Gemini is going public!

If only non-crypto unicorns could find the same gumption!

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Monday! Welcome back to the week. Here’s hoping you got some rest. Our economic calendar is here. It’s a light week, apart from Zoom on the earnings front, and initial jobless claims (how strong is the labor market?) along with flash services and manufacturing PMI (how active are businesses?). Today, we’re looking at the Gemini crypto exchange IPO filing and how the changing technology labor market is impacting the rank-and-file of startup-land. To work! — Alex

📈 Trending Up: AI hacking … OpenAI’s lobbying shop … AI hardware … getting rolled … sticking up for the LLMs … Hurricane Erin … contra-Free Press? … podcast consolidation … Molly White … wet bulb temps …

📉 Trending Down: Medical paperwork … the price of bitcoin … the First Amendment … livability … South Korean troop numbers … Chinese GDP growth …

Gemini is going public!

Last week we watched crypto exchange Bullish go public at $37 per share, only to see its value skyrocket after listing. The company closed at $69.54 last week, giving it a price/sales multiple — using its Q1 2025 adjusted revenue to set a run rate — of around 40x.

That was enough to get Gemini, another crypto exchange, off the benches and into the mix. While Bullish is focused on the institutional market, Gemini has more of a consumer bent to its operations, if you want to differentiate between the two. Gemini is also well known for its founding team — the Winklevoss twins of Facebook fame — and long-standing brand in the web3 world, having been founded back in 2014.

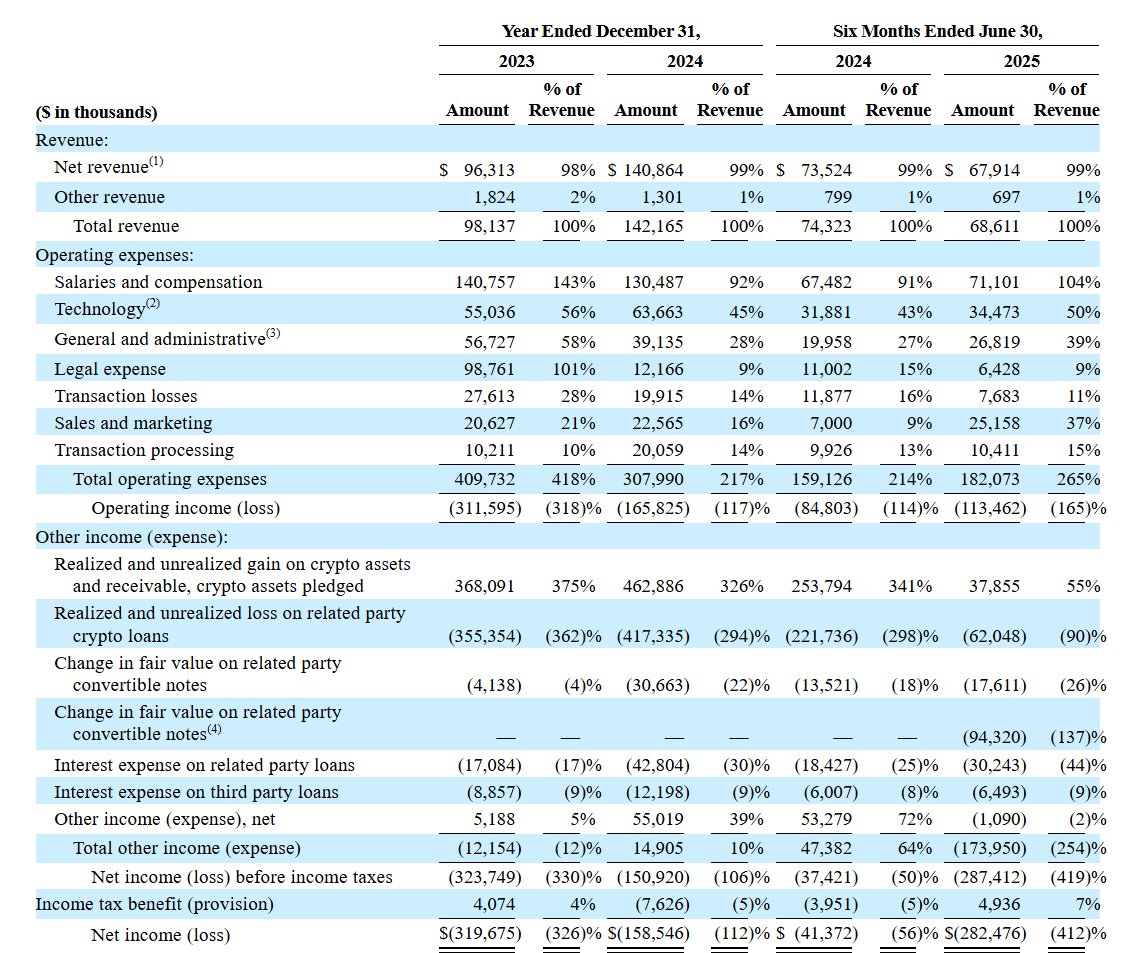

Since Coinbase went public years ago, we’ve become accustomed to the company type. That allows us to skip straight to the numbers: What does Gemini bring to market? Here’s the income statement:

Gemini’s revenue fell in the first half of 2025 compared to the first half of 2024, despite expanding trading volume ($16.6 billion H1 2024 compared to $24.8 billion in H1 2025), which, crossed with rising operating expenses, led Gemini to a stark $113.6 million operating loss in the first half of the year.

It’s not great to see a company’s operating losses exceed its total revenue for any given period. Once other costs were counted, Gemini’s net loss ballooned to more than $282 million for the period.

Are we being too strict? Should we instead look at a more lenient profit metric, like, say, adjusted EBITDA? I am so glad you asked. The numbers are still poor: