Fintech's winning, but the VCs are poor again

Also: Why the compute race isn't a one-lane competition

Welcome to Cautious Optimism, a newsletter on tech, business and power.

Thursday. The stock market is heading higher today while crypto prices remain depressed. Bitcoin is off just over 9% from the past week, while Ethereum’s token is down 7.5%. Meanwhile, precious metals are setting new records. It’s a mixed messages sort of month.

In better news, OpenAI just hired “black hole theoretical physicist Alex Lupsasca” for its science team. As a space dork, I can’t imagine a better use of OpenAI’s coffers than spending oodles of money sorting out how the universe works. — Alex

📈 Trending Up: AI + Spotify … American cybersecurity … Brown University … the length of the government shutdown … pivoting to video … short-form content … open-source AI … Apple’s silicon team …

📉 Trending Down: Stablecoin cred … Meta-Apple relations … the Voting Rights Act … peace in the Middle East? … journalism … free speech in Indiana …

Things That Matter

Fintech’s winning again: Now that travel booking startup Navan’s going public (more here), we’re on pace for yet another multi-billion-dollar fintech exit before the year ends. Navan’s following Chime, Circle, eToro and Klarna in realizing its IPO dreams this year, each of which notched another win for fintech investors who’ve endured years without an exit since the glory days of 2021.

Exit activity tends to build confidence, and fintech venture capitalists are feeling mighty cocksure these days. Just this month:

Better Payment Network (stablecoins) raised $50 million

Upgrade (online loans) landed a fresh $165 million

Coinflow (stablecoins) convinced investors to give it $25 million

Telcoin (blockchain banking) landed $25 million

Resistant AI (anti-fraud) raised $25 million

Bite Investments (private capital software) got $25 million

Aboon raised $17.5 million for AI-imbued retirement accounts

Baselane raised $20 million for its banking software aimed at landlords.

What’s more, fintech investment was “hot in Latin America” in the third quarter, per KPMG, implying that prospects are improving for financial technology companies everywhere .

Hot Fintech Summer indeed. The question before us now is how much capital fintechs can raise and recycle before the business cycle inevitably takes a breather.

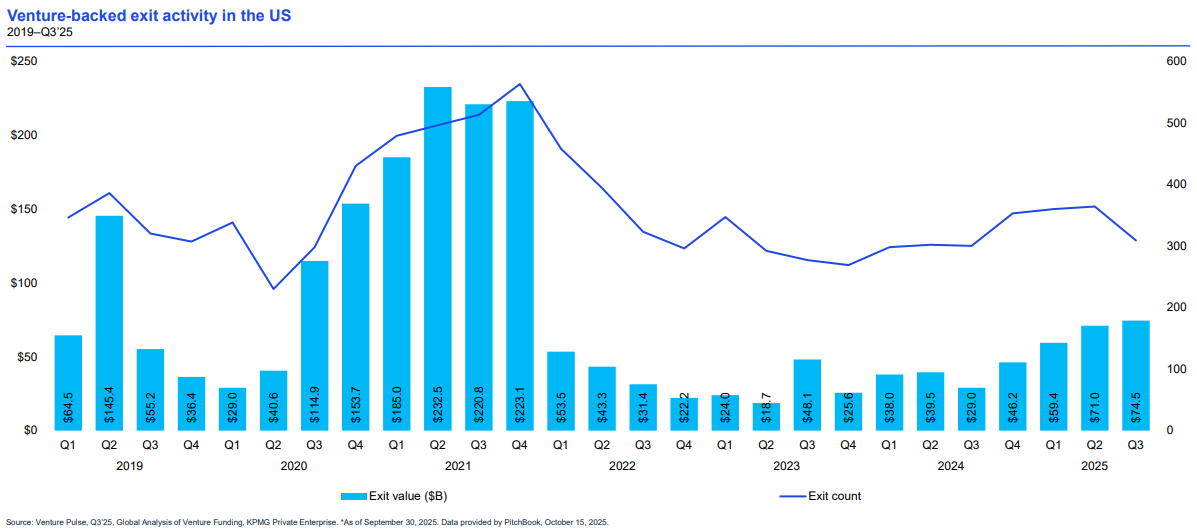

But the VCs are poor: The KPMG dataset we linked above also tracked $74.5 billion worth of exits in the United States in the third quarter, the largest single-quarter result since 2021:

