China's AI IPOs have me all jealous

Also: Happy New Year's Eve

Welcome to Cautious Optimism, a newsletter on tech, business and power.

Wednesday. Welcome to the final day of 2025. Monday brings the start of a new working year, and I expect a deluge of startup news, M&A announcements, and new AI model releases to get us off the line. It’s going to be great fun. If we get a mega-IPO from OpenAI, Anthropic, or Databricks in 2026, all the better.

May the new year bring more peace to the world, more love and joy to you and your family, and more opportunities for us to make puns in headlines. Onward! — Alex

📈 Trending Up: Reporting slop … OpenAI’s equity comp load … enterprise AI spend in 2026 … Anthropic … fusion power … war with Venezuela? … bubble worries …

Read This: TechCrunch’s Anna Heim reports that 76 EU-based university spinouts have reached $100 million worth of revenue or $1 billion in value.

📉 Trending Down: Herd immunity … demand for Chinese chips? … demand for Chinese chips? … global fertility … the dollar …

Things That Matter

Twitter plans to double down on creator payments: After an X user argued that the social media service should bump “creator payouts way way way way up” to ensure its users create lots of unique data for xAI to train on, Elon Musk chimed in, agreeing with the plan so long as his company could block gaming of the system.

Twitter’s head of product, Nikita Bier, saluted the request, saying that his team has a “new method that should wipe out 99% of fraud” in question. Next year should see X become even more X-like, it appears.

If you think that incentivizing engagement on social media platforms is a capital idea, get posting. If you worry that incentivizing engagement on social media to ensure a font of human data is about as intelligent as subsidizing demand at the federal level to help combat unaffordability, well.

Yeah, Meta’s going enterprise: CO argued that Meta buying Manus, a Singapore-based startup with nine-figures worth of ARR and an agentic AI tool that has proven durably popular, only made sense if it wanted to sell AI services to other companies, instead of using its in-house artificial intelligence products to support its advertising business, and offer baubles to its consumer userbase.

Our perspective was hardly unique. M.G. wrote in the wake of the Meta-Manus deal that the former company has “just bought into the enterprise market,” for example.

The fun question is just how far Meta’s enterprise aspirations go. Building SOTA AI models and offering them in a hosted context is one level. Offering agentic tooling to companies to improve their internal operations is another. Going whole-cloth into building AI-predicated tools for companies that take on the broader productivity stack would be another.

Place your bets.

China’s IPO market is great fun

Enjoyed yesterday’s quick look at the Z.ai IPO? Based on my text messages after that newsletter went out, the Chinese AI lab was less well-known than I thought! Writing about companies one’s audience doesn’t know is open rate anathema, but when has that stopped us? Let’s do even more:

Reuters reports that Shanghai-based chip design firm OmniVision intends to raise as much as $617 million in its own upcoming Hong Kong IPO, while Beijing-based GigaDevice is taking its memory and microcontroller business public on the same exchange to raise $602 million.

But what about AI labs? The good news is that we have access to MiniMax’s own IPO financials. We noted back in June that MiniMax had a public offering planned. Now, armed with its numbers and knowledge that it could raise as much as $538 million, let’s take a quick peek.

