Godspeed, OpenAI's Compute Flywheel

Welcome to Cautious Optimism, a newsletter on tech, business and power.

📈 Trending Up: Squeezing the juice from what’s left of Facebook … Project Kuiper … not rates in Europe! … hearing from new voices … private equity ownership of media … pivots … nuclear power …

📉 Trending Down: The FTC under Carr … spray and pray … fiscal discipline … the lifespan of business-political friendships … Rad Power Bikes … US citizenship … rent-seeking … business profits in tariff-exposed industries …

Things That Matter

Inflation, US and EU edition: Inflation in Europe is tame, with the euro area reporting year-over-year price gains of 2.1% in November, while the European Union saw 2.4% price growth in the same period. The latter figure was down from 2.5% in October, while the euro area tally was flat. (You can read the full breakdown here.)

Meanwhile, in the United States, November inflation came in under expectations. The consumer price index (CPI) increased by 0.2% in November, representing a year-over-year rise of 2.7%. Core CPI — CPI less food and energy — rose 2.6%. The market had expected the CPI to post a +3.1% reading.

A far-tamer-than-anticipated inflation print will give the Fed more room to cut in the New Year. Stocks ticked higher on the news.

(Note: The data used to calculate the November inflation results was partial due to the government shutdown, so you may want to wait for December data before declaring that domestic inflation is on a new, lower trajectory.)

Google is now in business with the Trump family: The minute Trump Media and Technology Group — net sales of $1.0 million in Q3 2025 — intends to merge with TAE technologies, a fusion power company that has raised $1.3 billion since its birth.

TAE has raised capital from Google (a long-term partner), Chevron, Goldman, and NEA.

Are the two companies odd bedfellows? Yes. TMTG owns Truth Social, a social network with few users, Truth+, a streaming service that I am sure you watch daily and Truth.fi, a fintech brand that has yet to launch (as far as I can tell). Why would the tiny holding company merge with a hard-tech company?

The logic goes as follows: TMTG has a lot of cash, TAE needs cash, and both companies — here you need to wave your hands — want to support American AI dominance. I’m not kidding. The investor deck lists TMTG’s “experience with large capital raises and complex regulatory processes” as a plus, and places the fusion concern within its remit as it “promotes energy independence,” something critical to power all those data centers being built.

If you have business before the government — as, say, a fusion startup looking to build its first “utility-scale” reactor might — getting into bed with a company that features the President’s son on its board is certainly a choice. (TMTG had $672.9 million in cash and equivalents and no debt at the end of the third quarter.) That it has so much spare change makes the deal all the sweeter.

Combining a shrinking media company and a fusion power company that expects its planned reactor to start generating real power in 2031 makes little sense. But that’s what state capitalism does to an economy. And if the deal goes through, TAE backer Google will own a chunk of Trump Media and Technology Group. Hilarious.

China and the EUV race: Perhaps the biggest story in technology today is that China managed to reverse-engineer an extreme ultraviolet lithography machine (EUV) by collecting former staffers of the Dutch company ASML (a recent investor in the French AI company Mistral, recall).

EUVs are incredibly complex, making ASML a global chipmaking choke point. Hence why China ran an undercover effort to replicate the technology. Reuters, which broke the news of the Chinese project, reports that in April ASML itself felt that China was years away from recreating its core technology. Not true, though, while China’s EUV prototype "is operational and successfully generating extreme ultraviolet light, but has not yet produced working chips.”

If China manages to replicate ASML’s technology in production, it would dramatically shift the global chip balance of power. Taiwanese chip manufacturer TSMC is a major ASML customer; the Nvidia GPU axis rests on their shared might. China replicating ASML’s golden goose would create an alternative chip manufacturing locus that would empower the CCP to undercut the island nation, which the CCP considers a breakaway province. If TSMC — and, therefore, Taiwan — loses its grip on high-end chip manufacture, then it would be an easier target to consume by force.

It’s hard to have Cold War-style IP controls in a globally interconnected economy.

Coinbase gets into stocks: This week, American crypto giant Coinbase announced that it was bringing stock trading to its domestic users. It’s also partnering with Kalshi to bring prediction markets onto its platform. (Prediction markets are largely sports-betting operations by volume.)

Fair play from Coinbase. After all, traditional finance services have iteratively added support for crypto in recent years; why not return the favor? And prediction markets? Everyone and their long-lost childhood dog are stuffing those into every digital surface possible, so why not bring them to Coinbase, too?

Soon, all fintech products will offer users a combination of crypto, stocks, ETFs, gambling, and, in many cases, more exotic trading tools like options. Given the average level of financial education here in the United States, I see no issues with any of this.

What bubble?

Earlier this week, CNBC broke the news that Amazon was considering investing $10 billion into OpenAI. As the Anthropic-Amazon union has become as open a relationship as the OpenAI-Microsoft tie-up, why not was my vibe.

That news item might wind up as chump change compared to what’s coming next. OpenAI is in talks to raise tens of billions of dollars more from investors at a $750 billion valuation, The Information reports. That’s a lot of dollars at a very high price; the folks who can see OpenAI’s financials seem content to increase their bets.

OpenAI may go public next year at a trillion-dollar plus valuation; investors putting more funds into the company today may not expect to have their capital tied up for long.

Why does OpenAI need more money? More compute! Yes, the market is screaming that there’s too much money being spent on building out AI computing capacity, but OpenAI doesn’t agree. So much so that it released a little video of Greg Brockman discussing how his company’s compute constraints mean that it has chosen, at times, to serve current demand at the expense of allocating GPUs to research.

