All that spend and Meta is still GPU poor?

And other AI highlights from Microsoft and Meta earnings calls.

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Editor’s note: Today CO hit 100 paying subscribers! We appreciate the heck out of you all. Thank you for riding along with us almost every day. — Alex & Holden

📈 Trending Up: UChicago’s own Noelle Laing … US-Ukraine relations? … dating apps heart AI … stablecoin usage … sheer chutzpah … hilarity …

📉 Trending Down: Domestic consumer health … Indian venture capital … international AI competition … stablecoin regulation … privacy in India …

AI takeaways from Meta & Microsoft

It’s earnings season, and Microsoft and Meta are working to make it a party. Both companies delighted investors with their calendar Q1 performance. CNBC has good numerical overviews here (Meta) and here (Microsoft).

I want to highlight metrics and notes from the two companies earnings call regarding AI. The two companies are amongst the largest investors in AI infra, AI capacity, and in-market AI offerings. So, the better they do — given their broad AI footprints — the more we can infer that the technology market that startups are selling into is healthy. And, the inverse.

Meta earnings call quotes (transcript source):

“In just the last quarter, we're testing a new ads recommendation model for Reels, which has already increased conversion rates by 5%. And we’re seeing 30% more advertisers are using AI creative tools in the last quarter as well.”

We discussed Meta’s AI API launch earlier this week, arguing that it added an external business case to the company’s internal AI usage. Here’s evidence that the latter really does matter.

“Across our apps, there are now almost a billion monthly actives using Meta AI. […] Over time, I expect the business opportunity for Meta AI to follow our normal product development playbook. First we build and scale a product, and then once it's at scale then we focus on revenue.”

I read that as Zuckerberg implicitly telling skittish accountants worried about its capex to chill. And speaking of capex:

“The pace of progress across the industry and the opportunities ahead for us are staggering. I want to make sure that we're working aggressively and efficiently, and I also want to make sure that we are building out the leading infrastructure and teams we need to achieve our goals.

To that end, we're accelerating some of our efforts to bring capacity online more quickly this year as well as some longer term projects that will give us the flexibility to add capacity in the coming years as well. And that has increased our planned investment for this year.”

That didn’t stop Justin Post (Bank of America) from asking about the issue. “Your CapEx spend is now close to some hyperscalers with very big client bases,” he pointed out, asking for context on how “the ROI works without direct enterprise spend to drive revenues.” To which Meta CFO Susan Li responded:

“Your second question is about why we’re investing more in CapEx. And we really believe that our ability to build world-class infrastructure gives us a meaningful advantage in both developing the leading AI technology and services over the coming years. And there are a lot of opportunities also for us to improve our core business by putting more compute against our ads and recommendation work.

So even with the capacity that we’re bringing online in 2025, we are having a hard time meeting the demand that teams have for compute resources across the company.”

All that spend and Meta is still GPU poor? Wild.

Microsoft earnings call quotes (transcript source):

Here’s what Satya Nadella had to say about data center capacity at the company, which has made some headlines due to certain compute capacity projects finding themselves killed off by Redmon:

We continue to expand our datacenter capacity. This quarter alone, we opened DCs in 10 countries across four continents. […] Across our blended fleet, where we have increased AI performance by nearly 30% ISO power. And, our cost per token, which has more than halved.

More capacity and lower costs are what you want to see from hyperscalers; we want cheaper, faster, better AI, right? Well, this is how you get it.

Foundry is the agent and AI app factory. It is now used by developers at over 70,000 enterprises and digital natives. […] We processed over 100 trillion tokens this quarter, up 5X year-over-year – including a record 50 trillion tokens last month alone. And four months in, over 10,000 organizations have used our new Agent Service to build, deploy, and scale their agents.

Nadella’s comments imply that in calendar Q1 2024, Microsoft processed about 20 trillion tokens. It processed 5x that many in Q1 2025, which is impressive. But even more impressive is is that in March 2025 alone, Microsoft processed — generated? — 2.5x its entire Q1 2025 token load. If you were curious about how much AI inference demand there is in the market, here’s a bullish signal.

Next, a sheaf of metrics from Microsoft’s CEO and CFO (Amy Hood) regarding AI demand at the company:

All-up, we now have over 15 million GitHub Copilot users, up over 4X year-over-year. […] We now have 56 million monthly active Power Platform users, up 27% year-over-year, who increasingly use our AI features to build apps and automate processes. […] More than 230,000 organizations – including 90% of the Fortune 500 – have already used Copilot Studio. […] This quarter alone, customers created over 1 million custom agents across SharePoint and Copilot Studio, up 130% quarter-over-quarter. […] In Azure and other cloud services, revenue grew 33% and 35% in constant currency including 16 points from AI services. […]

Notably, Microsoft guided for Azure “revenue growth to be between 34% and 35% in constant currency driven by strong demand for our portfolio of services” in the current quarter. If you wanted to cap off the general economic worries, how about a little hyperscaler reacceleration?

What happens when we don’t need junior staff?

