Come on in, the party's just getting started

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Hump day! After the bell today, we’ll hear from Alphabet (capex, search profitability, cloud growth, AI revenue notes), Tesla (margins, sales decline mitigation notes, impacts of changing regulatory climate), ServiceNow (Saas!), and Oatly (how goes the pressed-oat business?). I’m flat-out stoked to see the numbers, so expect extra vigor tomorrow morning! — Alex

📈 Trending Up: AI talent wars … solutions perhaps still hunting up a problem space … hey that’s my face … the IPO pipeline (defunct VenHub SPAC deck) … memestocks, again … podcasting …

📉 Trending Down: Domestic intelligence … US AI research in China … cybersecurity … Chinese economic optimism … house prices in China … search traffic …

Before we dive into our main work today, Vanta just raised $150 million at a $4.15 billion valuation. Bloomberg writes that Wellington led the investment, with funds from banks and venture capital firms tagging along. The company’s previous round valued it at $2.45 billion, and Vanta had yet to spend any of the $150 million round it closed last year.

What’s notable is that when Vanta was on the 2024 Forbes Cloud 100 list, it had a reported 8,000 companies using its compliance automation technology. In coverage of its new round, the figure had scaled to 12,000. That explains why the company, which cleared the $100 million ARR milestone last January, was able to raise so much more, at so high a price. Vanta is now public-market scale, and cash-rich. Not a bad place to be in 2025. If you know Vanta’s current ARR, let us know.

Can xAI outrun its burn?

The ‘kill OpenAI’ plan from Elon Musk’s AI startup was simple: Build a bigger computer faster, and use it and data from Twitter (X) to build better AI models faster than rivals.

There’s good logic to the effort. Compute and data are key ingredients of any AI model, and the more compute capacity you have, the more — and more unique — data at your behest the better. Thanks to what is widely considered a very quick buildout of a 100,000 GPU cluster, later expanded to 200,000, xAI’s Grok family of models have improved to the point of being competitive on a benchmark basis.

Grok 4, the company’s most recent family of models, scored highly on well-known AI tests, leading some to hail xAI as the new leader in LLM technology. Since then new models from Moonshot AI (the Kimi-K2 family) and Alibaba (new models in the Qwen3 family), have continued to push the state of the art further.

However, we're paying closer attention to usage data to prevent our eyes from being blinded by the benchmark Olympics. By now, you’ve become accustomed to seeing OpenRouter data on CO. It shows that amongst folks running tokens on the service, xAI remains mired in the low single-digit market share range, below both Moonshot and Alibaba, let alone its domestic rivals.

All this is to say that the approach of building out your own compute while levering your own data can earn you a performant model, but that market share doesn’t necessarily follow. Especially when open-source technologies from China ensure that the value of an AI model mere inches from the cutting edge is all but instantly commodified.

A good question at this juncture is so what. Why do we care if xAI has yet to secure more market share amongst foundation AI model companies? After all, with Musk’s backing and a huge amount of capital raised in recent months, surely all is going according to plan?

Maybe not. The WSJ reports that xAI is in the process of raising $12 billion more to purchase even more GPUs to power its enormous compute clusters so that it can keep doing what it has shown can keep it competitive in benchmark terms: Scaling up compute and crunching its proprietary data.

Crunchbase News, July 1 2025: As The Generative AI Wars Heat Up, Elon Musk’s xAI Secures $10B In Debt, Equity

With a reported burn of around $1 billion per month, xAI has leaned on fellow Musk companies for cash (SpaceX is into xAI for a supposed $2 billion) and is toying with complicated lease agreements to get its hands on even more chips. The question before the company is how much of an edge even more chips will earn it; OpenAI, after all, is busy securing multi-gigawatt capacity with partners like SoftBank and Oracle, while Anthropic is happily leaning on Amazon to build out city-sized computers to run its computations.

Put another way: xAI is building its hyperscaled infra while its domestic rivals went the partnership route earlier on. OpenAI has long leaned on Microsoft’s cloud footprint (though it is building for itself, too), for example, just as Anthropic is a leading user of Amazon’s internal silicon. Google of course has an entire pre-built cloud to bring to bear for its own uses (and its own chips, the TPU line). And then there’s xAI, taking out debt at double-digit interest rates (per the WSJ) to buy chips that depreciate in the face of new, faster, more powerful chips coming out on the regular.

Therefore, xAI has to rip revenue (ROIC, I suppose) out of its GPUs at a pace that at once pays for the cost of capital used (interest) and the natural loss of value of GPUs put under heavy load (depreciation) to make its spend even begin to pencil out. But, with xAI’s models not lighting up the usage charts, we can infer that paid usage of Grok 4 and its friends via the xAI API is yet modest compared to what Anthropic and OpenAI are themselves seeing.

What I would kill to see is xAI’s revenue numbers from the last, say, four quarters. That would tell us whether the xAI rush to earn AI prominence is either on track to financially pencil out, or if the company might have been better off linking up with an extant compute provider instead of trying to in-house Mag7-level capex using equity and debt capital.