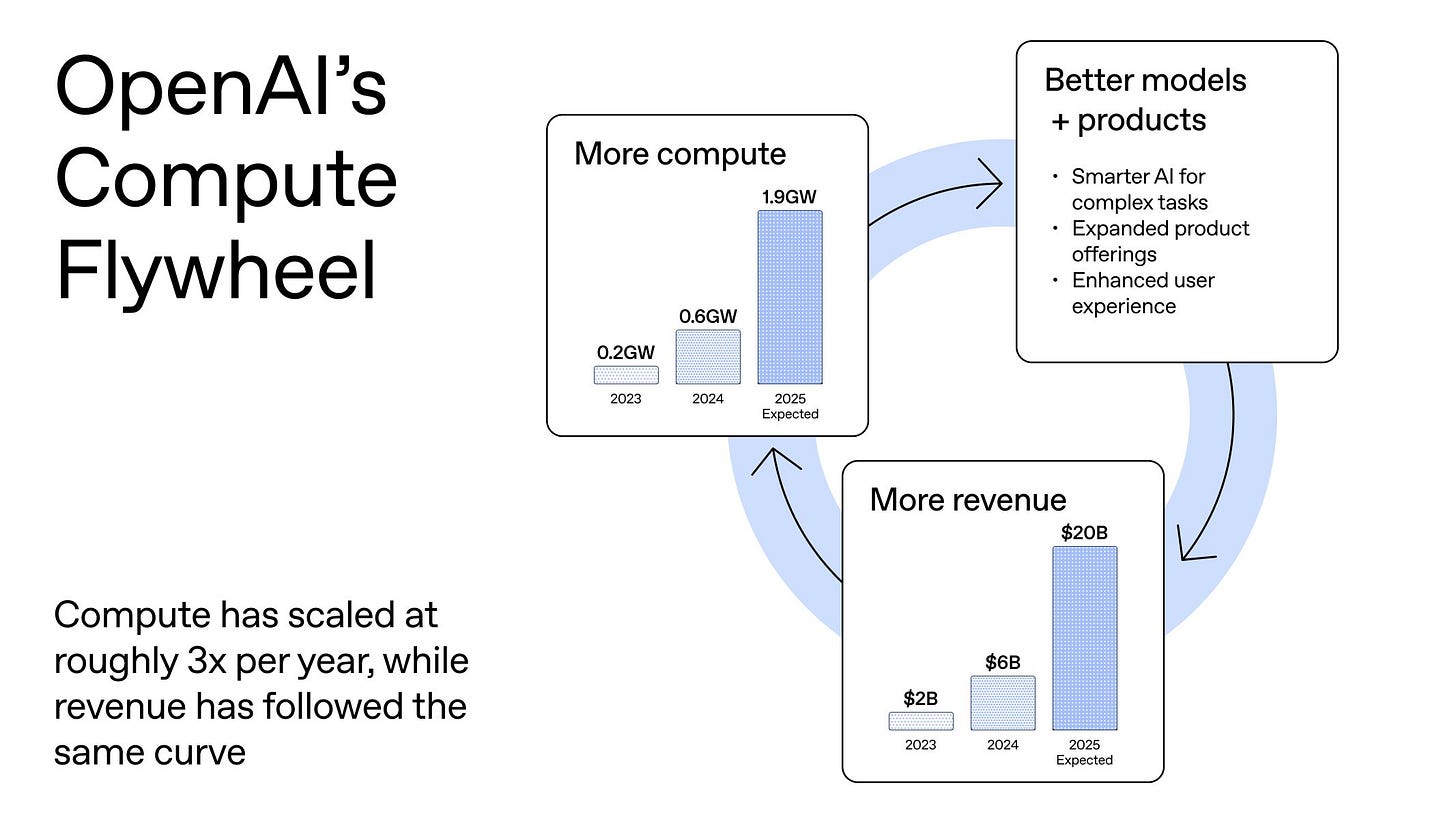

Here’s the OpenAI explainer:

The lower left corner of the chart is the most important piece. If compute and revenue scale roughly at the same growth pace, and you want to keep growing top-line, you need to keep growing compute. That means more capital and more partners. Both of which OpenAI seems able to collect.

Godspeed, OpenAI, don’t blow up and tank the economy, please.

The compute race is minting mini-Nvidias, it’s worth noting at this juncture. Memory maker Micron just crushed earnings on a scale that is hard to explain in the space we have left to us this morning.

The good news for OpenAI and everyone racing to pour more capital into its operation is that the two core ingredients of the AI boom are progressing quickly: Model quality continues to improve (Google just released Gemini 3 Flash which is both cheap, and very impressive), and the app layer continues to grow.

Lovable’s newly-announced $330 million round at a $6.6 billion valuation (Google’s CapitalG led the round with Menlo Ventures) is predicated on it reaching $200 million ARR recently, keeping the European vibe-coding service in company amongst the fastest-growing startups of all time.

Naturally, Google having a good new model and Lovable raising more venture funds do not directly assist OpenAI (you can use OpenAI models inside of Lovable, I suppose). But the two data points point to cheaper and faster intelligence for startups to lever, and they will.

Will that be enough for OpenAI’s revenues to eventually meet its expenses? Maybe; a lot of smart money thinks so.

The compute flywhel framing is sharp. What stands out is the chart showing compute and revenue scaling in lockstep, which makes the capital raises logical if investors believe that relationship holds. The real question is wether demand stays elastic as prices drop or if we hit a ceiling where most use cases don't justify incremental compute cost. I've seen enterprise AI budgets stall once the easy wins are deployed and the ROI math gets harder. If OpenAI can keep converting compute into differentiated capability that enterprises will pay for, the model works, but that's a big if as competition intensifies and open models close the gap.