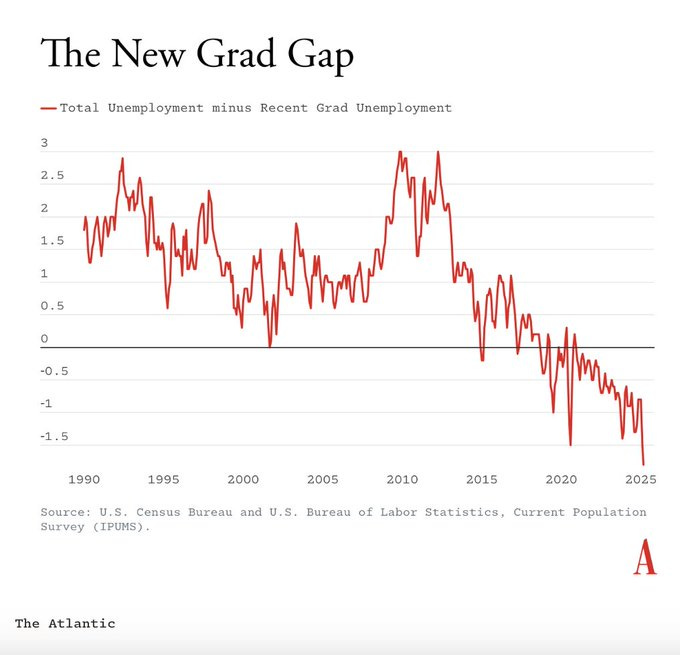

For a long time, recent college graduates were more employed than the average worker. The Atlantic charts the trend as a stable employment rate premium over time — until the last 2010’s pushed the metric to all but even. From that point on, the unemployment rate for recent grads kept losing ground to the total unemployment rate; recent grads are now less likely to have a job than the average worker:

You can squeeze a lot from that chart. Depending on your priors and politics, you might argue:

That recent grad unemployment being higher than the national rate implies that colleges are failing to prepare workers for the job market.

Or, that worries about falling productivity growth are overblown as the above-chart indicates that companies are doing just fine getting more work out of fewer people.

Or, that the rise of automation-focused software (the UiPath era) followed directly by the rise of genAI models and applications (the OpenAI era) has changed the labor market so much that companies need fewer junior staffers as their work is the most automatable.

That last option is where The Atlantic puts most of its stock:

“When you think from first principles about what generative AI can do, and what jobs it can replace, it’s the kind of things that young college grads have done” in white-collar firms, [David Deming, an economist at Harvard told the magazine]. “They read and synthesize information and data. They produce reports and presentations.”

Bingo.

This is something that’s come up on TWiST time and again. The rise of generative AI and applications thereof like Deep Research in all its permutations do take away some work that recent grads were once called upon to do — the grunt intellectual work of various industries that command high incomes at their senior levels.

Companies, being profit-maximizing entities, want to control costs. If a new piece of technology can replace humans, it’s going to sell. Tech is always cheaper than humans in developed economies where labor costs are comparatively high.

In the near-term, it’s a double-win for companies. Lowering costs by employing fewer junior staff and allowing AI to pick up the slack means lower costs and a shot at paying senior staff — those who actually make comp decisions — more.

In the long-term, industry is making an odd bet. The same senior people who might enjoy larger pay packets if they cut junior staff will, eventually, need to replace senior staff with other senior staff. People change jobs. They leave the workforce by choice. They die. They burn out.

But what happens when AI took the early-career gigs in non-physical workstreams, and companies only want to hire the most experienced? You have a massive pipeline problem, yeah?

The market will self-correct over time, of course. But today it really does seem that the average junior banker (here’s a startup that wants that job), junior lawyer (here’s a startup that wants that job), and similar are facing a labor market that is busy working to make them redundant.

I don’t see how that is a healthy way to approach the future, but I suppose that the same argument was possible when we moved to mechanized labor. Still, I wonder what my kids are going to do in 20 years when they land in a job market that has had two more decades of time to improve, and lower the cost of AI workers.

Recession watch

The negative US GDP print released yesterday was a bummer. Economic growth is good, while no economic growth is poor, and negative growth is catastrophic. (For fun: Ask yourself if you are more, or less likely to job-hop, go freelance, or generally shake up your economic life now than you were in, say, Q4 2024.)

POTUS has declared that the rapid change in economic fortune — recall that the domestic economy grew at a 2.4% pace in the final quarter of last year — is not his fault, adding that even the second quarter’s results will have nothing to do with him. Bold claims from a President who claimed 2024 stock market performance was his doing.

Regardless, serious people are worried. Apollo’s John Zito, who shares the President title and “co-lead[s] all investing activity” at the private equity giant, is one.

Bloomberg got its hands on an investor letter that Zito wrote, the published quotes from which are brutal. Here are a few choice riffs:

“US-listed companies have consistently traded at 40% to 70% valuation premiums over global peers — not just because of earnings strength or sector mix, but because capital trusts this system,” Zito wrote in a letter to investors seen by Bloomberg News. “The longer and more volatile the path to a trade-policy reset, the greater the risk to this regime and its benefits.” […]

The problem isn’t just a Wall Street issue and could have ripple effects throughout the economy, according to Zito. If the US loses its premium, “the consequences will be measured not in basis points, but in trillions of dollars in lost enterprise value,” he wrote. “It could mean substantial cuts in jobs tied to innovation and loss of long-term investment.”

It’s worth digesting how seismic a shift the American markets losing their premium would prove. Why do so many companies from around the world list in the United States, for example? Because they can get a better share price here than in their home markets. That public-market tailwind also makes domestic companies worth more, period. That means juicier opportunities for entrepreneurs, bigger returns for investors, and healthier pension funds and organizational wealth.

Therefore, per the incredibly left-leaning Apollo, the current trade war with our allies could change global capital flows enough to cause the United States to lose a singular advantage on the international market. If you wanted to diminish the nation, a dramatic curtailment of soft power, alienation of our allies diplomatically, and the erasure of our equity premiums would be a quick, holistic way to go about it.

Jeez.