Inside the guts of Figma's S-1 Filing

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Happy Wednesday, friends. Instead of dorking out about Lovable potentially reaching a nearly $2 billion valuation — so much for Europe being unable to birth new unicorns — we have to talk Grammarly-Superhuman, how AI content marketplaces are reacting to Cloudflare’s news, and the Figma IPO filing. To work! — Alex

📈 Trending Up: Weaponization of state power … redux … bot scoring … soft power … cowardice … Anthropic’s revenue run rate, now at $4B … Surge AI … tech comp jealousy … religious fervor … banking, by Anduril … hard hats at Oracle … more layoffs at Microsoft …

📉 Trending Down: India’s manufacturing progress … freely moving customer data in the AI era … food aid … US arms to Ukraine … Tibetan freedom … regional business activity … cross-border dealmaking? … Tesla’s Q2 sales …

Figma’s IPO filing sparks joy

While my birthday is not until later this month, Figma’s Dylan ‘Zoink’ Fields delivered an early birthday present by filing to go public. As the company reported in April that it had filed a confidential prospectus to list, the news was not a complete shock. But given the shallow pool of IPOs that we’ve seen this year, and more venture investors taking the secondary route to liquidity, major exits are incredibly welcome news.

You can read the full S-1 here. What follows is a sequential telling of the company’s health and history in a manner that everyone should be able to follow, seasoned investor or merely curious party alike.

What does Figma do?

Online design tools, with a growing stable of AI-imbued tools that compete with other well-known startups. If you need to design something, especially with others, Figma Design has you covered. Want to team up and make slides, or a presentation? Figma Slides and FigJam are for you. Need to turn one of your designs into code? Dev Mode is your jam. Want Figma to build something for you including code with just a prompt? Figma Make has you covered.

In short, if you are building something online, Figma has a tool for you and your team.

The company is popular the world over. In Q1 2025, despite its domestic domicile, a massive 85% of Figma’s monthly active users (13 million in total) were international, bringing in 53% of the company’s total revenue. That’s incredibly impressive, implies lots room to grow at home and the whole world as target market for the former startup.

Closing our preliminary details, Figma intends to list on the New York Stock Exchange under the ticker symbol “FIG.”

Is Figma a good business?

Hell yes. Figma grew faster in 2024 (48%) than it did in 2023 (46%). The design startup also reported strong customer retention metrics, indicative of strong product-market fit; Figma customers provided the former Adobe takeover target with 134% net retention in 2024 (up from 122% in 2023), a figure that came in at 132% in the first quarter of the year, up from 125% in the first quarter of 2024.

Figma is also quickly scaling the number of customers with $10,000 or greater annual recurring revenue from just over 8,000 in Q1 2024 to 11,107 in Q1 2025. $100,000 and greater account scaled similarly, expanding from 701 in Q1 2024 to 1,031 in the first quarter of this year.

And discounting a massive, one-time employee-shareholding related expense last year, the company was profitable in 2024, and is in the black to start 2025.

To sum: Figma is growing quickly, has great customer metrics, an ever-growing number of large, and very large accounts, and is profitable. Well done.

Show me the numbers

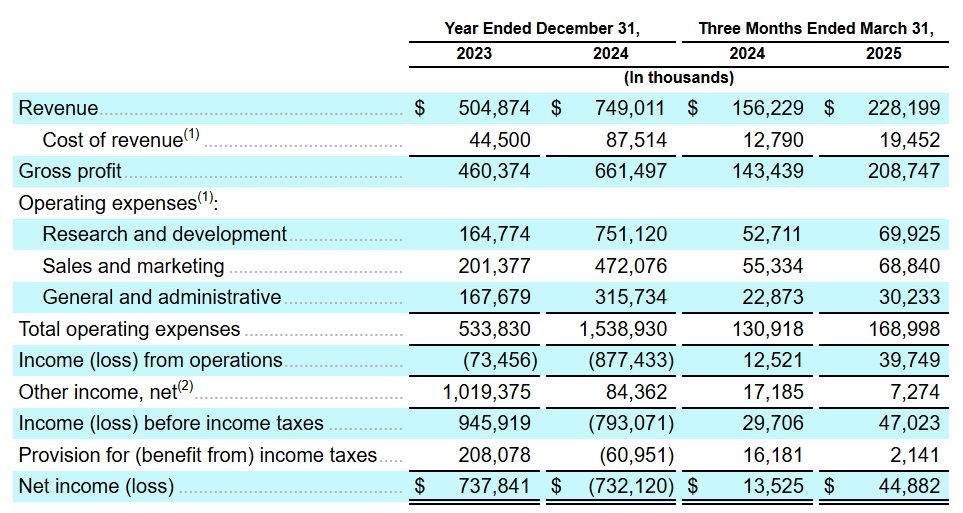

Your wish, my command. Here’s Figma’s income statement for 2023, 2024, and the first quarters of both 2024 and 2025:

Revenue growth in Q1 2025 was 46% on a year-over-year basis. Over the same timeframe, operating expenses at Figma expanded by a much-smaller 29%. In the business world, we call that operating leverage, or the ability of a company to scale its top line faster than its costs rise; if you want a company to become more profitable on each new dollar of revenue it brings in, this is the way.

