Here’s a win of sorts for the tech-right

And: Apple smacks Google to protect its pockets

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Happy Thursday! I trust that you are in spitting health. There’s too much going on today for a single newsletter, so we’ll need to be more summary than we’d like. For example: OpenAI just snatched Instacart’s CEO Fidji Simo to be its new CEO of Applications, which Sam describes as the part of the company that “brings together a group of existing business and operational teams responsible for how our research reaches and benefits the world.”

Poor Instacart. Simo was a capable leader of the former grocery delivery startup. The company is still working on its own way forward, but if I was offered the chance to run an already-public company worth $12 billion, or lead the public-facing portion of OpenAI, well, I'd do the same. I’ve spoken with Smino a time or two — she’s wicked smart and, so far as I could tell, rather nice a person to boot. Now, onto the rest! — Alex

p.s. There’s a big AI hearing today. You can read the opening statements here.

📈 Trending Up: Trade deals that leave tariffs in place … AI standards … stablecoins … Rhode Island? … Simple Closure … rent seeking … corruption …

Democrats? It seems that the Abundance agenda is picking up steam in Congress. Good.

📉 Trending Down: The need for human drivers … concerns about AppLovin? … ARM, after earnings … offline AI … child life expectancy … Shopify after earnings …

Really, this Gates interview is remarkable. Here’s the man on DOGE and its cuts:

That riff is evidence that fuck you money really does exist!

