Down with the Jensen Tax

And: Inflation, IPOs, and more!

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Tuesday! Welcome back. July inflation data came in mixed this morning, with the broad Consumer Price Index (CPI) rising 0.2% in June, good for for a 2.7% year-over-year gain. The market had expected a 0.3% monthly increase and 2.8% on a year-over-year basis.

So, all things are good? Sadly no. While total CPI was flat at 2.7% in July compared to June, core CPI — stripping out a few volatile categories — rose 0.3% last month for a gain of 3.1% on a year-over-year basis. That’s ahead of the 3.0% increase that was expected.

In short, inflation is at least staying stubborn, and perhaps picking up. You can read the numbers however you see fit, but political attacks against the Fed for not cutting rates sooner are already underway. To work! — Alex

P.S. Our editor is off until Wednesday. Please do not email the typo you find.

📈 Trending Up: Notion, which is profitable … Intel, after its CEO went to the White House … new blockchains … corruption … shipbuilding consolidation … political patronage … coffee prices … domestic shock troops to suppress dissent …

📉 Trending Down: The open internet … vaccination rates … Starlink dominance? … traditional political alignment ... the BLS … Fed independence …

IPO Watch:

Bullish is a go: Crypto trading platform Bullish raised its target IPO price range from $28 to $31 per share, to $32 to $33 per share. And RenCap reports that the company also intends to sell nearly 10 million more shares than it previously expected. That’s almost 50% more total shares. Bullish’s accounts are set to fill when it prices this evening and starts trading tomorrow.

StubHub retrenches: After pausing its IPO earlier this year in the wake of a surge in trade barriers and resulting market upset, StubHub is back at it. The company dropped a new S-1 filing (albeit sans Q2 data), and CNBC reports that the ticketing spinoff from eBay could go public next month. At last.

Figma stock: After a bonkers early run from its IPO price of $33 per share, Figma has settled into a price range around the $80 mark. That gives the former design startup a market cap of around $40 billion, or double what Adobe agreed to pay for it a few years back.

Circle results: Shares of stablecoin company Circle — an early 2025 IPO — are up 14% this morning after its earnings showed the company’s revenue rising 53% to $658 million. Circle’s “revenue less distribution costs” was $251 million, up 38%. Total USDC in circulation was up 90% year-over-year, and the company’s adjusted profit rose by more than 50%. Circle is also now worth around $40 billion, meaning that we’ve effectively seen two quadracorn IPOs this year from just two companies. (Chime is worth $11 billion, meaning that it’s in a slightly lower size tier compared to Figma and Circle.)

Maybe some other unicorns should list while the listing is good?

Wait, is antitrust cool again?

The drum-beating by CO that antitrust enforcement can be good for startups is quixotic. We know that, even if we can’t shut up.

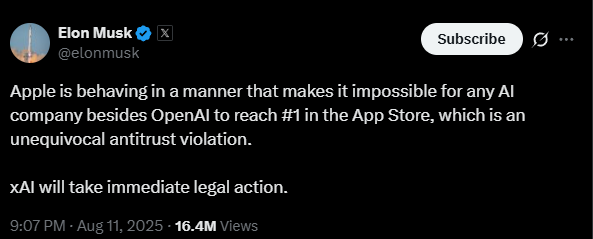

So color me surprised when former 47 staffer Elon Musk dropped the following over on his house social network:

A few things. First, he’s wrong. As many users pointed out, DeepSeek has made it to the top of the App Store, and other AI apps like Perplexity have topped other national iOS application charts.

But more to the point, Musk here wants the government to intervene on his behalf to end the dastardly boosting of his rival by Tim Cook and company. OpenAI’s Sam Altman, apparently not in the mood to endure invective, responded — clapped back? — that Musk’s claim was “remarkable [given] what [he had] heard alleged that Elon does to manipulate X to benefit himself and his own companies and harm his competitors and people he doesn't like.” He then provided this link.