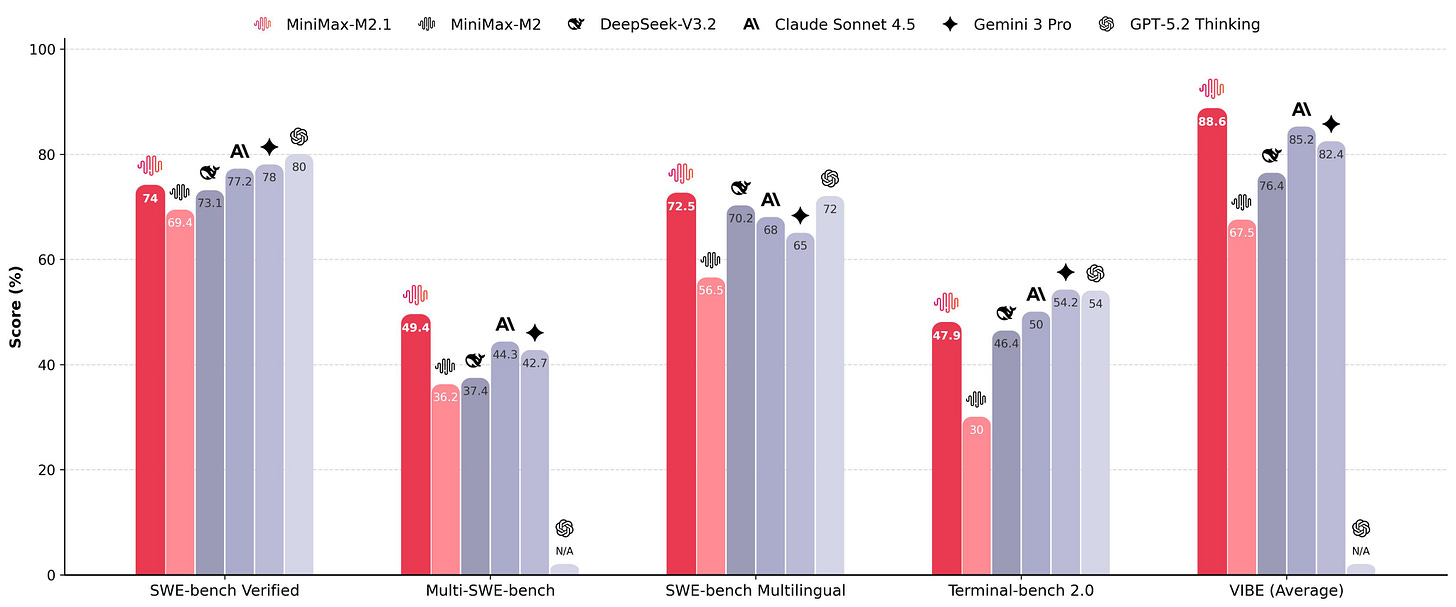

MiniMax’s AI models are good. The company’s current leading model, MiniMax M2.1, compares well with models from both China (~open) and the United States (closed):

All that from a free model you can run locally and has released its weights? Pretty damn impressive, yeah? (M2.1 ranks sixth on the LMArena WebDev leaderboard and is tied with Grok 4.1 Fast on the Artificial Analysis Intelligence Index.)

MiniMax has other models and tools (more on that in a moment), but now that we’ve established that it’s building incredibly capable technology, let’s talk money:

