Choose your own regulator

Also: Do OpenAI's finances look sane?

Welcome to Cautious Optimism, a newsletter on tech, business and power.

Wednesday. As expected, the government has shut down. Startups that sell to the government could face slower contract approvals and payments, and key information that influence interest rates, like payroll and inflation data, could be delayed. IPOs are probably on hold, too, PitchBook reports. And the stock market fell in response to the national mess. Not a great day for economic growth.

But at least we have the Sora 2 slop machine from OpenAI coming our way! I suppose that similar to the ‘stories’ hype from a few years back, every tech company today needs to have a short-form video project. Call it the TikTok-ification of tech. Naturally, LinkedIn is also taking part, as are DoorDash and Meta. Alas. — Alex

📈 Trending Up: Eve’s legal AI service … Vercel, after its investors reupped their support … novel ways to scoot around space … European startups? … crypto prices …

I caught up yesterday with the CEO of Boom, a startup building a supersonic passenger jet. It’s one of my favorite companies in the world.

📉 Trending Down: Peace in the Middle East … Canadian fertility rates … local media anti-consolidation … UK access to Internet products … health care affordability …

Things That Matter

Choose your own adventure regulator: Brian Quintenz, the Trump administration’s candidate to run the CFTC — an agency that oversees much of the crypto world — is out after the Winklevoss twins lobbied the President to yank his candidacy. The move is a surprise, but not one that was presaged by Quintenz releasing messages in which Tyler Winklevoss appears to argue that government policy should comport with their complaints.

Apparently, Quintenz (also global head of policy at a16z’s crypto division) wasn’t pro-industry enough, so the twins complained to POTUS and now we don’t have a nominee to lead the CFTC. With enough political support for the White House, you can choose your own regulator! The situation is an L for a16z, whose partners have also supported Trump.

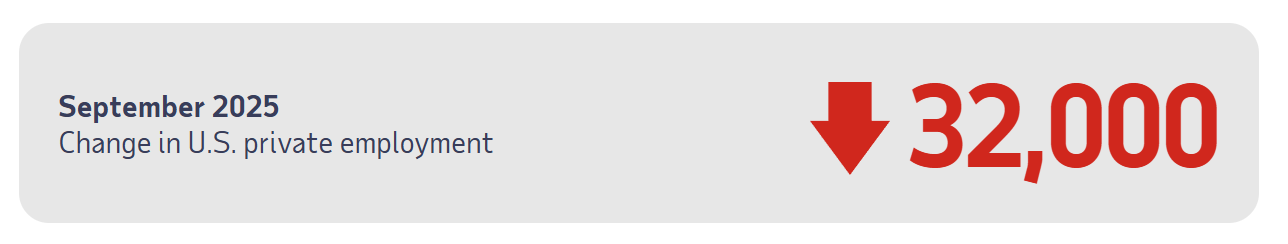

Here’s a data point from the ADP National Employment Report:

Are OpenAI’s finances sane? OpenAI is back in the news today for inking a deal with Samsung and SK to source high-bandwidth memory. The deal is the latest of several tech-boosting agreements between the AI giant and companies that build the hardware you need for training AI. Oracle has gotten a similar boost; Nvidia is riding much the same wave; CoreWeave is feasting on OpenAI… The list goes on.

We’ve joked that OpenAI’s demand for compute is helping to hold up the tech industry, and therefore the stock market, and therefore the domestic economy. With the stock market near all-time highs, spending by the wealthy is helping keep things moving. It’s not really a joke anymore, and the point is more global than local.

Is OpenAI growing fast enough for the numbers to work out? Maybe. The Information reports that OpenAI’s revenue totaled $4.3 billion in the first half of 2025 (16% more than its full-year result in 2024). That is straight up impressive, as is the fact that the company reached monthly run-rate revenue of $1 billion this summer.

That growth didn’t come cheap: the company burned $2.5 billion, and its GAAP losses were larger. Still, I think cash accounting makes the most sense for OpenAI today given how it’s approaching growth and spend. The AI company intends to burn more in the back half of this year as it continues to scale. And seeing as it ended Q2 with $17.5 billion in capital, it certainly has the cash it needs.

So, OpenAI’s finances are bonkers but reasonable so long as demand for its products and services continues to rise. But don’t let go of your backside just yet. The hyperscalers’ Q3 reports will help us understand how far behind the cloud giants are regarding compute scale, and if they have caught up to demand, OpenAI’s spending will suddenly feel a lot less reasonable.

It’s a great time to build more solar, wind and batteries: Bloomberg has a great piece on how data centers impact local power costs — if you live close to a data center, where power is likely to be in high demand, your bills are likely heading higher. The headline number, “electricity costs as much as 267% more than it did five years ago in areas near data centers,” is stark.

But this means this is a great time to build lots of power generation. But instead of doing just that, as a nation, we’re attacking wind and solar projects. A massive wind farm project was killed by fiat until a court blocked the order. I know people working on the project, and it’s nearly done. We need lots more power generation, so it’s plainly asinine that we’re trying to win a race while trying to starve ourselves.

Yes, the country needs baseload power, but we also need green energy production and storage. We can do it all at once! Given how much power generation we must bring online now, it isn’t helping that we keep stubbornly throwing grit in our own gears.

Oh, we’re buying chip startups now?

Meta is planning to scoop up Rivos, a startup building chips based on the RISC-V architecture. RISC-V is open-source and competes with similar products from Intel (x86) and ARM. Naturally, Meta, whose capex is crossing $60 billion this year, doesn’t want to pay someone else’s margins on its outlays, so bringing more chip manufacturing in-house makes sense.

Google is building its own line of chips for computing workloads, including AI tasks.

Amazon is building a line of chips for computing workloads, including AI tasks.

Microsoft is building a line of chips for computing workloads, including AI tasks.

Rivos’ chips are AI-focused, and the company touts their ability to handle AI training, RAG, and fine-tuning work. But it’s hardly the only startup chasing this particular dragon.

Cerebras Systems just raised $1.1 billion in a Series G that valued it at $8.1 billion, and claims to have the “fastest AI infrastructure”; Groq’s inference chips are also seeing big investor demand, with the company raising $750 million last month; Etched is building transformer-specific chips (my interview here); and South Korean chip upstart Rebellions just raised $250 million more.

The list of startups worth tracking in chip-land stretches on and on. Positron is working on ASICs to handle transformer-based AI workloads; Lightmatter thinks photonics will greatly speed up computing; Tenstorent is building processors to crunch AI workloads, too.

In short, the entire world is coming after Nvidia’s insane value and proven market demand. And we haven’t even touched the memory side of the computing equation.

Why bring this up now? Once the deal goes through, we could see other major compute players also get busy with their checkbooks, unleashing a wave of purchases that could convert a host of promising startups into in-house chip accelerators. A little early liquidity would be welcomed by venture investors, but wouldn’t it be cooler if we got more independent chip companies reaching decent scale?

What’s funny is that a small startup is worth a fraction of any major cloud company’s capex in a single quarter. So they aren’t cheap in revenue terms, but the potential savings could prove enormous. Or not, if Nvidia keeps besting everyone.

No matter what happens next, we all need to spend more time staying abreast of chip startups.