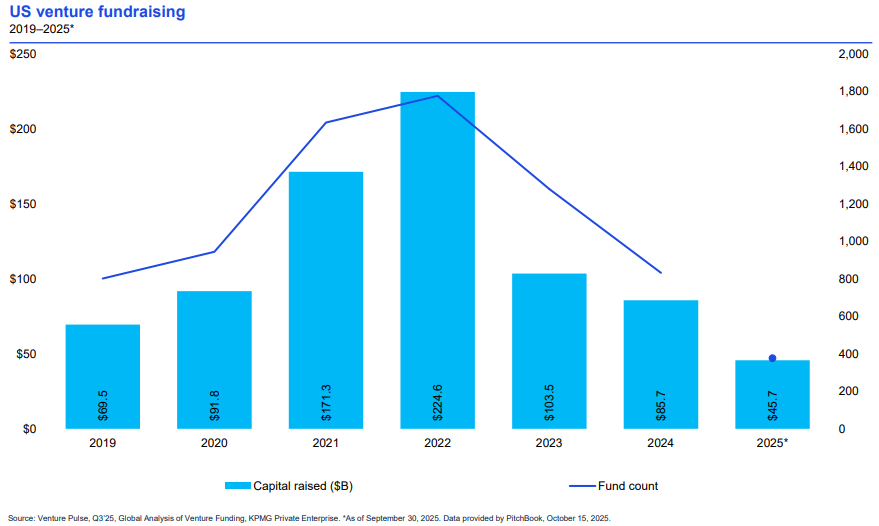

Despite these improving trends, it appears that venture capital firms are still struggling to raise new funds. U.S. venture firms raised just $45.7 billion through the end of Q3 2025:

Globally, the picture is even worse: VC fundraising totaled just $80.7 billion this year through Q3, down from $196.1 billion in 2024, and $412.1 billion in 2021. (We’re comparing a three-quarter result to full-year figures here, but it doesn’t look good.) I’d expected venture fundraising to reflect the improved exit tallies faster. Why was I wrong? Perhaps because the total value of still-private unicorns has reached a staggering $6.6 trillion dollars, per Crunchbase data.

If you’re an LP sitting on an allocation that is worth lots on paper, you might not have the spare basis points to put into new venture funds. That means we may need to see several quarters of accelerating exit volume until the venture market is back to a neutral funding/exit posture.

Can VCs keep funding AI startups at their current pace if it’s so hard to raise new funds? Perhaps that’s why Nvidia is investing in anything that touches AI?

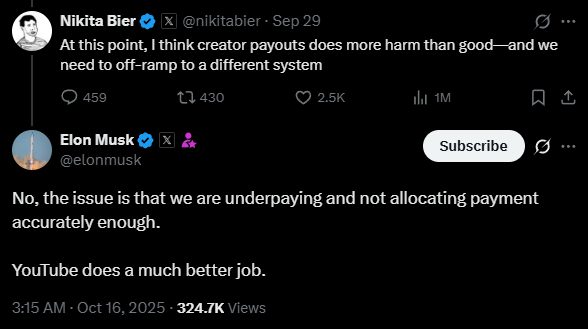

More, or less: I was heartened in late September when X’s new head of product said paying people to post would be a net-negative activity. Weeks later, his boss, Elon Musk, has pushed back:

Bier’s desire to return the social network formerly known as Twitter to a place where engagement farming was only rewarded with engagement (and not monetary rewards) struck a chord with many users, myself included. But X’s move towards a ‘For You’ style algorithm and paying for viral moments has changed it to something like an Instagram for words.

Sadly for those of us who miss the days when folks saw posts from people they followed in a time-series feed, it appears that Bier is losing his fight to reclaim a bit of the old Twitter magic.

I miss the time when social networks didn’t all taste like

chickenTikTok.

Free speech? When the chat logs of a Republican group got leaked and a host of racist and violent messages spilled into public view, some took the situation seriously. Not our Vice President, who argued that the folks in question — members of Young Republican organizations, some of whom are in their 40s — are just kids acting silly and should be treated as such.

Here’s a headline: “Trump Team Plans IRS Overhaul to Enable Pursuit of Left-Leaning Groups”

Meanwhile, the United States recently revoked the visas of six foreigners from six different countries “after reviewing their online social media posts and clips” about the death of conservative activist Charlie Kirk.

In short, if your comments on the Internet align with the rulers, you get a pass; if not, you could get deported. This is going to be stupendous for our ability to attract foreign talent and capital during this period of heightened economic rivalry with autocratic nations.

All your compute are belong to us

Yesterday, we discussed the importance of tech giants’ upcoming earnings reports. If Amazon (AWS), Microsoft (Azure) and Alphabet (Google Cloud) say that they are still compute-constrained, the frenzy to build more compute capacity to handle AI workloads would appear more sane than otherwise. If those companies report that they have enough capacity, then OpenAI’s plans to spend hundreds of billions more in the coming years to bring more GPUs online would make it look mad.

