I scream, you scream, we all scream for qubits

Welcome to Cautious Optimism, a newsletter on tech, business and power.

Thursday. Last night, CO went to see Dream Theater and it was, predictably, incredible. Unlike Tesla earnings, which, despite some highlights (greater-than-expected revenues), showed profit declines and rising operating costs. Those results mixed with concern that the now-ended EV tax credit will harm growth are weighing on the car company’s shares. Not much, however, as many in the investing public remain bullish on its robotaxi and humanoid robotics efforts. Let’s get into it! — Alex

📈 Trending Up: Dork glasses … shipping costs … Trump-rancher relations … Playstation … let’s hope not … GM-Google relations … oil prices … natalism in China …

📉 Trending Down: The birthrate … society, via sports betting … human labor … Vance-Knesset relations … the rules of war … Italy …

Things That Matter

The airlines are soaring: After cutting its profit forecast earlier in the year, Southwest surprised investors with black ink in the third quarter, projecting “record sales in the last three months of the year,” per CNBC. Similarly, American Airlines expects a strong Q4 despite posting a nine-figure loss in the third quarter. United also thinks the fourth quarter is going to rip. Delta, too.

Delta and United are interesting. The Times notes that the two airline companies appear to be separating from their peers, thanks in part to “increased revenue from loyalty programs and the sale of premium seats.” That got me curious, so I read through the Delta’s earnings call and found two interesting nuggets:

Wealthier households are driving demand for premium tickets: “[Our] exposure to higher household income cohort has enhanced our relative position versus carriers that are catering to a more stressed lower to middle-income environment.”

And premium is now beating common, in profitability terms: “[W]hat’s changed over the last ten or fifteen years, the premium products used to be loss leaders, and now they’re the highest margin products.”

This tracks. I have become increasingly convinced of the K-shaped recovery, economic shorthand for an economy in which the upper tiers do well, while the lower strata suffer. It’s not hard to find supporting evidence. Recent data from Moody’s indicates that the top ten percent of domestic households “now account for nearly half of all spending,” the “highest share since the late 1980s,” per a Times summary. The trend of the wealthy keeping consumer spending afloat has been ongoing for some time, despite a brief pause during the COVID-19 pandemic. Asset prices are up, and those who own them are doing well. Everyone else?

Why, though? In June, prediction market Kalshi raised $185 million at a $2 billion valuation. Then, in October, it raised $300 million at a $5 billion valuation. Not to be outdone, rival prediction market Polymarket raised up to $2 billion from the NYSE’s parent company at a valuation of $9 billion to $10 billion, depending on how much cash is eventually invested.

That was not enough capital in the eyes of investors; however, Bloomberg reports that Kalshi is now set to raise even more at a valuation of $10 to $12 billion. And there’s more! Polymarket is now reportedly in talks to raise at a valuation of as much as $15 billion.

Such valuation races are not uncommon. See: Rippling raising at a $16.8 billion valuation, followed by rival Deel raising at a $17.3 billion valuation.