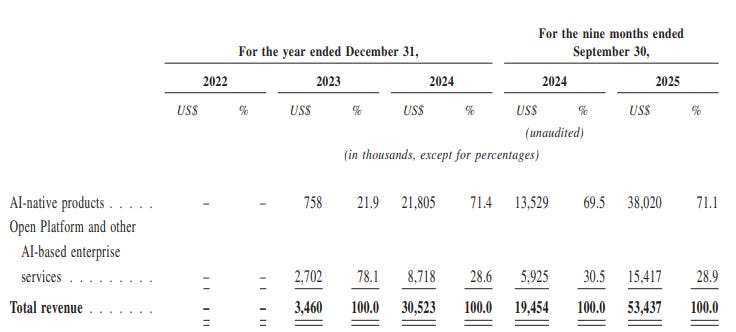

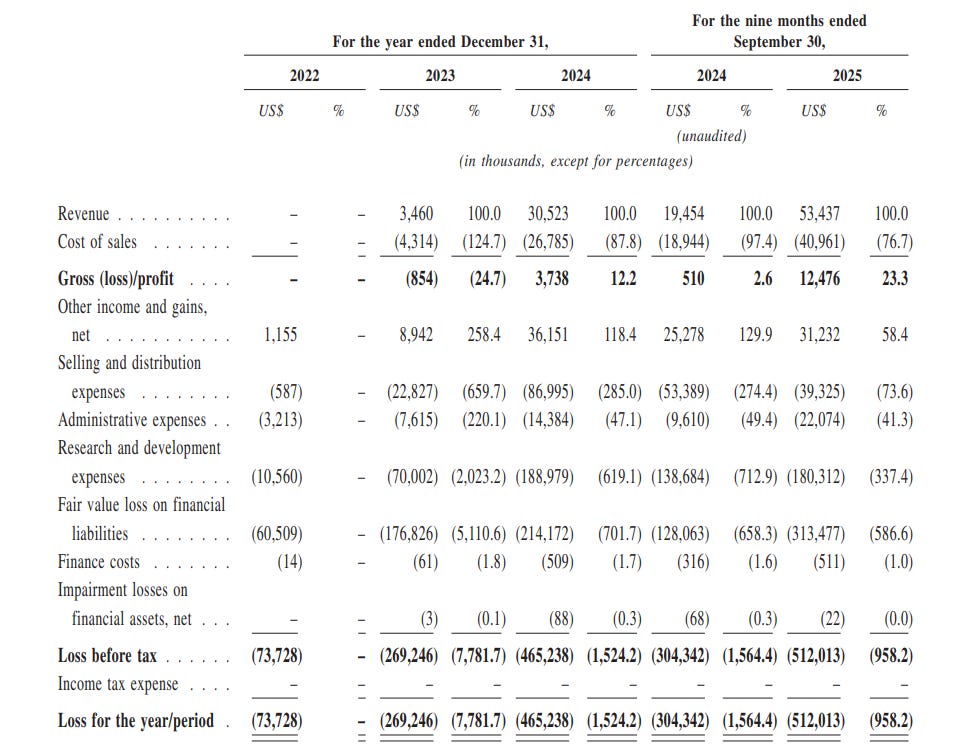

Revenue growth from $19.5 million in Q1-Q3 2024 to $53.4 million during the same period of 2025 was good for growth of 174%. That’s a stonking result, and one that becomes even more impressive when we take into account that MiniMax had negative gross margins in 2023 (-24.7%), modest gross margins in 2024 (12.2%), and a roughly twice-as-good outcome in 2025 (23.3% through Q3).

As MiniMax had R&D costs through the third quarter of 2025 of more than 3x its revenues, the company is deeply unprofitable on an operating basis. But what did we expect? The fun thing about Chinese AI labs going public at their current level of maturity is that they are not fully baked concerns drifting into their low-growth era. No, if MiniMax were an American company, it would raise a billion dollars and stay private. Probably until the heat death of the universe.

Alex, stop talking about gross margins! Alright, let’s talk product mix instead.

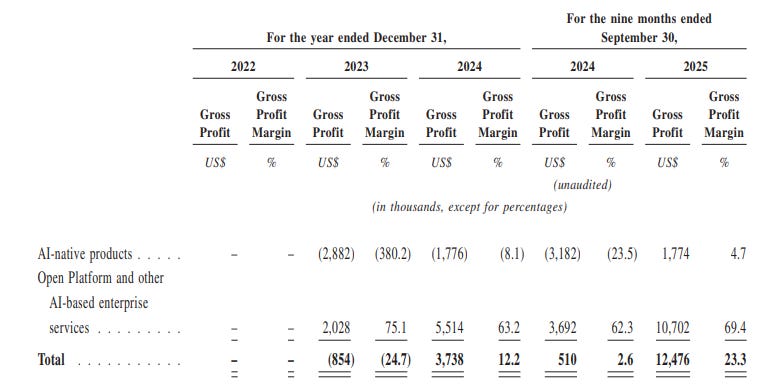

Here’s MiniMax’s revenue broken down into two categories:

You can think of AI-native products as the things MiniMax has built that consumers can buy (access to the MiniMax app, its Hailuo AI video-generating app, and its AI chat service Talkie), while the latter category represents enterprise incomes.

Recall that yesterday we saw from Z.ai that many expect the enterprise AI market to outstrip consumer AI spend in time; today, MiniMax is performing more strongly amongst consumers than enterprise, at least in trailing revenue terms.

Consumer and enterprise revenues loosely tripled in 2025 (through Q3) compared to 2024, though the company remains 70-30 split between the two revenue sources.

