmly in the AI camp.

Yesterday we spent a little time poking at the question with known LLM limitations, how are startups that lever genAI models doing, and the answer seems that they are doing pretty well. I consider Cyera’s latest fundraise and implied growth to add further weight to our conclusion.

Welcome to the crypto boomlet

On the heels of news that crypto exchange Gemini is heading towards an IPO, the FT reports that Thiel-backed Bullish is also making progress towards the public markets. Bullish is a crypto exchange, comparable to Gemini and Coinbase, which raised $300 million back in 2021 in a round co-led by Thiel Capital, and Founders Fund (Thiel capital) according to Crunchbase. The FT framed Bullish’s privately filed IPO documents as responsive to the White House’s crypto-friendly policies, and Circle’s strong IPO. Fair enough.

But how big is it? I won’t lie to you and say that I knew off-hand. So, CO went hunting:

Not that big compared to market leaders. BitDegree pegs recent 24 trading volume on Bullish at about $1.3 billion, up from the start of the year but lower than recent peaks.

However, when we look at market lists of the largest ten crypto exchanges by CoinGecko ranking, Bullish doesn’t crack the top ten. But then again, neither does Gemini and it’s going public, too.

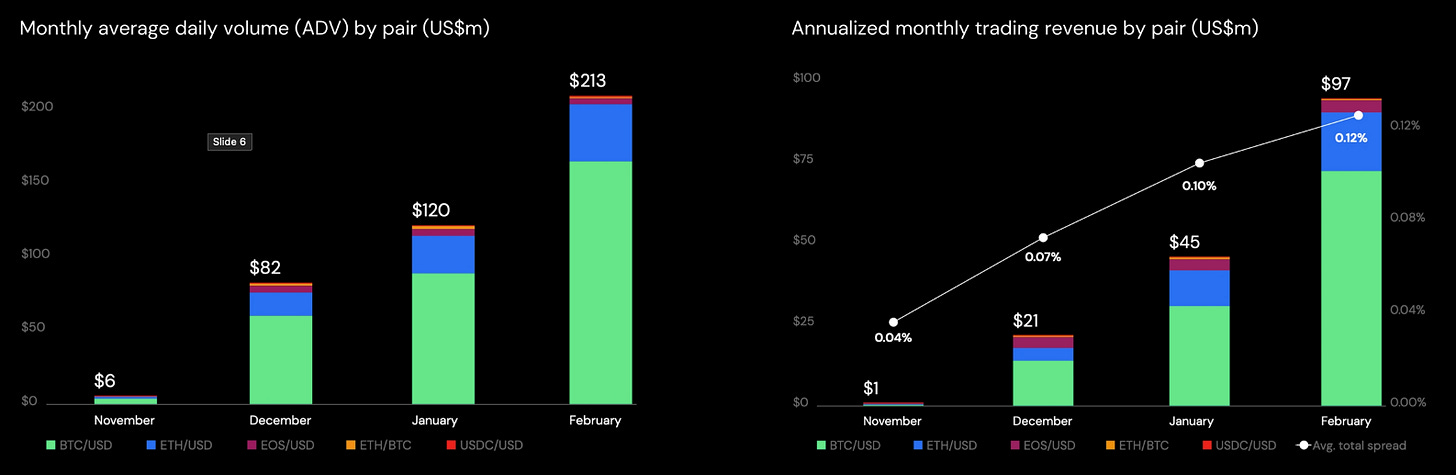

Bullish tried to go public via SPAC a few years back, giving us a historical deck that we can peek at. Here’s a great chart that details the well-known correlation between crypto trading volume, and crypto exchange revenue:

Bullish has grown since then, meaning that its revenues have scaled, too.

Just as I love a smaller SaaS IPO, I am similarly excited to see what a second-run crypto exchange — by volume! — looks like in P&L terms.

Meta’s Fourth Act

OpenAI’s decision to lower the cost of its o3 model was paired with the release of its o3-pro model that Sam Altman was quite proud of. Here’s how OpenAI described early usage of the model:

In expert evaluations, reviewers consistently prefer o3-pro over o3 in every tested category and especially in key domains like science, education, programming, business, and writing help. Reviewers also rated o3-pro consistently higher for clarity, comprehensiveness, instruction-following, and accuracy.

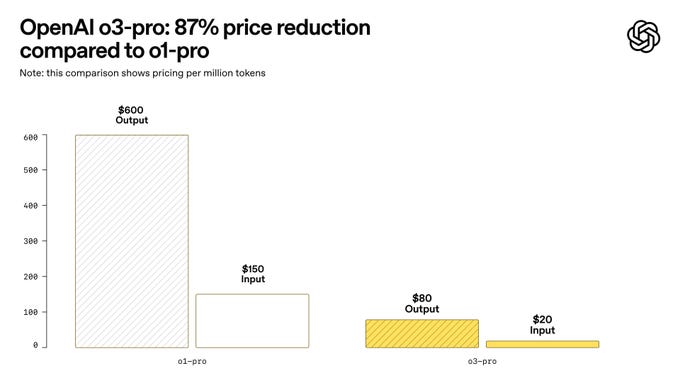

And OpenAI is pricing o3-pro at about 1/6th the cost of o1-pro, which is a big deal:

Better models for lower prices? You love to see it.

Why did we put a Meta headline on a passel of OpenAI news? Because OpenAI’s progress underscores the company’s position in the AI game. Ahead, in case you needed it spelled out.

While OpenAI is dropping better models, cutting prices, and screaming past the $10 billion ARR milestone, Meta’s Llama family of models are struggling to find wins in their fourth generation. So much so that the company is pulling of two hail-mary passes this week:

Meta is building a “new artificial intelligence research lab dedicated to pursuing ‘superintelligence,’” the New York Times reports, offering “seven- to nine-figure compensation packages to dozens of researchers from leading A.I. companies such as OpenAI and Google,” the paper continued.

And Meta is taking a 49% stake in Scale AI at a price of $14.8 billion The Information Reports, with the Facebook parent company snapping up Scale’s CEO Alexander Wang while kicking cash to existing shareholders.

Those are not the moves of a company where AI is going well, at least compared to market ranks. Currently Meta’s models languish in the mid-30 ranks over on LMArena, while Google and OpenAI own the top five slots with Anthropic nipping at their heels.

Meta’s fourth act. From Facebook (Act 1), to social behemoth (Instagram, WhatsApp in Act 2) to the metaverse (Oculus and the Reality Labs push in Act 3) to today, Meta’s AI era. I think before the above you could argue that AI was one of several major efforts at the company. Spending $15 billion to buy not-quite-half a startup, hire a new exec, and build a new team at great expense in addition to prior AI work? That’s a new core thrust.

In a sense we want Meta to do well in AI; the stronger open-source, and open-source-ish AI models that exist in the market, the more that closed-source model concerns have to fight for commercial viablity. And more competition is more good. All that said, do you think that Meta’s new plan will succeed in keeping it on the AI podium?