Everything is a prediction market

Also: Nvidia's Midas Touch

Welcome to Cautious Optimism, a newsletter on tech, business and power.

Wednesday! It’s Fed rate day (more below), and this afternoon we will get to see how Meta, Alphabet and Microsoft performed in Q3. That’s two of the three largest cloud computing companies, and Meta, which has its own AI strategy, so by the time you read this tomorrow morning, we’ll know a lot more about the AI boom, how durable it’s proving, how much more compute is needed to fuel it, and notes on enterprise adoption to boot. I’m stoked. — Alex

📈 Trending Up: Inflation in Australia … agentic harmony … OpenAI’s IPO plans … slop … AI safety tools? … Nvidia the VC … Reddit ads, thanks to AI … Chinese soybean purchases … Canada-India relations … India-EU relations

📉 Trending Down: Game development at Amazon … Boeing’s cash burn … clean government … EU digital sovereignty … public tech companies … Hungary’s global status … the Russian economy

Things That Matter

The Midas Touch: Any company that can get its hands on a big Nvidia or OpenAI partnership is rewarded by the stock market. PayPal was tapped this week to bring payments to ChatGPT, and its shares rose. Nvidia announced it would invest $1 billion in Nokia to work on advanced telecom tech here in the States, and Nokia shot nearly 23% higher.

Some of these gains will endure a bubble — Nokia and Nvidia will still work together if the stock market corrects. But nothing this sunny lasts forever. Investors won’t be content to preorder the promise of growth in the wake of starting-gun announcements forever.

AI compute demand is boosting demand for high-bandwidth memory, per South Korea’s SK Hynix’s recent earnings report. The company saw revenue increase 39% to 24.45 trillion won ($17.13 billion) while operating profit rose to 62% in the quarter. The AI boom is a global phenomenon.

And if it’s really a bubble, its pop will be heard worldwide too. Jensen isn’t worried.

It’s rate cut day: Investors have priced in a 99.9% chance that the Fed will cut interest rates by 0.25% today, or 25 basis points. The new Federal target rate will be 3.75%-4.00% later today when the Open Market Committee announces its decision at around 2 p.m., East Coast time.

The labor market is weakening, layoffs are mounting, and lots of folks want to build stuff that requires immense borrowing. For those reasons, an interest rate cut is welcome. If you are an inflation hawk, the fact that price increases have gone from 2.3% in April to 3% in September is incredibly worrying.

The Fed only has so many tools at its disposal, and they are often crude. Here’s hoping that inflation doesn’t rise much higher as we try to support the labor market.

Everything is a prediction market: Polymarket intends to return to the U.S. with a “focus on sports betting,” Bloomberg reports. And with FanDuel getting into prediction markets, it only makes sense that prediction markets would target sports betting.

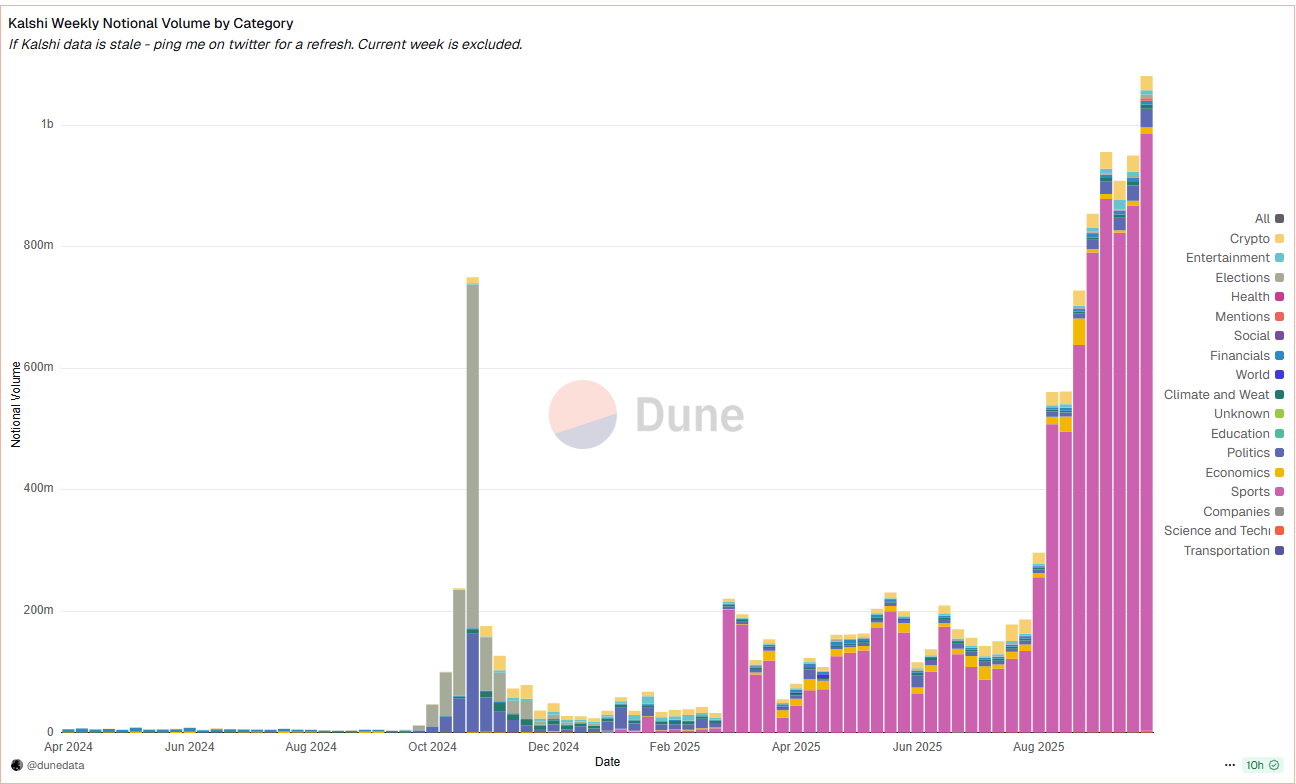

And there’s good evidence that sports betting is the real use case for prediction markets. To wit, Kalshi’s platform volume today is heavily predicated on sports-betting activity, per Dune:

Because Polymarket and Kalshi have been so successful at clearing the regulatory thicket and attracting capital, others want to play, too. Enter Trump Media and Technology Group, owner of the President’s Truth Social social network:

[TMTG], operator of the social media platform Truth Social, the streaming platform Truth+, and the FinTech brand Truth.Fi, today announced that it will make prediction markets available on Truth Social through an exclusive arrangement with Crypto.com | Derivatives North America (CDNA), a CFTC-registered exchange and clearinghouse. Following the integration, Truth Social will be the first social media platform to offer its users technology to access embedded prediction markets capabilities through CDNA.

Most excellent. Soon you will be able to combine two addictions: gambling and social media. What’s next? Sports betting on your Samsung smart refrigerator? Asking Alexa for Amazon Prime Prediction odds? I love a flutter, but I also wonder if we’re executing a society-level experiment on gambling that will stress-test our collective libertarian streaks.

The robots are coming

A few weeks ago, Figure showed off its third-generation humanoid robot. It looks slick in the demo videos, as all humanoid robots do, but with a fresh billion in hand and a new robot working its way to production, Figure seems to be doing rather well for itself. It’s not alone in making progress on this front, though.