Dispatches from the earnings trenches

And: FireFly Space IPO Deep Dive

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Wednesday! To kick off, the day’s must read is this download from a recent OpenAI employee describing how the company works, and what makes it a somewhat unique company for its size. In case you were worried that OpenAI, due to its massive growth in the last few years, had become a hidebound org entirely bedeviled by internal politics, well, rest easy. Now, to work! — Alex

📈 Trending Up: Crypto-friendly legislation … BBC revenue … Chinese cyberattacks … OpenAI creeping into Microsoft territory … inflationary pressures via tariffs … the Epstein fight … $12B Seed valuations … European cybersecurity …

Grok usage? The new Grok 4 model is showing up in OpenRouter datasets, but is not currently at risk of toppling any major names.

📉 Trending Down: Doge-DoD relations? … media economics … economic literacy on the American right … POTUS’s brand? … OpenAI’s staff … AI code editors …

Before we dig into our two main discussions, let’s briefly touch on China.

The nation scored a win this week after the United States government changed its tune on Nvidia selling its somewhat-dated H20 chipsets to the nation. That decision was part of a larger agreement concerning minerals and trade between the two nations. Still, for Nvidia shareholders (anyone with an index fund) and Chinese AI shops hungry for more GPU grunt, this week has brought welcome news.

Elsewhere in China, AI firm MiniMax is gearing up for a $4 billion valuation in a Hong Kong IPO. Color me excited to see the metrics that an ‘AI Tiger’ from the nation has on tap. Recall that fellow AI Tiger Mooonshot AI’s Kimi models turned heads recently.

And, finally, the Times has a great piece up on just how much state support the Chinese AI industry enjoys today. That won’t beat the private capital flywheel that we have here in the States, but it will keep domestic AI model companies sharp. And that’s no problem by me.

Dispatches from the earnings trenches

Pulling from ASML, JP Morgan, and Citigroup earnings this morning, a few critical nuggets for your mastication:

ASML warns about 2026: Despite reporting €7.7 billion worth of Q2 revenue and guidance for the full year of 15%, Dutch lithography titan ASML is not confident about next year. Here’s the CEO:

Looking at 2026, we see that our AI customers' fundamentals remain strong. At the same time, we continue to see increasing uncertainty driven by macro-economic and geopolitical developments. Therefore, while we still prepare for growth in 2026, we cannot confirm it at this stage.

We expect to see goods prices to start picking up over the summer, as tariffs take effect, and we have seen pauses in capex and hiring amongst our client base. All of that said, the strength of the U.S. economy driven by the American entrepreneur and a healthy consumer has certainly been exceeding expectations of late. As I've been speaking to CEO, I've yet again been impressed by the adaptability of our private sector aided by the depth and breadth of the American capital market.

JPMorgan on the IPO window, and how you have to play the game on the field:

I have heard some things […] to the effect of that there is pressure to kind of recycle capital and get things done. And yes, sure, after the initial shock of the tariff policy changes, everyone kind of went on hold. But as we've noted in our comments a few times today, at a certain moment, you just have to move on with life. And it does feel like some of that is happening just because you can't delay forever.

JPMorgan on charging for access to customer data:

So this is very important. So forget pricing for a second, we are in favor of the customer. So we think the customer has the right to, if they want to share their information. What we asked people to do is, what are they -- do they actually know what's being shared? What is actually being shared? It should be everything. It should be what their customer wants. It should have a time limit because somebody of these things going on for years. It should not be remarketed or resold to third parties. And so we're kind of in favor of all that done properly.

And then the payment, it just -- it costs a lot of money to set up the APIs and stuff like that to run the system protection. So we just think it should be done and done right. And that's the main part. It's not like you can't do it.

The data point is material. We’ve seen Salesforce limit access to Slack data that startups like Glean need to operate; and JPMorgan made news in the last week for its plans to charge fintech companies for access to its customer’s data.

On one hand, it’s the customer’s data. On the other, JPMorgan clearly expects to be remunerated for its work to make customer data accessible. It would be a blow to the fintech world if every customer dataset became paywalled; such an environment would pool power in the hands of deposit holders. I’m actually a little surprised that there hasn’t been more howling about this trend. If we restrict data flows, not only will financial technology startups find themselves painting sans paint, but AI startups will struggle to acquire necessary context. And then everyone has to buy Salesforce AI products. Not great.

Fly me to the moon

As promised, today we’re taking a deeper look into the Firefly Aerospace S-1 filing today. As a fair warning, I am a space dork. A complete simp for orbit. Utterly under the boot of launch systems. Obsessed with getting my sack of meat to zero-gravity before I become plant food. You get the idea.

What does Firefly Aerospace do?

Builds and launches small (sub-2,000 kilograms), and medium-scale (sub-20,000 kilograms) rockets to bring payloads to orbit. It also builds and launches spacecraft, including a lunar lander that was the first commercial landing vehicle to complete a “fully successful moon landing.”

Firefly’s Alpha (small launch vehicle) is the “first and only U.S.-based orbital rocket in the 1,000 kilograms class to successfully reach orbit,” the company states. With four launches under Alpha’s belt, it’s now part of the larger fabric of the global launch economy. The company’s Eclipse (medium launch vehicle) rocket is expected to take its first flight in early 2026.

Doesn’t SpaceX make that work moot? Why build more rockets when the Falcon 9 is busy launching every few days or weeks? Because demand is bonkers. Firefy has a $1.1 billion backlog (up from $559.4 million at the end of Q1 2024), which is impressive for a company with such a nascent launch profile.

