Atlassian enters the browser wars

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Thursday! Yesterday on the podcast, we interviewed the CEO of Nuro, the self-driving company working with Uber (ridehailing platform), and Lucid (EVs) to build a robotaxi business that will launch next year. Elsewhere, Salesforce’s earnings were a flop while Figma took stick after reporting its performance for the first time as a public company (more below). To work! — Alex

📈 Trending Up: Grift … investments in fertility … government meddling in chip exports … concern … Google paying fines (lots of them!) … DeepSeek … Swiss AI? … domestic taxes … GEPA …

📉 Trending Down: Chinese capital productivity … C3.AI after earnings … Salesforce after earnings … young male checking account balances … the xAI c-suite …

Things That Matter

AI sentiment is down, AI investment not so much: News that OpenAI is expanding the size of a secondary offering from around $6 billion to more than $10 billion underscores investor confidence that buying into the American AI shop at a $500 billion pricetag is a good bet. The implication? That many investors think that OpenAI will be worth trillions in time — challenging the currently Mag7 for a slot atop the global market cap charts.

French AI model company Mistral is raising €2 billion at a €14 billion valuation, Bloomberg reports. That’s a big jump from Mistral’s previous €5.8 billion valuation. The startup’s Mistral Medium model is currently ranked 8th in the world.

The domestic economy: ADP data indicates that job growth (private employers) rose just 54,000 in August. That’s under the 75,000 net new jobs that analysts expected, and CBNC notes that it’s a sharp decelreation from “the gain of 104,000 seen in the prior month.” The full dataset is here, but woof. ADP’s chief economist said that “labor shortages, skittish consumers, and AI disruptions” could be to blame for the poor figure.

Poor jobs data? A great time to lower rates. FedWatch has the chance of a 25 bips rate cut at 97.6% this morning for the upcoming central bank meeting.

Figma’s public welcoming party concludes: Figma’s IPO was crackerjack. The design unicorn priced well, and soared after listing. Since then, the party has been winding down. Reporting Q2 revenue of $249.6 million (+41%), positive operating income, positive net income, and more than $$62 million worth of operating cash generation, you would be excused for thinking that Figma had done well. Nope. Investors had expected it to do better than merely beat estimates and its own guidance.

Why the gloom? Perhaps Figma’s estimate of growth of just 33% in the current quarter. Or that Figma expects “further gross margin compression in the near term as [it rolls out] AI products, including FigmaMake, and recognize increases in inference spend?”

Regardless, Figma is healthy as shit and should be fine so long as it can keep shipping. Its share price will gyrate in the meantime.

A short chart interlude

CO is not in a rush to fret about AI capex for two reasons. First, the companies spending the most are the richest, so we’re not at risk of seeing the most extended firms evaporate. If Microsoft, Amazon, or Alphabet whiff on AI growth, they still shit gold and sit atop a dragon’s hoard. Second, because companies like OpenAI, Mistral, and Anthropic keep growing.

