Diverging AI bets detail two-lane future

And: Sometimes playing the game on the field is an error.

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Happy Tuesday! Did we get away with record deficits because interest rates were so low? Rising bond yields for state debt imply that that era is behind us. Too late, perhaps, to avoid all pain but it appears that democracies, gas stations, and autocratic societies alike are awash in debt. The deleveraging could get painful. Everywhere.

And on that cheery note, to work! — Alex

📈 Trending Up: Don’t do this … self-driving partnerships … paying for the nuclear triad … quantum consolidation … Seed prices … Boeing sales … revenue at TSMC … no shit …

📉 Trending Down: The popularity of state violence … crypto forgiveness? … Seed math … Apple’s AI ambitions … media economics … streaming media profits … early-stage investing …

Chart of the Day

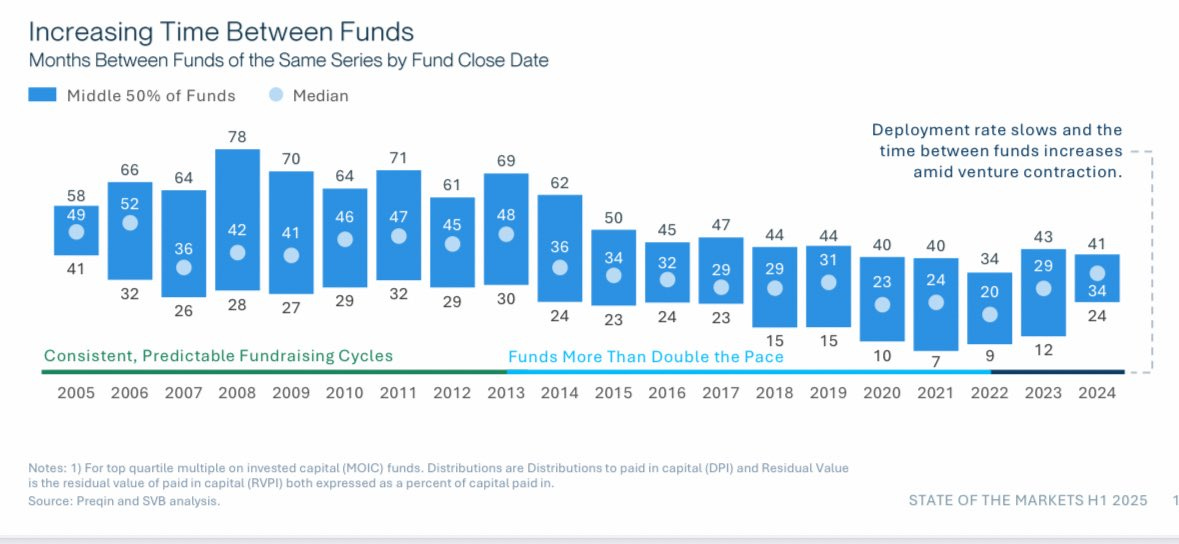

Via Altimeter’s Meghan Reynolds, the pace at which venture funds are being disbursed is slowing:

I doubt we’ll get back to post Great Financial Crisis timelines, but it appears that the invest new funds in two years or less era is behind us. And with good reason. Startup valuations move, somewhat, in waves, tracking up and down due to several factors. But if you invest all your capital quickly, and at a time when startup prices are hot, you can get burned.

That we see the most violent venture investing cadences when prices are high is also something to keep in mind; sometimes playing the game on the field is an error.

Where’s the pain?

Here’s a puzzler. At present, US GDP expectations are hot for Q2. At the same time, inflation expectations are coming down. There’s some weakness in hiring data, but anticipated pain from the global trade and macro uncertainty don’t appear to be causing much near-term economic damage.

It’s odd. Coming from the Chicago School of economic thought, I expected more economic dislocation to have manifested by now. A good question is why. It’s not hard to find stories of small businesses taking blows, farmers struggling to source enough labor — you name it. But in aggregate? Things are alright. Hell, the stock market is trading like tariffs are zero and we don’t have a debt problem. Nice for now, but I wonder.

Diverging AI bets detail two-lane future

Amazon announced $10 billion worth of investment in North Carolina last week, funds earmarked for “AI infrastructure” along with a host of local goodies (training, grants, etc). Not be outdone by itself, Amazon announced a $20 billion investment in Pennsylvania to, you guessed it, “expand AI infrastructure.”

We’re living in a world where Anthropic is still compute constrained and OpenAI is considering working with Google to source more GPUs as it build globe-straddling data centers of its own. Hell, Microsoft has plans to build more AI infra in Switzerland and South Africa. And we haven’t even touched on the massive AI spend in, and stemming from the Middle East. Mix in other hyperscaler buildouts — Microsoft pledged to spend $80 billion this year, while its peers pledged similar capex in 2025 — and we’re looking at a simply bonkers, and growing race to build larger and more powerful data centers.

Those data points and headlines contrast with AI skepticism, a viewpoint accelerated this week by Apple’s AI paper that we discussed here. The gist is that even “thinking” LLMs suffer from material weaknesses when posed with increasingly complex challenges. The negative viewpoint is that AI model progress, both current and future, is sufficiently overhyped to undercut expected growth in AI revenues.

On one hand, technology companies cannot stop spending to support a future in which AI compute workloads are as common as breathing. On the other, there’s the belief that tech is high on its own supply and repeating 90s-era overbuilding mistakes. What about dark fiber, is something I’ve heard a few times.

I think it’s best in moments like these to simply take score instead of trying to ferret out which gambler is making the sharper wager. So, what can we see? Here’s a bundle of datapoints that I think matter:

OpenAI announced this week that it has reached $10 billion worth of ARR, up from a reported $5.5 billion figure last year. Nearly doubling from a ten-figure ARR starting point in under a year is pretty insane.

