Chime’s Road to IPO: Growth Holds, Margins Improve, and Losses Slowly Fade

And: Databricks goes shopping

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Happy Wednesday, friends, it’s going to be a busy one. Chime is going public, and yes its IPO filing is our main entry this morning. We’re also digging into the latest MENA AI news, copyright regulation, and Databricks buying a startup. All that is below.

Up top, remember when we discussed the US copyright office’s report which argued that not all use of copyright-protected information was fair use for AI model training? And then its leadership was tossed out like last week’s leftovers? Well, The Verge reports that the folks being brought in to replace exited leadership might be more critical of big tech — and big tech’s AI ambitions. Caveat emptor, and all that.

The regulatory-AI news is not all bad from an industry perspective. Congress might override state-based AI oversight for ten years, a potential coup for OpenAI and others worried that California or another large economy could implement stricter AI regulation than might pass in D.C.

Now, to work. — Alex

📈 Trending Up: Corruption … self-driving IPOs … consumer spending hopes? … TensorWave …

📉 Trending Down: Ten blue links … AI safety? … manners … national research … Huawei? … self-driving (temporarily) …

Technology employment? Microsoft is shedding 3% of its staff, around 6,000 jobs, to limit management layers. DCD reports that Xbox and LinkedIn took blows, while Azure also endured a trim.

We’re about to give authoritarian governments cutting-edge AI tools

While the Biden-era rules around chip exports were unpopular amongst chip makers, they had a reasonable underlying logic: Selling AI tech to authoritarian regimes was risky. From the Framework for Artificial Intelligence Diffusion, now defunct (emphasis added):

Experts from across the U.S. government have determined that as the capabilities of these models continue to improve, they will enable malicious actors to engage in activities that pose profound risks to U.S. national security and foreign policy objectives. As the Office of the Director of National Intelligence has assessed, AI models have the potential to enable advanced military and intelligence applications; lower the barriers to entry for non-experts to develop weapons of mass destruction (WMD); support powerful offensive cyber operations; and assist in human rights violations, such as through mass surveillance.

With those rules out of the way, it’s go time for selling chips into the Middle Eastern market. We discussed HUMAIN yesterday, the Saudi Arabian G42 catch-up effort that appeared predicated on building data center capacity in the region. We might have undersold the scale of the effort, because this morning both AMD and Nvidia are about to land massive orders:

AMD: Secured a “landmark agreement to build the world’s most open, scalable, resilient, and cost-efficient AI infrastructure” that will include $10 billion worth of spend to “deploy 500 megawatts of AI compute capacity over the next five years.”

Nvidia: Will sell chips to Saudi Arabia, including “an 18,000 NVIDIA GB300 Grace Blackwell AI supercomputer with NVIDIA InfiniBand networking,” while “the Saudi Data & AI Authority (SDAIA) will deploy up to 5,000 Blackwell GPUs for a sovereign AI factory and enable smart city solutions.”

Investors are heartened by the news, sending shares of both companies up in the wake of the announcements. But I have to wonder if we’re making a good call here as a nation. Selling more stuff is always good; but allowing regimes that stifle dissent, repress women, cling to monarchy, and have a history of abusing technology to keep their polity in check is not my dream. The opposite, in fact.

But it appears that we’re no longer worried about such things, except as they apply to China. This is a choice.

Databricks goes shopping

The third most important startup-capital story this morning is news that data warehouse, analytics, and AI giant Databricks is buying Neon for what the WSJ describes as “about $1 billion.” That’s a lot of scratch.

Crunchbase data indicates that Neon raised around $130 million while private, including a $46 million Series B led by Menlo Ventures in 2023, and a $26 million top-up led by Microsoft’s M12 in 2024.

Neon is known for its database work with Postgres, but more recently got into the AI agent game. To wit:

In 2024, something shifted: AI-native apps started taking off. And we realized that our architecture was uniquely well-suited to power them. We leaned into agent-focused development, and within a few months, over 80% of databases were being created by AI agents rather than humans. […] Neon quietly became the go-to Postgres backend for many LLM-powered apps and platforms.

