Hot damn, Nvidia

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Often our interest in technology, the business world, and who holds and wields power are three distinct areas of focus. Today is not such a day. Before we get to work, I think it’s somewhat humorous that the current political-educational climate is engendering this sort of response. Surprise second-order effects, everyone! — Alex

📈 Trending Up: Cowardice … takedowns … DeepSeek … Rillet … Shein’s IPO … EU muscle … paying for distro … chip mergers … consulting gigs … cool …

📉 Trending Down: Honesty … the SBC … Ben Shapiro? … VOA … cybersecurity … personal responsibility … consequence-free cyberattacks … not chasing headlines …

Trade Shock

The biggest news this morning in the realm of business — apart from Nvidia’s earnings, which we’ll get to in a moment, is a decision from the U.S. Court of International Trade, which “blocked steep reciprocal tariffs unilaterally imposed by President Donald Trump on scores of countries in April to correct what he said were persistent trade imbalances” this week.

I didn’t see that coming. Neither did the markets, which are up on the news. The tech-heavy Nasdaq is up a fat 1.2% today, bringing it within a few points of its all-time highs. That’s welcome. And perhaps temporary.

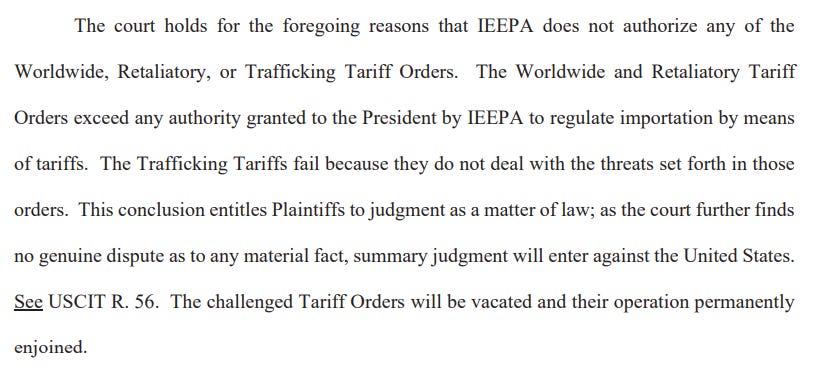

The ruling — here — is worth reading at least in part, but I think that the summary we find on page 48 the most important bit of verbiage:

The Trump administration is appealing the ruling, meaning that it could wind up in front of the Supreme Court in time. For now, however, the domestic and global economies are stuck sorting out the state of play. CNN reports that the White House has no intention if taking the loss sitting down. Even if the court’s ruling feels pretty clear on a first read; POTUS wants unilateral ability to set tariffs rates under emergency powers, and the court states plainly that the IEEPA (International Emergency Economic Powers Act) doesn’t grant him that power.

Reason’s Ilya Somin took a victory lap for their role in the case, adding in their coverage of the ruling that the judges in question were appointed by Trump, Reagan, and Obama, respectively; an activist court this is not. What will happen at SCOTUS, presuming that that is where the current dispute is heading in a hurry? A split ruling, one way or the other. I suppose we’ll have to see how Roberts and Coney Barrett come down on the matter.

The potential reprieve could not have come at a better time. Axios, covering data from an HSBC survey, writes that some “70% of U.S. small and mid-sized businesses say tariffs have already increased their operating costs.” That’s a lot.

Protect small business! Long live free markets and unmolested trade!

Hot damn, Nvidia

Nvidia’s latest earnings showed yet another quarter in which the American chip giant added another $4 to $5 billion to its incremental revenue scorecard:

In percentage terms, Nvidia’s Q1 revenue was up 12% from the sequentially preceding quarter, and a stonking 69% from the year-ago period.

The company’s revenue and profitability were smashed by a ruling by the government that “a license is required for exports of its H20 products into the China market.” The move cost Nvidia a $4.5 billion charge in its most recently completed quarter, and some $2.5 billion worth of incremental revenue. The government decision also cost Nvidia about 10% worth of gross margins, and about $0.15 worth of diluted, adjusted EPS in the period.