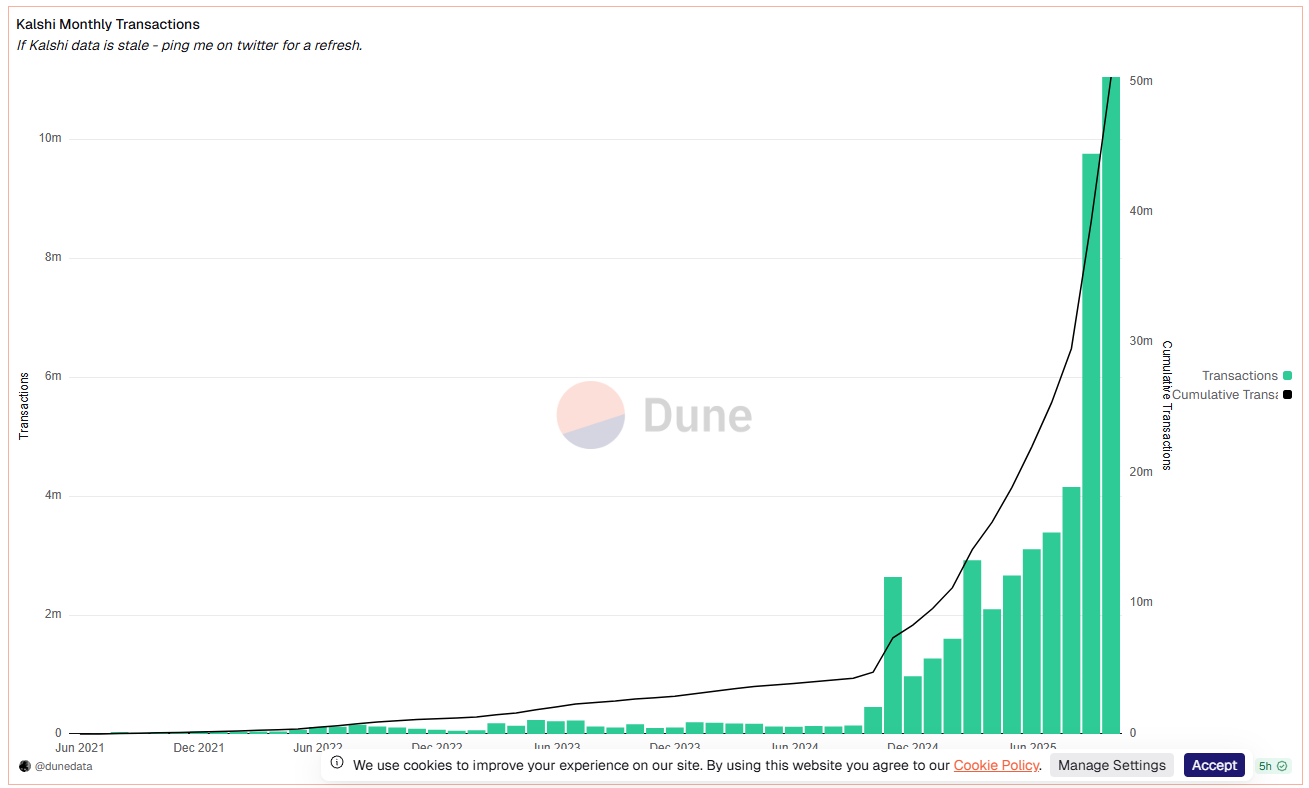

There’s logic behind the wagers. Kalshi is growing. Dune data (sourced from the Kalshi API, I believe) shows an incredible rise in volume after the startup partnered with Robinhood to offer some of its markets on the now-public consumer trading service:

Relatedly, Polymarket is rebounding from its post-election lows.

But why do these two companies need to be force-fed capital like a duck that got started late in foie gras season? I’m so old-fashioned that when companies raise effectively infinite capital during an upswing, I recall prior times when the experiment was run and the result was (often) carnage. Especially with rival companies like sports-betting DraftKings getting in on the fun (sports-related wagers are a big deal on Kalshi, thanks to its Robinhood deal).

Prediction markets — binary contracts on whatever you can get others to bet on — will continue to grow because people like to bet. But with anticipated price competition stemming from intense competition, I wonder about future cash flows.

Prediction markets also got the Tesla earnings report wrong. They are fun, but I am still skeptical of any ascribed consistent ability to provide market-disproving alpha.

Reddit’s legitimate beef: Reddit’s suit against Perplexity (AI search) and three scraping services is brutal. You can read the words here, but the gist is that after telling Perplexity to stop stealing scraping its data, the startup went to third parties to get the same information sans permission or payment.