Where in the market is there a huge amount of corporate data and an AI platform built atop it that would love to bring in-house the market-leading backend solution for a wave of genAI applications? Databricks! Which has ample shares and cash to make the deal. (Sadly, we lack valuation information on Neon, but I presume that its backers did well. Please enjoy the DPI!)

For about 1.6% of its ‘market cap’ the deal makes good sense for Databricks. Naturally, Databricks still won’t go public even with a new feather in its cap. But some companies are, so let’s get into their news.

eToro goes public at $52 per share

After indicating a $46 to $50 per share IPO price range, consumer trading service eToro sold 11,923,018 shares in its public offering at $52 per share. That means the company sold more shares (initial plans were 10 million) at a higher price ($48 midpoint) than anticipated. RenCap reports that the IPO generated around $620 million in total transaction value, with about half the shares in question being secondary instead of primary — and a fully diluted equity worth of $4.9 billion for the company.

eToro will start trading later today, but its upsized, overweight IPO pricing is a win for fintech companies, period. Speaking of which:

Chime’s going public!

Company: American consumer neobank that offers checking accounts, savings accounts, overdraft services, and the ability for consumers to get paid early.

Backers: Crunchbase lists 11 known funding rounds for Chime, bringing its total capital raised to $2.3 billion. The company was last valued at about $25 billion in August of 2021 when it raised a $750 million Series G.

Core Numbers from its S-1 filing:

Revenue: $1.64 billion in 2024, up 31% from 2023. In Q1 2025, Chime reported $518.7 million worth of top line, up 32% from the year-ago result.

Revenue Quality: Chime’s gross margins have consistently expanded, rising from 79% in 2022 to 83% in 2023 to 88% in 2024, the same level they landed in the first quarter of this year.

Profitability: Chime’s losses have consistently declined in recent years, from net income of -$470.3 million in 2022 to -$203.2 million in 2023 to -$25.3 million in 2024. To start 2025, Chime reports net income of $12.9 million, down slightly from $15.9 million in Q1 2024.

Great, but how does Chime make money?

Chime’s business model is easy to grok. It’s mostly interchange revenue, generated when Chime customers use their branded debit cards. Payments revenue, Chime reports, “represented 80%, 80%, and 76% of our revenue in 2022, 2023, and 2024 and 72% in the first quarter of 2025,” including a mix of credit and debit card transactions.

The company also makes smaller incomes from a number of assistive product lines, including “fees from access to out-of-network ATMs,” “net revenue based on high yield savings balances,” and similar. Those incomes “contributed 20%, 20%, and 24% of revenue in 2022, 2023, and 2024, and 28% in the first quarter of 2025.”

So, Chime is an interchange shop, but one that is slowly lowering its dependence on that revenue stream to a more diversified mix over time. That’s bullish, as Chime notes in its risk sections that “new laws or regulations related to interchange fees may be enacted” that could "limit “interchange-based fees that [the company dervies] from transactions.”

If you decide to buy into Chime’s IPO, you are making a wager that interchange laws will remain static for the company long enough for it to become entirely non-dependent on those incomes.

How did Chime manage to cut its net losses so quickly?

Growth, and cost control. The growth side of Chime is easy to see in the following chart, which tracks purchase volume from the neobank (recall that it makes money off transactions):

Chime accelerated its growth rate from 2023 (27%) to more than 30% in 2024, which crossed with rising gross margins mean that the company generated a lot more gross profit in recent years. That helps clear expenses.

But Chime also managed something notable regarding expenses:

Member support and operations declined from $292.5 million in 2022 to $286.9 million in 2024, despite rising membership levels and overall platform usage.

From 2022 to 2023, Chime reduced its spend on R&D (“Technology and Development”) and G&A. Those costs picked up again in 2024, but Chime managed to lower certain line items when the market was lean and profitability was in. It speaks well about the company that it is so flexible.