And the pain is set to continue. Nvidia expects its current-quarter revenue to land at just $45.0 billion, the first time in recent memory when the company won’t add billions to its quarterly revenue tally. Why? “This outlook reflects a loss in H20 revenue of approximately $8.0 billion due to the recent export control limitations,” the company wrote.

For those counting, if we strip the $4.6 billion worth of H20s that Nvidia sold in its most recently completed quarter, then the firm will grow nicely in its current period. But the market doesn’t grant mulligans, so I doubt that nuance will carry the day.

Put simply, the government is slowing Nvidia down massively. And perhaps in silly fashion:

The argument that the United States should not allow sales of top-end chips to China to prevent the rival nation — and form of governance — from besting us in the AI race has some merit.

The argument that the United States should only ban the sales of truly cutting-edge hardware to China has more.

During his company’s earnings call, Nvidia CEO Jensen Huang took a surprisingly bold tone with the current administration policies (emphasis added):

On export control, China is one of the world’s largest AI markets and a springboard to global success. With half of the world’s AI researchers based there, the platform that wins China is positioned to lead globally. Today, however, the $50 billion China market is effectively closed to US industry. The H20 export ban ended our Hopper data center business in China. We cannot reduce Hopper further to comply. As a result, we are taking a multibillion-dollar write-off on inventory that cannot be sold or repurposed. We are exploring limited ways to compete, but Hopper is no longer an option. China’s AI moves on with or without US chips.

It has to compute to train and deploy advanced models. The question is not whether China will have AI, it already does. The question is whether one of the world’s largest AI markets will run on American platforms. Shielding Chinese chipmakers from US competition only strengthens them abroad and weakens America’s position. Export restrictions have spurred China’s innovation and scale. The AI race is not just about chips. It’s about which stack the world runs on. As that stack grows to include 6G and quantum, US global infrastructure leadership is at stake. The US has based its policy on the assumption that China cannot make AI chips. That assumption was always questionable and now it’s clearly wrong. China has enormous manufacturing capability.

The argument here that blocking the sale of even watered-down American chips to China will only bolster domestic competition is pretty damn reasonable. I wonder if we’re still not nailing the chip diffusion side of the AI race.

Nvidia, however, is still shitting gold. Onward, Jensen.

Media ups, Media downs

Here’s a splitscreen of recent news for you:

Over at BI, a memo indicates that some 21% of the staff is being let go in a move that will “touch every department.” The publication is also narrowing its focus, “scaling back on categories that once performed well on other platforms but no longer drive meaningful readership or aren’t areas where we can lead.”

But BI is not merely doubling down on business coverage, it’s also working to retool its entire business model away from traffic-dependent reporting:

We’re at the start of a major shift in how people find and consume information, which is driving ongoing volatility in traffic and distribution for all publishers. […] 70% of our business has some degree of traffic sensitivity. […] We’re also exiting the majority of our Commerce business, given its reliance on search[.]

Put in simpler terms, BI’s business model is a mess. Reporting and publishing with hopes of attracting enough readers to profitably monetize its work doesn’t. So, cuts.

Bending the clock, BI launched a paywall back in 2017. It backed away from the model somewhat in in 2022, moving about half of its paywall team in front of the gate, because it didn’t drive enough subscriptions from its wall for the economics to pencil out. Arab News* reports that the company’s paywall efforts came after the company was heavily reliant on traffic from Facebook.

BI therefore rode a social traffic wave, plunged into paywalls when the former source of inbound eyeballs slowed, and eventually moved back to collecting irises when it became clear that charging for access wasn’t going to be the jam. So, search traffic I presume was the goal. That’s in decline, too, thanks in part to AI. Not just AI search tools like what OpenAI offers, but also Google’s efforts to summarize the web and feed its users answers, accurate or not, instead of links. Not that traffic from Google was healthy pre-AI; it wasn’t, but the explosion in new search tools are not proving a boon to the media world.

TollBit, a startup that wants to help publishers license their content to AI companies reports that in Q1 2025 “AI chat bots on average [drove] referral traffic at a rate that is 96% lower than traditional Google search.”