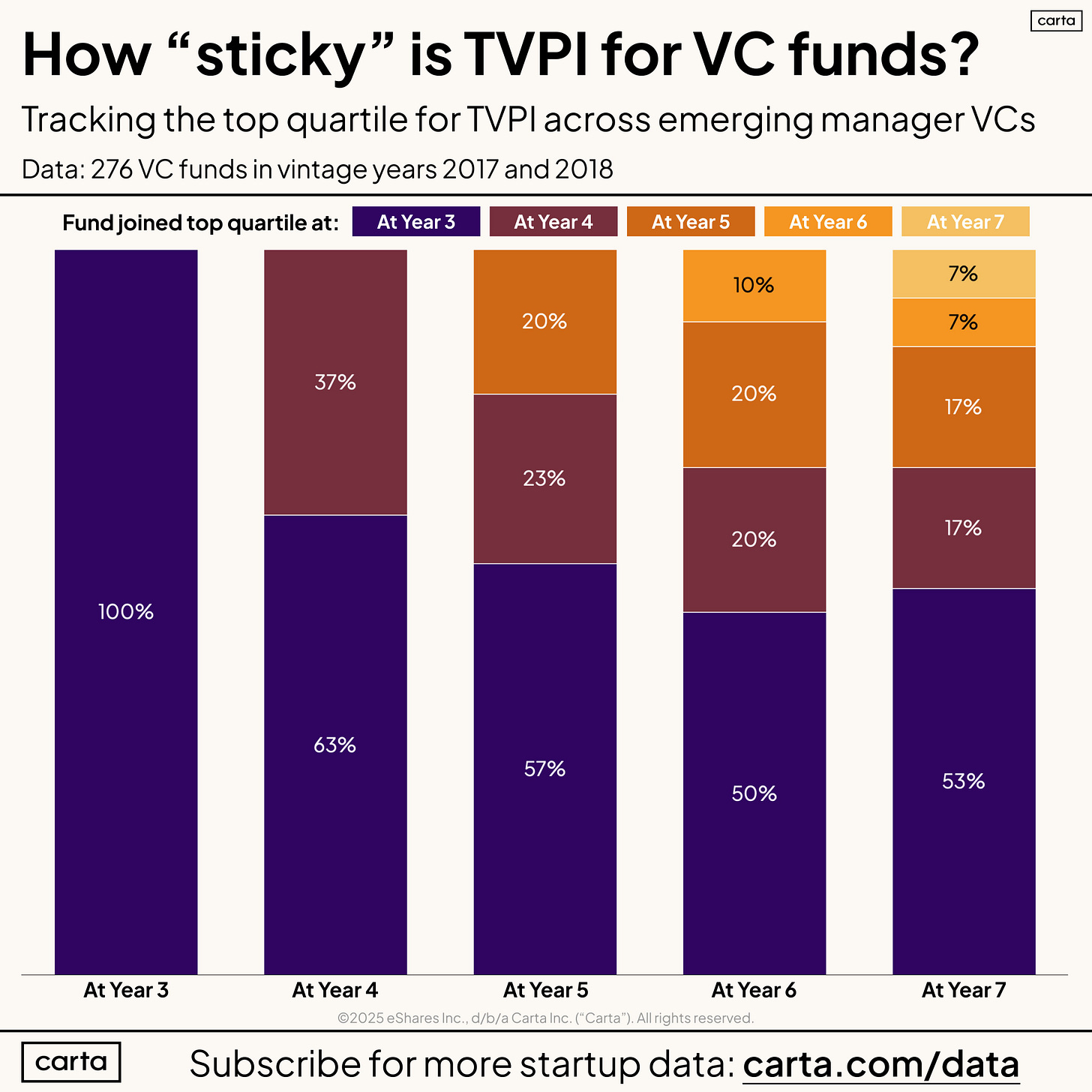

Chart of the Day, via Carta’s intellectually pulchritudinous Peter Walker:

Apple smacks Google to protect its pockets

One possible remedy for Google’s court-determined monopolist status in the online search space is the curtailment of its payment for default search status on third-party platforms. For Apple, the scale of the loss is enormous. Google pays the iOS and iPhone maker around $20 billion per year to maintain its default status in Safari, Apple’s browser.

Should Apple lose that income stream, it’s business would suddenly be around $5 billion less profitable per quarter, though of course we’re being a little bit simplistic in that math.

So, what’s Apple to do? The company took a two-prong approach:

During testimony on the case, Apple made noise about “revamping the Safari web browser on its devices to focus on AI-powered search engines, a seismic shift for the industry hastened by the potential end of a longtime partnership with Google” as Bloomberg put it.

Result? Shares of Alphabet, Google’s parent company, lost hundreds of billions of dollars worth of value.

Why? The chance that search is changing faster than Google can adapt, implying that its ability to stripmine user queries for advertising dollars is in doubt.

But Apple didn’t pop off simply to cause their search partner to look silly and shed 7% of its market cap. No, Mark Gurman writes that the effort was a way to shift focus: “[The executive’s] disclosure of Apple’s plan to shift its browser to AI systems had a clear goal: downplaying the importance of the existing Google deal.”

In essence, Apple took the posture of making its Google deal appear small, and nearly historical. So that the judge in question won’t force it to lose a $20 billion yearly payment from Mountain View.

Summing, Apple threw Google’s stock under the bus in hopes of preserving its stream of search checks. Tough times for Google, but you have to marvel a bit at Apple’s gamesmanship.

Of course, Apple’s public comments about AI search are probably doing wonders for group chat activity amongst Perplexity backers. But we’ll have to wait for those receipts to leak.

Here’s a win of sorts for the tech-right

The WSJ reports that Coinbase is snapping up crypto trading platform Deribit for $2.9 billion, including $700 million worth of cash and 11 million shares of Brian Armstrong stock.

Asking yourself what the hell is Deribit, and how is it worth nearly $3 billion? I hear you. As someone who doesn’t trade crypto, I didn’t know either. It’s an options and futures trading platform for Web3, if we still use that term. And per its 2024 report, it’s doing very well.

Deribit told the world that its total trading volume grew 95% in 2024 to $1.185 trillion from $608 billion in 2023, with the fourth quarter of last year putting up its “highest volume quarter ever.” In chart form:

Coinbase still makes the majority of its money from trading fees, so the deal makes sense. And with Coinbase reporting earnings later today, the deal’s timing is also pretty reasonable.

Shares of Coinbase are up around 4% this morning, indicating that investors are not fretting about the deal.

Worth some $52 billion, Coinbase is spending around 6% of its market cap on Deribit, which makes it a material deal for the American concern. And a huge winner for investors in the private company.