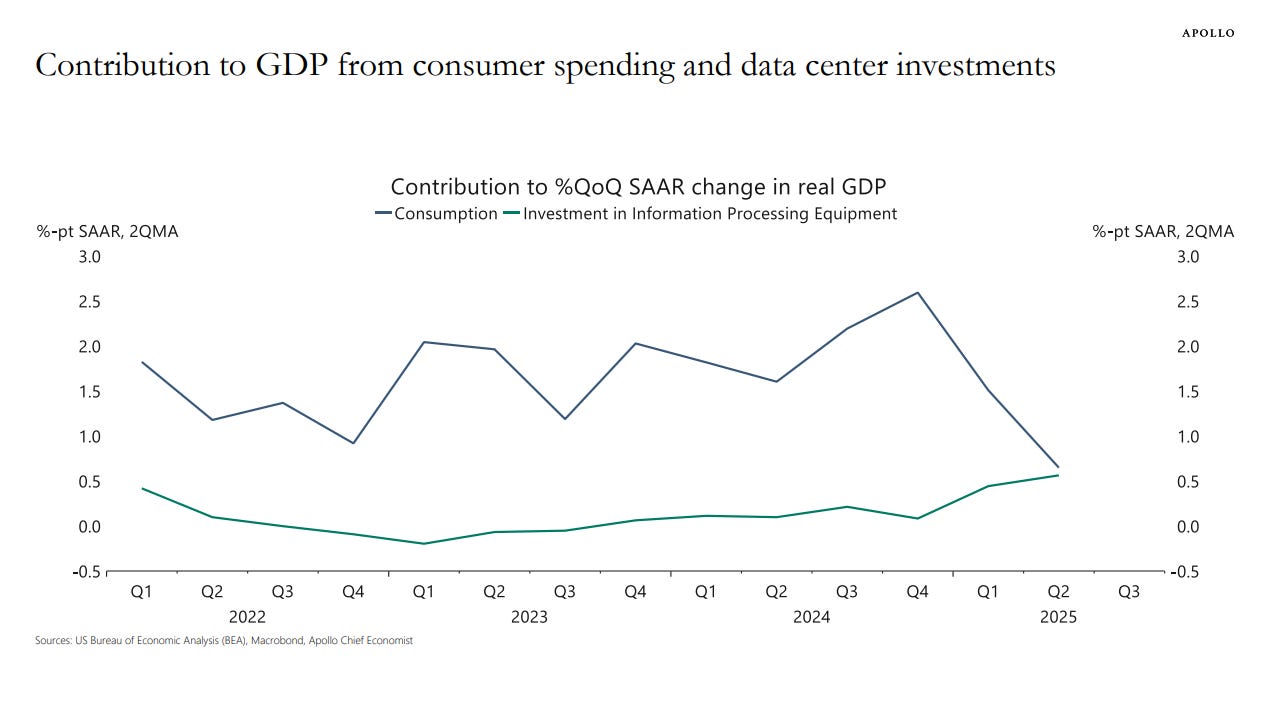

So long as OpenAI is compute constrained, it’s probably too early to worry greatly about AI infra spend. And yet. From Apollo’s chief economist:

That chart shows that GDP growth was all but equal between consumer spending in Q2, and data center buildout over the same time period. If consumer spending slips again, we could wind up in a world where AI buildout is driving more GDP growth than the aggregate American consumer.

OpenAI scaled from $5.5B ARR at the start of the year to more than $12 billion recently, while Anthropic grew from $1 billion ARR to $5 billion over a similar interval.

Worrying? Yeah, a little. On one hand it’s good that the United States can marshal so much capital so quickly to invest in the future. On the other hand, that’s the same argument that we saw with — variously — canal mania, the South Sea Bubble, overbuildout of railroads, overbuildout of fiber, and the like.

The Browser Company sells for a slight premium

Shortly after a judge decided that Google could keep Chrome, we’re seeing knock-on effects take shape. Atlassian, the developer tools company infamous for Jira, is buying The Browser Company (TBC) for $610 million in cash, “inclusive of [its] cash balance.”

On the Atlassian side of the fence, the deal will be financed out of its balance sheet and is “not expected to have a material impact on the company’s financials in fiscal years 2026 and 2027.”

So, why buy TBC? The smaller company does a good job explaining that point. In a separate post, TBC writes that it will enjoy independence inside Atlassian to keep working on its Dia browser, bringing its “largest vision” of “ a cross-platform browser as an OS” closer to reality.

That’s not normal corporate babble. TBC first built Arc, a general browser with strong privacy protections. Then, it built Dia, an AI-first browser with agentic-ish tooling integrated into the browser. Just the sort of thing you would want to build if you expect that, over time, the browser (close to the Internt) will become the OS instead of more traditional operating environments (further from the Internet).

I vibe with TBC’s vision of collapsing the OS into the browser not because I like ChromeOS, but because when I flip between Mac and Windows several times each day I continue to live in Chrome. In a real sense, by allowing Google to keep its browser, the US legal system ensures that the domestic OS race remains a purely Mag7 affair (Linux to one side).

Does bringing Dia to Atlassian make sense? Sure. Atlassian wants to be deeply integrated into work, and work happens at the OS-level. So, if browsers will become the functional OS of the future, owning one makes good sense. And the dev tools company can afford the cost.

Of course, seeing a startup sell for a hair more than its final private-market valuation isn’t fireworks, but the deal will likely see early backers of TBC do well. And smaller-ball exits are still DPI. Period.