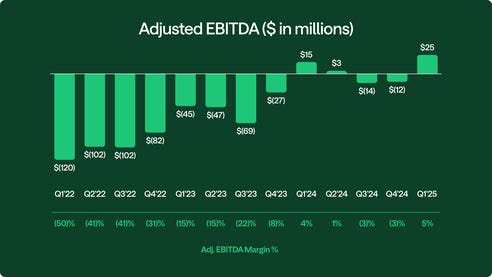

Rising usage, rising revenue, rising revenue quality, and cost control mean that Chime is now all but breakeven on a yearly GAAP basis, and increasingly profitable when we look at its adjusted EBITDA results:

Tell me more about its banking metrics

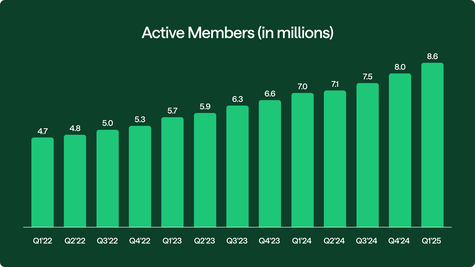

Chime has done a great job growing its active user count. Observe the following chart which is admirable for its consistency:

Consistency is too conservative a word. Chime has accelerated the rate at which it adds new active members. From +100,000 to +300,000 per quarter in 2022, to +200,000 to +400,000 per quarter in 2023, to a stonking +500,000 in Q4 2024 and +600,000 in Q1 2025.

And it’s making more money per active member (ARPAM) over time. That datapoint reached an all-time high of $251 in the first quarter of this year, besting a preceding all time high of $245 in the final quarter of 2024.

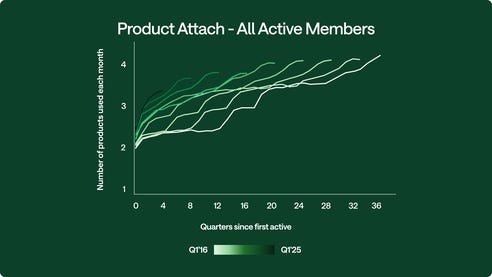

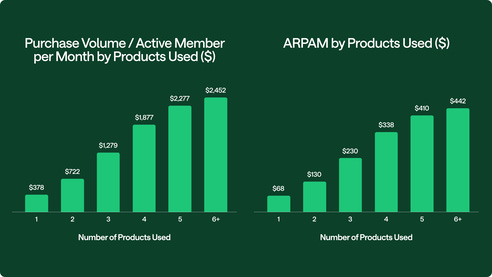

How is Chime growing ARPAM? By offering more products, and enjoying a higher attach rate amongst new customers:

Which in turn leads to more revenue per account:

Recall that we discussed the company’s revenue mix above, arguing that it was bullish to see Chime diversify away from interchange revenues. The preceding two charts are how the company managed the feat in more detail.

If we had more space, I’d get into MyPay and how Chime is making money helping folks get paid sooner — but let’s get to the final piece of meat we need to chew:

Who owns what?

The Chime IPO is going to unlock a simply huge amount of invested venture capital. Provided that the world holds it together for a few weeks, at least.

Here’s the list of 5% and greater holders of Chime shares, per its S-1 filing:

DST Global: 52,268,715 shares

Crosslink Capital: 29,247,210 shares

Access Industries: 19,601,430 shares

General Atlantic: 19,208,760 shares

Menlo Ventures: 17,442,713 shares

Cathay Innovation: 15,300,990 shares

Cathay texted over a comment from Aloha Simon Wu who led the Chime Series B, saying that when the firm met the startup it was “immediately clear that Chime was building something different,” and that it took point on the transaction “when few Silicon Valley investors believed.” Points to Cathay for the win, but I reckon the real victory lap is the IRR it’s about to convert from an Excel entry into distributed shares.

ICONIQ: 15,034,594 shares

And other investors, too. Forerunner was in the Seed round, while Homebrew led the Series A for example. At least 36 total investors bet on Chime during its life as a private company. That means a lot of liquidity. And VCs have needed nothing so much as just that in recent quarters.

Well done Chime. Now let’s get this sucker priced.

Quick edit: just to be clear, Homebrew co-led the seed with Forerunner (and Satya sat on Chime's board for many years), but Crosslink led the A.