Enter Amazon and the New York Times. The Grey Lady has teeth, and is currently in suit against OpenAI for alleged plagiarism and intellectual property theft. News, therefore, that the publication has linked arms with its first genAI partner is big news indeed. Here’s the Times, on the Times:

The deal could include “use of editorial content from The Times” on Alexa, and written words from the “Times will also be used to train Amazon’s proprietary A.I. models,” it reported.

You could argue that the Times is a better publication than BI. I think that that’s taking a small-pie approach to the current media-economics landscape. It’s not good, in other words, if the world’s preeminent news organization can land itself a healthy AI deal on top of its healthy subscription business, while BI is left holding an ever-emptying bag of search traffic.

The drying pool of search traffic and the chance at an AI content deal is not a healthy position for any publication other than those most large.

For fun, here’s CO’s own run of search traffic since last May. Naturally, as a blog that is distributed via email in the majority, we do not depend on search traffic. Which is damned good, because here’s the data:

That adds up to all but zero, and the trend — apart from whatever happened in March, 2025 — is negative.

Pour one out for our friends at BI, a place where I have almost worked a time or two, and has some of my favorite people on the masthead. And points to the Times, for ensuring that at least one publication is going to make it out alive. I just wish today’s lifeboats had more than one or two seats.

Too honest by half

One way to drive AI adoption is to frame it as a new set of tools that will bolster individual worker productivity, allowing for humans to generate more total value from their work. As such, their wages will rise over time, and global GDP will rise along with worker incomes.

That’s too shiny, but it’s an argument you could make with a mostly straight face. My contention that companies are interested in AI not to make their existing staff more useful, but to limit the total number of humans they are forced to employ may seem too pessimistic, but I present to you the following as backing evidence:

If CO’s parent LLC had invested in Anthropic — there’s a small hint there about a future announcement, but more later — I’d be on the horn with Dario telling him to clam it.

Today there’s a robust global debate on how to regulate AI. Concerns vary from deepfakes confusing voters, to non-consensual synthetic intimate imagery, to .new cyberthreats, to losing control of higher-level AI systems that crash the power grid because we made them draw one more goofy image. The positive case needs no restatement, but if I was in charge of a company whose future hinged on the market for AI tools being both wide, and without encumbrance, I might spend less time telling the world that I am going to put them behind on their mortgage payments.

Certainly most CEOs are too taciturn, too media trained, too boring. But at least here we have the opposite. Dario just can’t help himself. Personally I just hope that my families accumulated wealth from our first 1.5 decades in the job market is enough to insulate my children’s future.

Pinch me, I’m screaming

Up top I promised notes on the union of business, power, and technology. Here’s a few things I can’t get out of my head:

U.S. pushes nations facing tariffs to approve Musk’s Starlink, cables show

Elon Musk Tried to Block Sam Altman’s Big AI Deal in the Middle East

These two items I think underscore the risk of executive power — see above — and the union of particular business interests with any one political party or leader. It’s very bad that the United States tried to force nations to change their internal regulations for the benefit of — allegedly — one company with close ties to the current White House.

And it’s also poor that a rival tried to scuttle OpenAI’s big deal in the Middle East. I am not endorsing the bear-hug of the autocratic UAE and monarchical Saudi Arabia by United States businesses, but that’s a subject for another day. Not only did xAI want OpenAI to suffer, it wanted in on the deal, and used the threat of POTUS axing the deal as leverage. The parties were not cowed, and OpenAI won, but still, yuck.

There’s an interesting argument forming amongst some tech folks that I think goes like this (a big thanks to Jason for riffing with me about it on the show yesterday):

Yes, POTUS makes a lot of noise, but the tariffs won’t last, M&A is picking up, and the stock market is doing fine. Mix in an expected GDP rebound from negative Q1 territory, and the White House is meeting business expectations.

Perhaps. But I think it is interesting to see how quickly complaints about government overreach have been papered over. And I am not convinced that all the noise is merely that.