All eyes on hyperscaler earnings

Also: Have stablecoins found a home in B2B payments?

Welcome to Cautious Optimism, a newsletter on tech, business and power.

Monday! To absolutely nobody’s surprise, office workers are using AI to create fake expenses. Corporate expense policies are, in my experience, designed to be so difficult to parse that workers are dissuaded from actually reporting their costs. And apparently some folks have so much time that they’re using AI to generate fake receipts. It’s only a matter of time until Ramp et al. come up with AI tools to sniff out the fraud, but then AI image generation will improve, too. Welcome to the Truth Wars in the Age of AI.

Also: A big cheer to my friends at TechCrunch who are kicking off the yearly Disrupt conference in San Francisco today. May all guests be on time, may the coffee flow, and I hope everyone has a blast. To work! — Alex

📈 Trending Up: Stablecoins in Japan … real-estate slop … MENAI … hunger in the U.S … trade policy dictated by pique … EU’s attractiveness … China-India relations

📉 Trending Down: Peronists … China’s 737 … Russian demographics … Federal worker patience … The Washington Post’s video strategy … Microsoft-Australia relations … Russian infra

Things That Matter

Not so rare: The US and China could be nearing a trade war detente, provided their staff get their way. Government workers from both nations made progress on an agreement covering tariffs, rare earths and more. Rare earths, in particular, could be set aside as a geopolitical issue under the guise of a ‘deferral’ if the premiers do as they are told.

In response to the news, shares of rare earth mining companies tumbled. Investors had been wagering on a partial US government takeover of the sector, not free-market competition with Chinese rivals

But the broader stock market is stoked that the two economies could soon play nice. And it appears that the TikTok sale is a go. That means the administration-aligned Ellison family will soon have another major organ of public opinion under their purview. (Speaking of White House-led suppression of free speech, this is a doozy. And there’s this.)

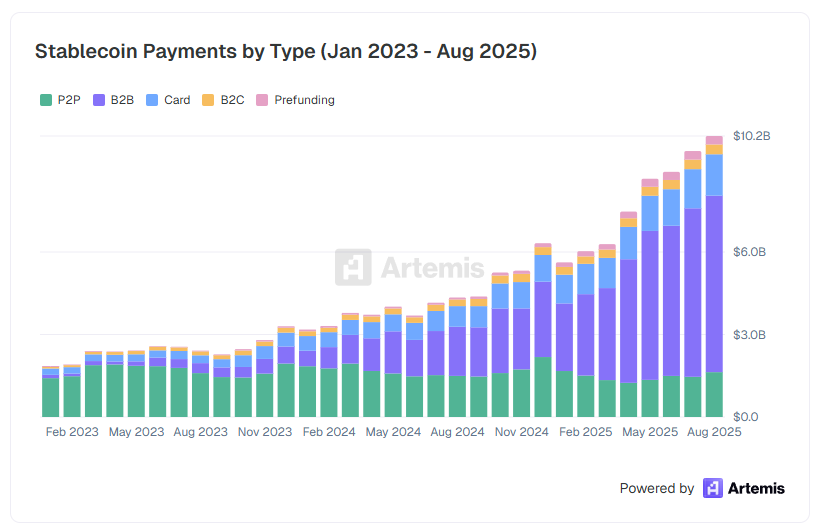

Chart of the Day: Via Artemis Analytics’ Stablecoin.fyi website.

I did not expect B2B payments to be the de facto use case for stablecoins. Perhaps that’s why startups like the YC-backed Infinite are working on business-to-business stable payments, and Coinbase is building more B2B infra for its partnered USDC stablecoin.

The site also indicates that the United States, Singapore and Hong Kong account for nearly half of all stablecoin volume. Japan, the U.K., Germany and the Netherlands round out the next four spots.

Renting flesh and blood in the AI era: Mercor started off aiming to build a better labor-job matching tool. But it’s hard to build a broad, two-sided marketplace, so the company decided to focus on serving AI talent to get started.

And what an incredible choice that was. Today, Mercor aggregates demand for humans from major AI labs and corporate giants alike, and then connects those companies to experts for contract work. The hired people provide human data, instead of its synthetic alternative, to AI companies training models for specific work. This is called Reinforcement Learning with Human Feedback, or RHLF for short. (Here’s an Amazon primer on why the method yields better AI models and services.)