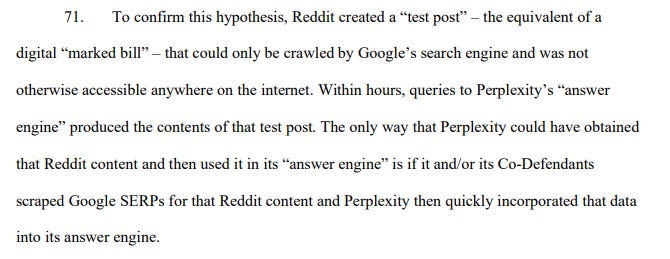

Reddit data is valuable because it’s (mostly? partially?) created by humans talking about current things. That’s LLM gold. So, Perplexity allegedly went after the data after being told to keep its hands out the cookie jar. Reddit — akin to the honeypot set up by Rippling in the Deel spying suit — set a trap:

Oof. The tech industry appears to be still bent on not paying for training and source data. Not good, not capitalistic, and not how we build a long-term, healthy, and winning economy. Do better, Perplexity (and its venture backers).

State-sponsored quantum

If you have spent any time learning about the quantum world, you know how fascinating it is. Quantum field theory, in particular. But in more practical terms, quantum computing is what most folks care about when it comes to the very small. As we’ve written, that industry is having a big year:

Closing 2024, Google showed off its ‘Willow’ quantum chip that demonstrated a reduction in errors as it scaled up using more qubits.

In February of 2025, Microsoft detailed its ‘Majorana 1’ quantum chip, which the company claims is the “world’s first quantum processor powered by topological qubits.”

And a bit later in February, Amazon showed off its ‘Ocelot’ quantum chip, which it says can “reduce the costs of implementing quantum error correction by up to 90%, compared to current approaches.”

The largest, deepest pockets in tech are putting their capital to work on quantum, and with good reason. If we can get quantum computing working at an industrial scale, we can tackle new types of questions that current computing methods cannot handle.

Like what? Google announced this week that its Quantum team “demonstrated that a quantum computer can successfully run a verifiable algorithm, 13,000x faster than leading classical supercomputers.” There’s a multi-trillion-dollar prize waiting for the company that cracks quantum. And legacy software players that we mentioned above are also competing with even more venerable titans like IBM, that also have a foot in the quantum game.

Startups are busy, too. There’s BlueQubit, Equal1, QuEra, Alice and Bob, and Quantinuum in the mix that I know of, and I presume even more players chipping away at the problem. A bit like the hunt for commercially viable fusion power, governments, megacorps, and startups alike are vying for the podium.

Enter the White House. Per reporting, the U.S. government is in talks to invest $10 million apiece into IonQ, D-Wave, and Rigetti. In exchange for Federal funds, the Trump administration would take a stake in each of the public firms.

Yuck. Not only is the Federal government seemingly preparing to bet on public quantum computing startups likely at the expense of their private rivals — directly fomenting against startups? — the capital markets have already made ample cash available to the sector. Even more, $10 million is pissant funds for quantum. Crunchbase News reports that quantum startups raised north of $1.5 billion last year, and that’s not taking into account R&D costs from the Mag7 and the public cohort of quantum upstarts.

Venture investment into quantum was hot in Q1 and Q2 2025. I suspect Q3 was similar.

So what’s the point of the $10 million checks? Market-distorting control, I reckon. I don’t understand how it’s bullish for the Feds to take tiny stakes in a slice of part of an industry. It doesn’t help fund much research, and it creates a two-tier quantum ecosystem in which the non-funded companies are forced to compete with state-subsidized and favored entities.

What would be smarter is setting up a fund that co-invests in quantum rounds agnostically; that would boost capital availability for quantum startups while allowing the public players to tap ample public-market funds for their own work.

The gung-ho embracing of state capitalism is troubling. From raw materials to chip manufacture to now quantum computing, we’re slowly building a two-tier economy, one part of which is the government’s own, while the other belongs to the rest of us. I don’t see how that leads to faster economic growth over the long-term. Yuck.