And even better, the company writes that “before launch” it “typically [collects] approximately 90% of the total contract value, which is highly advantageous as production ramps.” Why does that matter? Cash flow, baby! Speaking of which:

Is Firefly a good business?

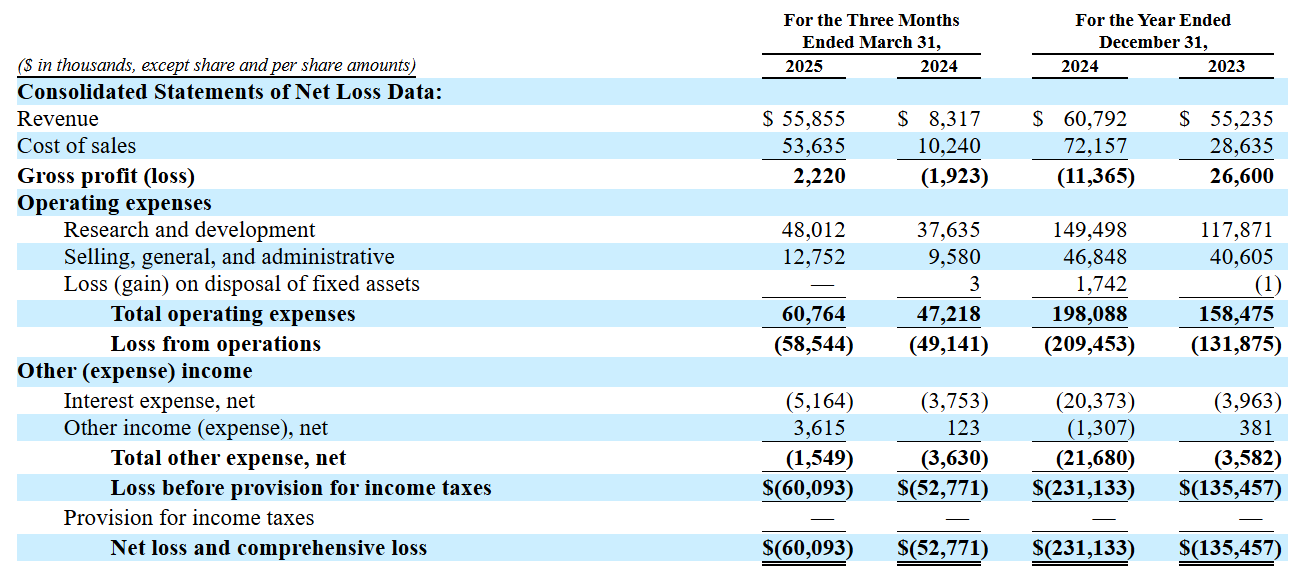

Not yet, but there are signs that it could be at scale. Here the income statement:

Growth is impressive. As we noted above, Firefly is getting into a launch cadence with its smaller rocket and that’s helping push its top line up. But, its revenue spike in Q1 2025 was more driven by Blue Ghost (lunar lander) than new rocket launches:

Encouragingly, the company went gross-margin positive in the first quarter after a margin-negative 2024. It’s a very slim result in the first quarter, but still indicative that as the company scales through launch volume and spacecraft revenues, it should be able to chip away at its losses.

Firefly agrees, writing in its S-1 filing that:

With each launch, we expect our cost structure and unit economics to meaningfully improve, as our increased launch cadence will result in fixed cost amortization and operating efficiencies. Additional efficiencies are unlocked by our streamlined development and production processes. Eclipse’s development is progressing rapidly given Alpha and Eclipse share significant carryover from our engineering team and substantial component commonality and supply chain compatibility.

If you think that demand for orbital access will continue to scale, then Firefly might be a company worth looking into. Unlike the towering SpaceX and its private-market status, Firefly is going public much earlier in its lifecycle. Which means that there’s still upside — and more risk! — to be found here than at the leading launch provider.

Why is Firefly going public?

Money. Firefly operations ate $56.5 million worth of cash in the first quarter, and the company wrapped Q1 2025 with cash and equivalents of $176.9 million. That’s just a few quarters’ burn at recent levels, implying a need for more capital to continue growth.

Firefly has secured a new $125 million credit line, so it could self-fund for a while. But going public was once upon a time a fundraising method, and not merely a victory lap for aged unicorns to execute only while both kicking, and screaming. The company intends to use its IPO funds to pay down debt, clear dividend obligations to its Series C and Series D Preferred Stock holders, with the balance reserved for “general corporate and working capital purposes.” The better Firefly can price, therefore, the more operational flexibility it will have.

Alex you haven’t dorked out about space once!

Yes, yes, but I’ve been saving the best for last. Here’s a tidbit from the Firefly filing that made my eyes light up:

Additionally, we expect to offer a lunar imaging service, named Ocula, through Elytra as early as 2026.

Elytra is Firefly’s “multi-mission orbital vehicle” that can do all sorts of things, including “carrying payloads into and out of orbit, performing long-haul communications missions, fostering space domain awareness, and other responsive space capabilities.” Sick. Using the in-house craft to do lunar imaging is a great use-case, and one that reminds me of startups like Albedo are doing, but simply aimed at a different celestial orb.

More when we get preliminary Q2 financial data, and even more when Firefly drops a first IPO price range estimate.

With Figma and Firefly both gearing up to list, at a minimum we’re going to have a two IPO quarter. Not great, not terrible.