Open the doors

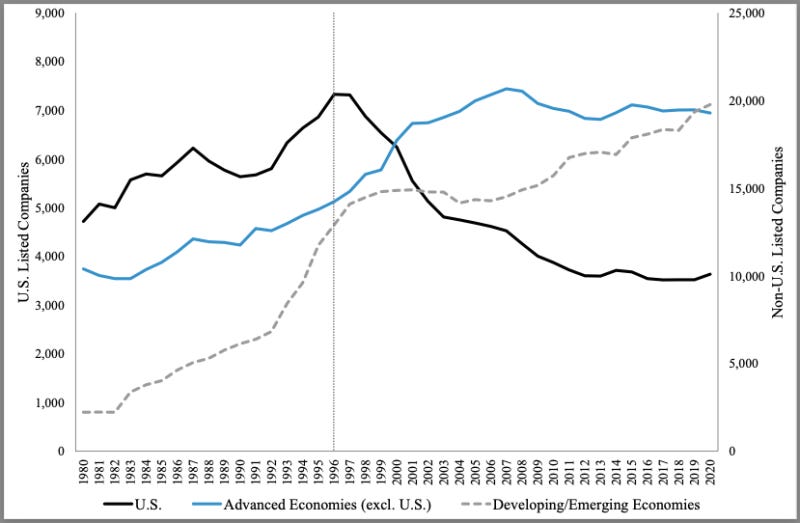

Here’s a chart from the Tuck School of Business, showing a decline in the number of listed companies in the United States over time:

The same article argues that on a merger-adjusted basis, the decline in American public companies is less steep. Anti-trust jokes aside, it’s a fair point. It is also correct to point out startups staying private longer, and the rise of secondary transactions have made public markets less than they once were.

So, it’s notable that the House passed the Equal Opportunity for All Investors Act of 2025 this week. The bill — provided the Senate passes it and POTUS signs it — would allow individuals who do not presently pass the accredited investor test to do so by making it a test instead of a wealth/income threshold.

Frankly, good. The accredited investor system we currently have in the United States is not unreasonable, but as our national risk tolerance has changed, it’s time to kill it. What do I mean? If you can wager your entire paycheck on sports betting from your mobile phone while commuting home from work, you should be allowed to invest in private capital. If you do not think that people should be able to invest in the private markets en masse, but are in favor of sports betting being allowed along and sophisticated trading tools offered to teens, I don’t know what to tell you.

Corollary: If you are in favor of alcohol being legal, but are opposed to cannabis legalization, you’re an idiot.

The more positive case to be made here is that as the number of public companies falls, and the best startups stay private longer, more of their value creation is being hoarded by private-market investors. So, we should find a way to let the 401k crowd get in there. Else, the market seems unfairly tilted away from regular folks. That’s no good, and since we can’t seem to get unicorns to go public, I’ll take this other option.

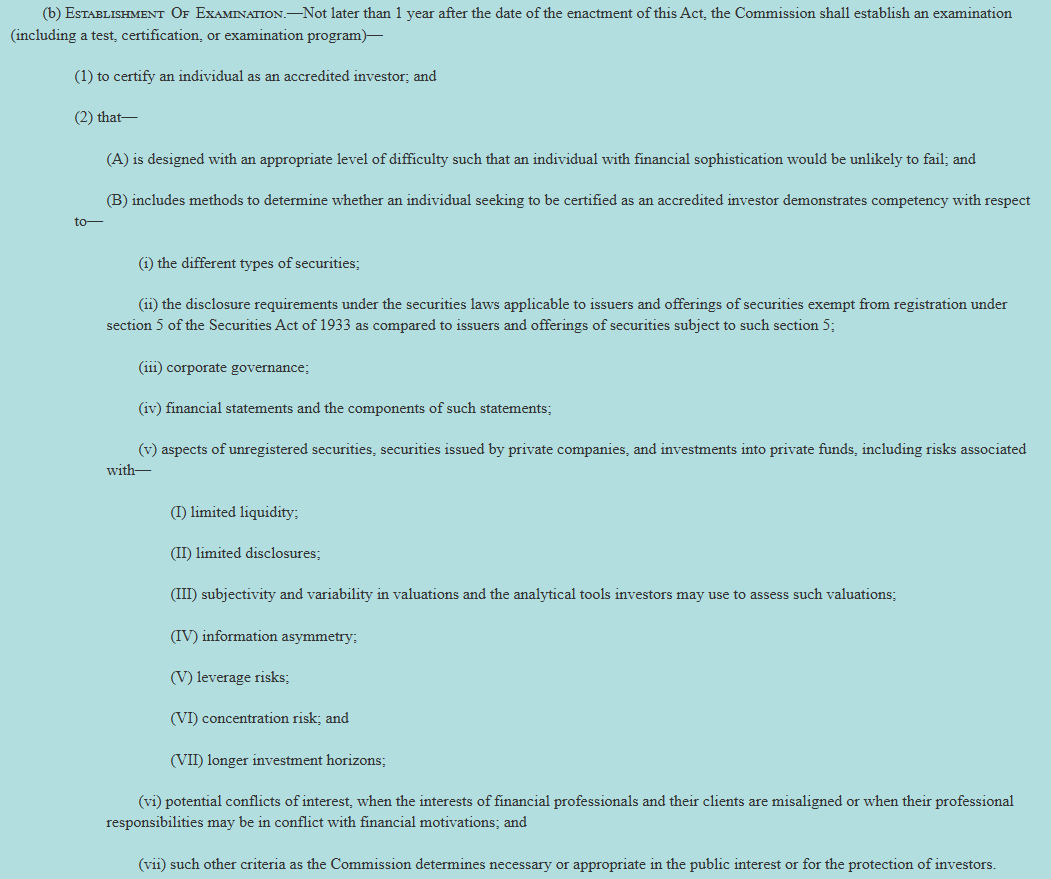

Here’s the bill’s list of what folks should know:

Fair enough, frankly.