For fun: We can now say that a market-clearing price for $1.185 trillion worth of trailing crypto options and futures volume is worth $2.9 billion, giving Deribit a total crypto options trading volume to market cap ratio of 408x, or, in reverse, a market cap to total crypto options trading volume ratio of 0.00244x. I doubt either metric is about to catch on.

Crunchbase reports that Deribit’s last known funding round was a $40 million investment at a $400 million post-money valuation secured in September of 2022. Every investor in Deribit is about to get paid, in other words. Sadly, the backer list isn’t the usual venture suspects. But, points to QCP Capital, Polybius Capital, Akuna Capital, and 10T Holdings for making the right bet.

Why did we mark this section a win for the tech-right? Because without their boosting of Trump’s candidacy, the crypto space might not be enjoying a period of time in which the rules are being rewritten to accommodate their industry. Regardless of how you feel about the current administration, you cannot argue that it hasn’t been good for crypto regulation, from an industry perspective.

And do we really think that the FTC is about to get its hands dirty with worries about crypto consolidation when POTUS is up to his suspenders in decentralized money?

Notes from Startup-Land

I had two rounds prepped for TWiST yesterday that didn’t make it into the final show due to time constraints. But as I have already reached out to the companies for clarifying details, it seems a waste to not discuss them here. So, from the now-dated TWiST docket:

Unblocked

Unblocked recently raised $20 million, adding another name to our “AI tools that help developers do something other than directly writing code” cohort, alongside with Lightrun, Ox Security, and Endor Labs.

Unblocked has now raised $30 million total for its business of using AI to provide context to human developers digging into a new codebase. The gist is that if you arrive at a new product and start looking under the hood, it can take ages until you sort out what’s going on with all the code. So, Unblocked wants to lower those barriers by having AI help you get up to speed.

B Capital and Radical Ventures led the new round.

I asked Unblocked how much accelerating code-creation from AI tools is driving demand for its service. Founder and CEO Dennis Pilarinos shared detailed notes in response to the question, telling TWiST (and CO, I suppose):

Lots of Unblocked’s “new customers are still focused on making human-written code more accessible either for humans as they onboard new employees, hand-off between engineers or as they debug legacy systems,” Pilarinos wrote, adding that there is lots more aged code in the world than code that is newly-written, and sorting out what it all does is a big darn job.

Still, the ‘help me sort out what the AI wrote in this here codebase’ is going to be a real business for Unblocked. Pilarinos said that his company’s tool also helps guide AI systems with the context that they need, too.

So, no matter if humans were at the keyboard when code was written and are at the keyboard now, or AI first and humans second, or humans first and AI second, Unblocked wants to provide “a persistent layer of context across both human and AI-written code,” the CEO concluded.

With those details, I too would lead a round into the company if I was 1. A venture capitalists and 2. Could get allocation. Let’s see what Unblocked can do this year in terms of growth. I bet it’s going to prove scorching.

Orca AI

Orca AI has built a hardware-software suite to help large boats see the world, navigate, and generally not run into things while getting goods across oceans in an efficient manner. For boat owners, saving money on fuel and not running into things is a pretty good offering.

It’s not a surprise that Orca AI raised a huge $72.5 million Series B, with Brighton Park Capital at the helm, bringing its total raised funds to over $110 million.

TechCrunch covered the round, noting that Orca’s tech could be used in a defense capacity. Very true. There are self-driving boat startups like Saronic that could use something like what Orca has cooked up, provided that they aren’t building their own nav systems internally.

So, I asked the company if it expects to be majority defense, or non-defense in the “near-ish” future just to get my mitts around how much defense demand there is today for self-driving boat tech.

The answer? Per VP of Marketing Keren Raiten: “We anticipate that the majority of our revenue will come from commercial contexts in the near future.”

Darn. Not that the answer is bad for the company — it isn’t; having a strong commercial revenue base to build defense incomes on top off sounds straight peachy — but I was hoping that there were so many autonomous boats coming off assembly lines that Orca was about to flip its script and go all Ratheyon on the world. Not yet, it seems.

To avoid overloading our fine editor, that’s enough for now. More tomorrow!