While I was writing that post, a consortium involving Microsoft, BlackRock, xAI and a few others, put up $40 billion to buy Aligned Data Centers. Here’s what they’re buying (emphasis ours):

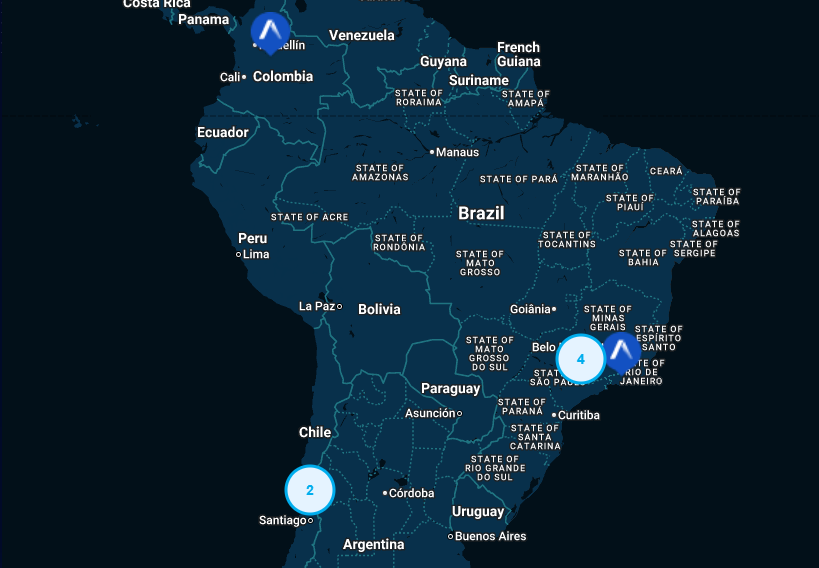

[Aligned Data Centers] designs, builds, and operates cutting-edge data campuses and data centers for the world’s premier hyperscalers, neocloud, and enterprise innovators. Aligned’s portfolio includes 50 campuses and more than 5 gigawatts of operational and planned capacity, including assets under development, primarily located in key Tier I digital gateway regions across the U.S. and Latin America including Northern Virginia, Chicago, Dallas, Ohio, Phoenix, Salt Lake City, Sao Paulo (Brazil), Queretaro (Mexico), and Santiago (Chile).

Per Aligned’s website, I count 12 data centers in Mexico and further south. That’s a lot of capacity in Latin America that the tech collective can lever. Here’s Aligned’s footprint in South America:

It would be easy to dismiss this deal as nothing more than private equity and wealthy tech companies scooping up even more compute capacity. But one could construe the purchase as a salve for some of our concerns, as Microsoft wouldn’t be spending more if it didn’t need more capacity.

Anthropic’s new, cheap and fast Claude Haiku 4.5 model saw 1.45 billion tokens processed on OpenRouter alone during its first day on the market. Today, the tally is up to more than 5.45 billion. That’s total token consumption on the AI model platform, but it’s impressive all the same to see how quickly new tech is being adopted.

Still, I think we need to view the transaction through an entirely different lens. Buying a load of South American compute isn’t too responsive to domestic concerns about having too many data centers. Instead, the move highlights global demand for AI services.

We’ve seen a similar boom in data center build-outs in Asia: Google’s putting capital to work in India; new facilities are being set up in Indonesia; and so much new compute is being brought online in Malaysia that the government is trying to slow the expansion to sort out power demands. So why not Latin America?

OpenAI and its rivals need to sell to the entire world, and that will require local compute — for both technical and data-residency reasons. That explains all the new facilities across Asia, as well as this Aligned Data Centers deal. And, I expect, more transactions along similar lines.

Perhaps instead of considering the compute race as a single competition, we should break it into region-sized pieces. China has moved to slow data center construction in regions where those facilities may be less needed, but a glut in part of China doesn’t mean that the entire world’s swimming in spare capacity.

That is why, even though I wanted to simply point at the Aligned deal and say that most bigtech AI capex is probably just fine for now, I don’t think I can. Instead, the deal is more indicative of Latin America being an enticing market for major AI companies in the coming years. That’s bullish, but it answers a different question than the one we’ve been chewing on.

Since July, OpenAI has ballooned its run-rate revenues by an entire billion to $13 billion (the most recent reporting), and Anthropic has similarly increased its run-rate to nearly $7 billion (October) from $5 billion just two months ago. That’s $20 billion worth of annualized revenue from two of the fastest-growing private-market companies of all time. Throw a 20x multiplier on those figures and you’re staring at a $400 billion valuation. Sure, the companies are currently worth a little less than $700 billion, but the numbers aren’t so far apart as to boggle the mind.

We’ve spent the year swinging between “it’s so over,” and “we’re so back.” It was only a couple quarters ago that DeepSeek shook the world earlier with its cheap R1 model (yes, that feels like half-a-decade ago). And the numbers just keep getting bigger.