Everyone is worried about AI revenue

And: why Microsoft is more solvent than the US government

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Monday! Our economic calendar for the week is here, in case you want to find out how barren the next five days’ earnings reports will prove; even the companies with offset economic calendars are going quiet. This is how quarters end.

Looking to the present, today we’re looking at IPO receipts, Microsoft’s new personnel issues, and AI revenue. To work! — Alex

📈 Trending Up: Oregonian spine … The EU, after Moldovan elections … superintelligence? … state mineral capacity … leveraged video game purchases by petrostates … print is alive? … shootings in America … AI in Excel?

📉 Trending Down: Federal employment … no disaster response … the right to dissent … X-India relations … Marissa Mayer … fuel availability in Russia … the Russian navy … surviving the Lunar night

Chart of the Day

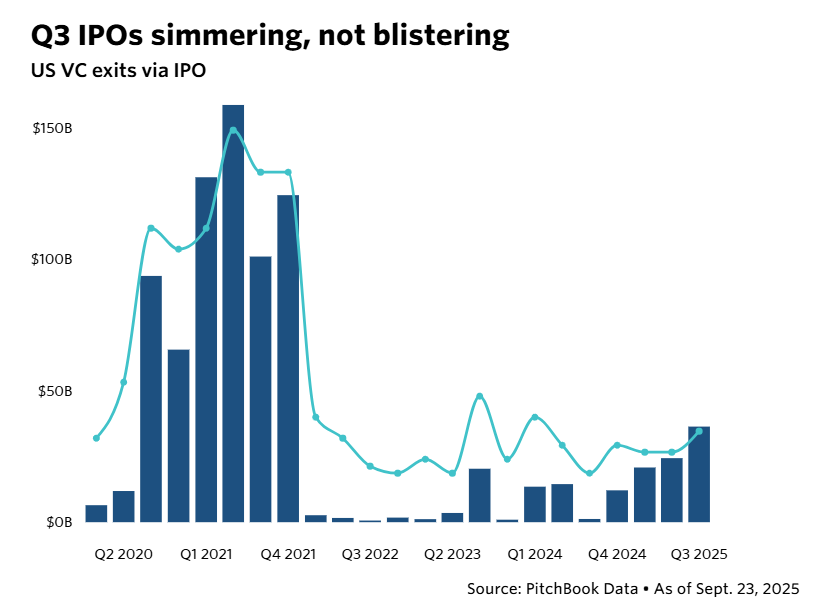

PitchBook data indicates that we’re near the tail end of the best quarter for IPOs since 2021. But it doesn’t feel like that because Q3’s results aren’t really that much better than what we saw earlier this year and for brief periods in 2023 and 2024:

Still, a consistent increase in IPO receipts here in the States means that material amounts of venture cash is being recycled at last. That should lower the tension between LPs and their venture partners, and potentially unlock more capital for startup investment. Viva la IPO Boomlet, may it continue into the fourth quarter and 2026.

Things That Matter

Microsoft is more solvent than the government: Recent coverage of Microsoft’s low borrowing costs compared to the United States government underscores an interesting moment in time. Microsoft is currently more solvent than the United States government, the market tells us by offering to lend to the company at a lower rate. (Treasury bills have long been considered one of the safest investments possible, so the news does carry some punch.)

As the Wall Street Journal points out, demand for corporate debt is hot at the moment, which helps explain the situation, but Microsoft is also locked in a race with other trillion-dollar companies to build ever-increasing compute capacity. The company reported capex of $24.2 billion last quarter, and expects that to rise further in its current fiscal year.

And investors are still willing to lend it cash at lower rates than to the government. This is because despite making massive investments, the company is still incredibly profitable and growing at a comfortable clip. So much for over-investment…

Elsewhere, folks are beginning to worry even more loudly that some data center buildout is financially precarious. The gist is that by using debt to fund its compute contracts, Oracle is taking on real risk. True, but for now, the market is content to fill its debt offerings.

Who runs Microsoft? POTUS wants Microsoft to fire Lisa Monaco, the company’s recently hired president of global affairs. Her sin is that she was formerly deputy attorney general of the United States during the Biden administration, and per Trump, a “senior National Security aide under” Obama. That’s enough for POTUS to demand her extirpation, with the President writing that “Microsoft should immediately terminate” her employment.

Bluster? Bullshit? Who knows!? POTUS directly cited “major contracts that Microsoft has with the United States Government” in his post on Truth Social, which is about as subtle as a thug looking around your shop and telling you it would be a shame if something happened to it. So far, it appears that Microsoft has not caved to the demand.

Imagine a Democratic administration demanding that Meta stop hiring former Trump staffers.

Some folks told me that the Monaco situation isn’t a big deal; she can just get a job elsewhere. Don’t give up on capitalism so quickly, friends. Turning your political rivals into economic pariahs is much more than sparring.

We’re not giving up on Taiwanese independence, are we? As the TikTok deal inches closer to a resolution, a broader economic arrangement between the United States and China remains a possibility. The WSJ reports that China’s leader, Xi Jinping, wants the United States to change its posture on Taiwan’s independence from “neutral position to one that actively aligns with Beijing against Taiwanese sovereignty” as part of a larger agreement.

I presume you would join me in saying hell no to that. In practical terms, dissolving the smaller nation’s independence would require an invasion, and in doing so, China would render Taiwan’s chipmaking facilities moot. Not merely through military engagement, but because TSMC is prepared for such an eventuality and has plans to shutter its facilities in the event of an invasion. Critical chip manufacturing equipment provider, Dutch ASML, can also scupper its equipment on the island if needed.

Which brings us to China’s recent move away from Nvidia and towards homegrown chips, and the United States’ ambitions to produce half of its needed chips domestically. Those are moves one might expect from nations desperate to control their destiny in a de-globalizing world, or what one would anticipate from two countries ready to take the global chipmaking crown jewel offline. Keep an eye on cross-Pacific conversations.