Put aside the AI CEO squabbling. Focus instead on the idea that the government should intervene in the market to avoid self-preferencing under the aegis of antitrust? Pinch me, I’m fainting.

Nvidia can’t catch a break

American chip giant Nvidia is thriving. Its GPUs are in hot demand the world ‘round, helping the company’s worth rise until — at $4.44 trillion today — it became the most valuable corporation in the world.

All the same, Jensen’s empire is having a bear of a last week. In case you needed a refresher: Nvidia was forced during Biden’s term to create a dumbed-down version of its H100 chip if it wanted to sell gear in China. So, it made the H20. It wasn’t as good, but it was designed to meet export controls as the two nations fought for economic and military supremacy.

During the first summer of the second Trump administration, H20 exports were banned. Later, Nvidia cajoled the Trump administration into allowing the sale of the chips again, but the licenses didn’t appear as promised. So, Nvidia went to the White House and wound up getting smacked with a 15% mandatory resort fee from the government.

Missing from the popular narrative we just went through is China’s reaction to the mess. The CCP fomented enough FUD — look, the term has a non-crypto use case! — about Nvidia chips being insecure that the American company had to post about how it does not have backdoors or killswitches in its hardware.

But being yanked around and uniquely taxed by its home government, Nvidia is now facing stringent pushback in China — a nation that has spent heavily to develop its domestic chip industry, and get GPUs onto the market that can challenge Nvidia’s dominance. Per Bloomberg:

Over the past few weeks, Chinese authorities have sent notices to a range of firms discouraging use of the less-advanced semiconductors, people familiar with the matter said, asking not to be named discussing sensitive information. The guidance was particularly strong against the use of H20s for any government or national security-related work by state enterprises or private companies, the people said.

I struggle to feel bad for Nvidia, as it sits literally atop the great corporate ladder, but damn. Nvidia wants to build great chips and sell them. Instead, it finds itself being taken advantage of on one side of the Pacific and slandered on the other.

Why the Jensen Tax is bad

Before we get too far, Wired has a great interview with the CEO of AMD, Lisa Su, that you should read.

Yesterday on TWiST, Jason and I discussed the forced revenue transfer Nvidia and AMD will pay the U.S. government for the right to sell detuned hardware in China. We riffed a little, including touching on the question ‘what’s the difference between the Nvidia vig and other taxes?’

It’s a good one. After all, trade agreements get deep into the nitty-gritty, so perhaps single-good export fees are somewhat normal? Not in this case. While import taxes (tariffs) are often tuned to protect domestic businesses, commentary from the financial elite makes it clear that the sort of protection money that the two leading American chip companies will have to pay the government for the right to sell the chips to China that they designed for China after the government set tough rules on selling to China, is not normal.

Forget the norms. Making Nvidia and AMD give up nearly one-sixth of their China revenue to POTUS is a bad idea on the merits. Here’s why:

Congress holds the Constitutional right to “lay and collect Taxes, Duties, Imposts and Excises [with the stipulation that] all Duties, Imposts and Excises shall be uniform throughout the United States.”

It’s a good system. Congress includes many political and geographical perspectives, so what it comes up with is widely informed (in theory) and fair (by uniform application).

Allowing one person (POTUS, in this case) to set trade policy unilaterally strips local representation from the process, creating a system in which companies have to earn the favor of their ruler (risking corruption) to do normal business.

In essence, the Trump tax on Nvidia and AMD is precisely how trade policy should not operate. Instead of being open and broad with shared authority, the policy is closed and narrow with single-point control.

I am trying to argue that having a king is bad, in case it isn’t clear.

If we accept the Nvidia-Trump situation as normal, get ready for fun things like:

Democratic presidents levying special fees on oil companies selling their goods, possibly demanding so steep a cut that petroleum production becomes economically unviable.

Republican presidents extorting profitable companies for a cut of their profits for the right to do their normal business.

Of course, we’re already seeing the latter, I just want you to chew on the former, too.