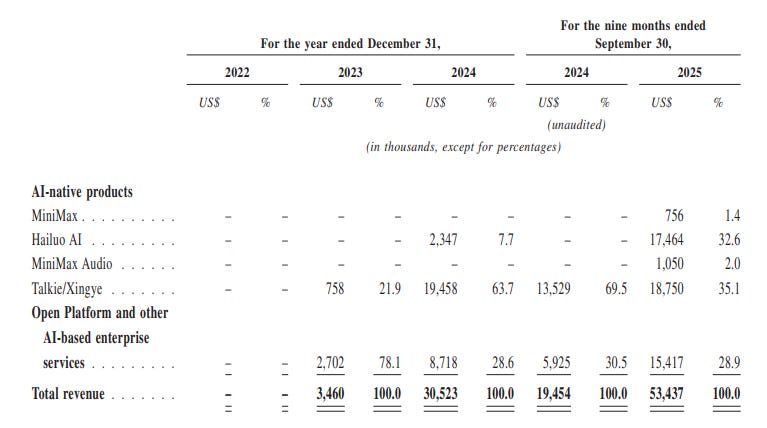

What’s capital about the MiniMax filing is that it breaks its revenue down into minute categories. Want to know which of its consumer apps are driving revenue and how quickly they are growing individually when compared with aggregate enterprise revenues? I got you:

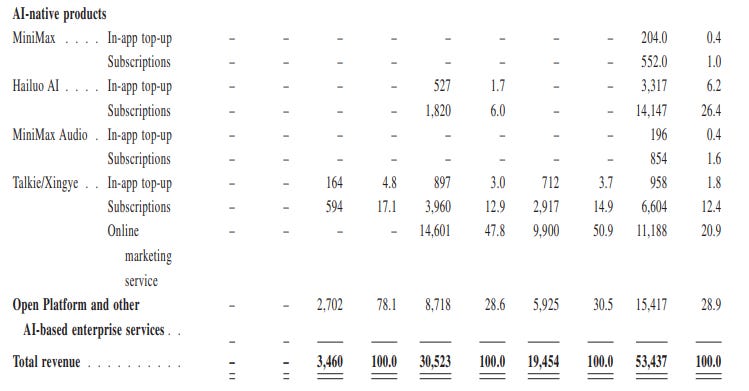

Fun, but can we learn more about how consumers are spending all that money? Of course:

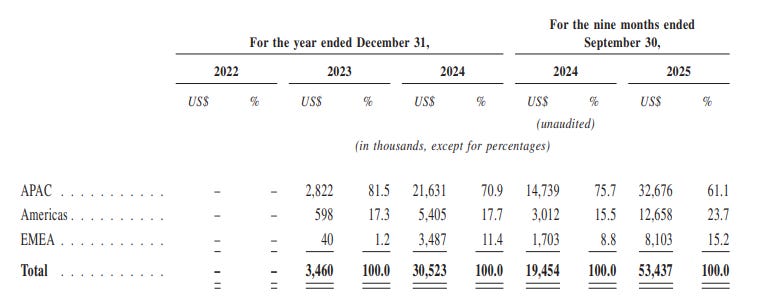

Or how about a breakdown of total revenue by region? Sure:

Good fun, yeah?

What we can glean from the above data is that the consumer AI business at MiniMax is heavily predicated on users wanting to generate video and have virtual chat buddies. Most of those incomes come from subscriptions, but top-ups are also important revenue contributors (especially for the MiniMax app itself).

Does it matter that MiniMax is mostly consumer-powered today? Yes, but not because we care, per se; if MiniMax became a quadrillion-dollar company on the back of consumer demand, cool. But what we learn later in its IPO filing is that while its enterprise business has very attractive gross margins, its consumer business does not:

Yoof.

Positive is better than negative when it comes to gross margins, meaning that MiniMax is having a much better 2025 than 2024, but the Δ between the margin profile of its two revenue sources is stark.

So, we’ll want to track how quickly MiniMax can scale its enterprise incomes (as Z.ai has) while still building and releasing open models. The risk for all the Chinese AI tigers is that they give away too much value (access to ~open models) to recoup their costs (R&D spend). Let’s find out!