And OpenAI is still cutting prices on some of its higher-end models. Put that in your pipe and smoke it.

Anthropic’s revenue has quickly scaled in 2025, rising from $1 billion on an annualized basis to $3 billion. Again, insane revenue ramp from a ten-figure base.

Cursor recently reached $500 million worth of ARR, scaling 5x in what could be record time for a company of its scale.

Windsurf has also scaled like the wind, cresting the $100 million ARR milestone, reportedly.

Syntheisa has crossed the $100 million ARR mark too.

Mercor jetted from $1 million ARR to $100 million in eleven months.

Together AI reached $100 million worth of ARR last year, recall.

Mistral has landed new contracts that could push it up to the $100 million

revenue mark this year, partially buoyed by European skepticism of American technology companies.Loveable is over the $50 million ARR mark, proving that you can build hyper-growth companies in Europe.

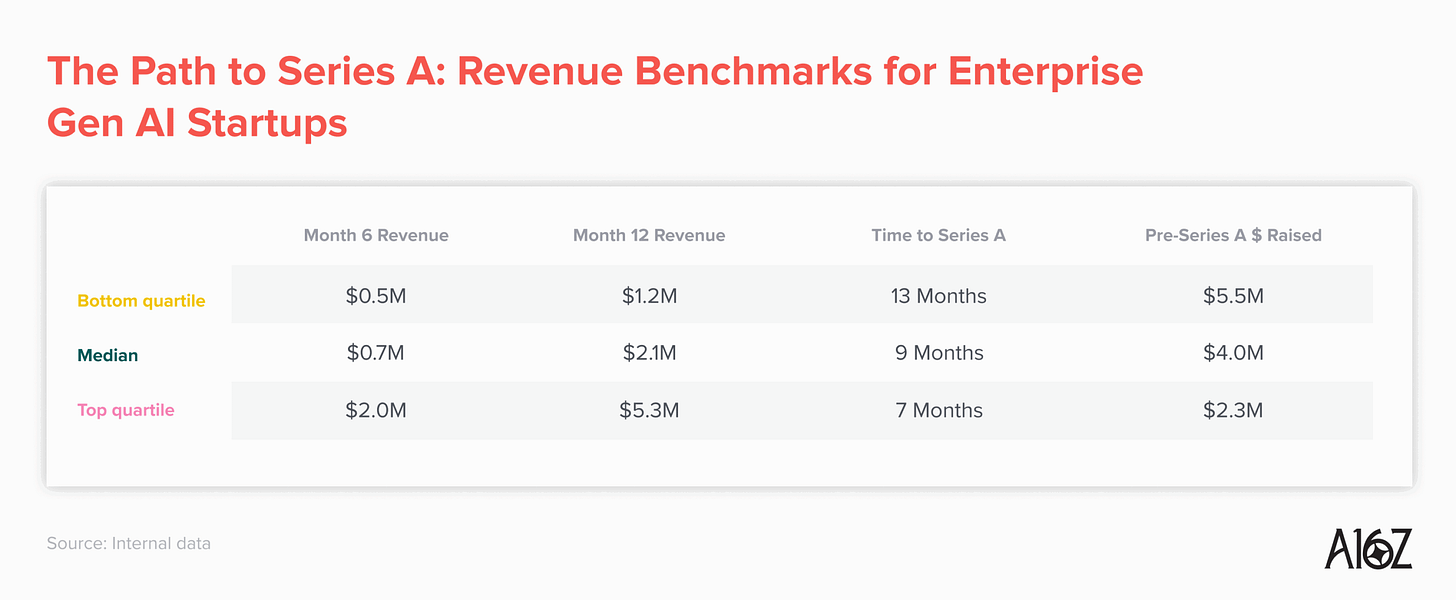

I could go on — and I am sure you have your own examples — but I think that that scorecard tells a pretty clear story. Recent data from a16z’s Olivia Moore makes the on-the-ground situation even clearer when discussing consumer and enterprise AI startups at the Seed stage:

Our data backs up the idea that we’re in a new era of startup growth. The median enterprise company in our sample set reached more than $2 million in ARR in its first year, raising a Series A just nine months post-monetization. Median consumer companies performed even better, reaching $4.2 million in ARR and raising an A round within eight months. What was once considered “best in class” — the $0 to $1 million ARR ramp — is now on the lower end of growth we’re seeing.

In chart form, here’s the new good/better/best for enterprise AI startups:

In case you aren’t accustomed to looking at tables like this, those numbers are insane. And far, far better than what was normal in the SaaS era. Back when Slack was the fastest growing software company of all time, it reached $100 million ARR in 2.5 years. Now that’s somewhat table stakes for breakout AI startups, if not a bit slow.

Taking all the above into account, the data indicates that startups are scaling faster than ever, and to even greater revenue heights younger, than before. The major change from the SaaS era to today? Introducing AI.

Yeah, but

Even with the impressive business results we’re seeing above, there’s no guarantee that there will not be at least some data center overcapacity in the coming years. What I struggle to do in light of that fact, however, is worry. Mostly the companies spending the most on AI infra are the wealthiest companies in the world. Some nations and sovereign wealth vehicles could see their fingers bitten, but for consumers — both startup and human — too much compute means lower prices, yeah?

Oh no, don’t threaten me with a good time.

Returning to Apple and our recent splitscreen on AI doomerism and AI euphoria, even if foundation model progress slows, I think enough has been accomplished to support a mountain of economic activity. And that means that whether or not you have quibbles with Apple’s paper, we’re far from high on our own supply.