Demand for human experts to help train AI models is so intense today that Mercor has turned into a rocket. The WSJ reports that Mercor is set to raise capital at a $10 billion valuation, after seeing its revenues grow by four times since Meta purchased invested in Scale AI, a data labeling and AI model evaluation company. The $10 billion number is predicated on an annualized revenue run rate of $500 million, per reporting.

The company’s business model is simple. Via the Journal: “If a client pays Mercor $100 an hour for a data-labeler, Mercor will keep around 30% to 35% and pass the rest on to the contractor.”

Back in August I spoke with Brendan Foody, the CEO and co-founder of Mercor. He told me two things that made me blink:

Mercor’s net retention rate is 1,605%. Not 106.5%, but north of sixteen hundred percent. In simpler English, Mercor’s customers tend to expand their business with the startup by an average of 16x over a year’s period. Given how recently Mercor has started to accelerate, the number will come down. But it’s also the highest I have ever seen that particular metric reach.

Until our interview, Mercor had been profitable during its growth explosion, leading to it having “more cash in the bank than [it] ever raised, which is, you know, unique for an AI company.” You don’t say.

So why Mercor is now raising $350 million is a little confusing, but perhaps it boils down to: Why not sell 3.5% of the company in exchange for a permanent capital base? Especially when it’s probably reporting gross instead of net revenues.

All eyes on hyperscaler earnings

Today and tomorrow, we’ll hear from Cadence Design Systems, NXP Semiconductors, F5, Confluent, Visa, Booking Holdings, PayPal, EA, SoFi, Teradyne and others about their quarterly performance. But the real show kicks off on Wednesday, when Microsoft, Alphabet and Meta report. Thursday will add data from Apple and Amazon to the mix.

That’s five of the Mag7 reporting in 48 hours, following Tesla’s results last week. Nvidia will report in mid-November.

It goes without saying that we pay special attention when the world’s most valuable and powerful companies report their quarterly results. Understanding how leading tech companies view the world is useful for our comprehension of enterprise software buying patterns, trends in tech employment, appetite for new products and services, and so much more.

That last point is why Amazon, Microsoft, Google and, to a lesser extent, Meta’s, reports matter so much this time. The companies are not only fielding their own AI-powered services, they also provide the compute that many of the AI-predicated companies of the world depend on to operate.

The AWS outage reminded everyone how dependent on cloud infra the modern economy is; we’re zooming into the subset of compute infra that deals with AI.

How much demand Amazon, Microsoft and Google are seeing for AI compute will tell the market several things:

How much compute demand they’re generating by themselves, since they each use AI to both augment their products and accelerate their teams.

How much compute they’re processing for third parties, as they offer AI infra services to customers of all sizes.

Everyone wants to know if we are in an AI bubble today. Actually that’s not quite right; most folks think that we are in an AI bubble, and the question before the market is merely one of size.

The way we answer the “Is AI a bubble, and if so, how big?” question comes down to capacity. If the hyperscalers report that they are keeping to their capex plans and are compute-constrained, we can infer that present investments into GPUs, server racks, land and power are economically sensible. That could still change, but it would be bullish to hear.

If, on the other hand, the hyperscalers report that they are finally getting enough compute set up to handle current demand, the market might decide that future capex plans are overwrought, lowering the value of future cash flows from companies like Nvidia, which has used its globe-straddling wealth to invest in customers.

If there’s an AI compute glut, stocks could get smashed. Startup valuations, too; if the AI market is already compute-rich, then it could be assumed that AI demand is slowing. Thus, startups chasing AI revenues could face far more difficult growth curves than they previously thought.

Last we checked, Microsoft told investors that it planned to “continue to invest against the expansive opportunity ahead across both capital expenditures and operating expenses given our leadership position in commercial cloud, strong demand signals for our cloud and AI offerings, and significant contracted backlog.” How deep is that backlog today?

Google explicitly said in its second-quarter earnings call that it expected compute constraints through next year:

[D]emand for our products is high, as evidenced by the continued revenue growth and the Cloud backlog of $106 billion. While we have been working hard to increase capacity and have improved the pace of server deployments, we expect to remain in a tight demand-supply environment going into 2026.

Amazon’s Andy Jassy struck a similar note during the Q2 earnings cycle:

I don’t believe that we will have fully resolved the amount of [compute] capacity we need for the amount of demand that we have in a couple quarters. I think it will take several quarters.

Let’s see.