Figma’s free cash flow (stripping out a few one-time costs) has consistently improved, including expanding from $48.5 million in Q1 2024 to $94.6 million in Q1 2025. With mor than $1.5 billion in cash and equivalents and more dollars flowing into its accounts, Figma is stable as a rock.

But what about that massive 2024 loss? After the Adobe-Figma deal collapsed, the startup gave staff a chance to sell some of their holdings. That move required a change to Figma’s restricted stock unit capitalization that resulted in the “stock-based compensation expense” worth some $801.2 million in the year.

That’s not going to happen every year.

Why as Figma so profitable in 2023? It earned a $1.0 billion termination fee from Adobe when the deal for the larger company to take an upstart competitor off the table failed. Again, that’s not something that will happen every year. If we strip out certain one-time expenses, Figma’s non-GAAP operating margin looks like this:

2023: 5%

2024: 17%

Q1 2024: 12%

Q1 2025: 18%

That’s healthy.

Figma’s second-quarter results should prove interesting. After expanding its product line in recent years, the company changed how it prices its products in March of this year. Customers can now “ buy multi-product seats tailored to the needs of different users,” and Figma “increased the prices on our Full seat for the first time, ranging from 20-33%.”

Given that those changes were only in effect for a handful of weeks to close the quarter, we’ll know a lot more about how customers respond when we get data through June. The better it is, the better the news for Figma.

What about AI?

We touched on AI when describing what it is Figma does, but let’s go one level deeper. Here’s how Figma described its AI costs in its S-1 filing:

AI and Related Costs. As a part of our product innovation, we have made and will continue to make significant investments to integrate AI, including generative AI, into our platform. We expect that the use of AI technologies and our investments to integrate AI into our platform will impact our business, operating results, and financial condition. For example, in the short-term, we expect that our AI investments and use of AI technologies, including spend on AI inference and model training, will impact our cost of revenue, research and development expenses, and potentially impact our sales and marketing expenses, which we expect to negatively impact our gross margins and operating margins.

The company closed that riff with a the future is uncertain caveat, but clearly Figma expects the costs of building AI tools and paying for the compute they consume to, for now, weigh on its quality of revenue.

Figma has lots of margin to play with, but may already be seeing the impacts of AI spend on its metrics. Figma’s gross margin slipped from 92% in Q1 2024 to 91% in Q1 2025. Given how incredibly strong the number started, losing a point is no big deal; most companies would sell arms and legs for a 90+% gross margin result, so Figma is playing with house money in a sense, when it comes to its AI investments.

How does governance look, and who owns a piece?

Figma has three classes of shares. Class A shares that have one vote, Class B shares that have 15, and Class C that have none.

Field owns 67% of Class B shares, for some 51.1% of total voting power before the company’s IPO. Inclusive of other shares that he controls, the CEO has just over 75% voting control heading into his company’s public debut; an investment into Figma, then, is a wager that Field has his head screwed on the right way forward. I have spent but a sliver of time with the man, but I think the operational results speak for themselves. Sure, Figma’s governance is more monarchy than democracy, but as the CEO has proved a competent steward — to understate the case — I doubt that many will fret.

Venture investors are going to take home massive wins from the Figma IPO, including:

Index Ventures, with 65.9 million Class A shares

Greylock, with 61.5 million Class A shares

Kleiner Perkins with 55.1 million Class A shares

Sequoia, with 34.2 million Class A shares

Recall that Figma raised its Series D in 2020 (a16z led) at a roughly $2 billion valuation, its 2021 Series E (Durable Capital Partners led) at a $10 billion valuation, and earned a price tag of around $12.5 billion during its 2024 tender offering. Adobe wanted to pay $20 billion for Figma, recall.

How big a deal is this IPO?

Huge. Tech has long needed a champion to list. A company that has rock-solid economics, massive venture backing, and the chance to convert a huge slug of illiquid private wealth into cash that VCs can return to their backers.

Chime was, to some degree, a first-shot at the sort of offering that many consider a potential logjam-breaker. After listing at $27, Chime is worth $32.39 per share this morning for a market cap of $11.8 billion. Figma should be worth much more, making its exit all the more potentially impactful.

You might argue that it would take more than one successful decacorn IPO to make the public markets attractive enough to entice more entrants. If so, Chime plus Figma could be just the ticket.

Data shows that the pace at which new unicorns are being minted in recent quarters has collapsed from its ZIRP-era highs. A powerhouse debut from Figma could get VCs not backing the same dozen or so AI startups more rizz, as the kids say. We’ll see.

More when we get a first pricing and anticipated share sale count. Until then, well done Team Figma. Your S-1 is a banger.

Digital economics, and the Grammarly-Superhuman deal

Cloudflare’s announcement yesterday of a new ‘Pay Per Crawl’ system for monetizing online content against AI scraping had us all aflutter. Later, I reached out to TollBit and Created by Humans for TWiST, two companies on our TWiST500 list. We didn’t get to use their responses on the show, so I’m sharing the key bits here, as their perspectives are useful.

Is what Cloudflare is building competitive to their own efforts? Complementary? Let’s find out (answers lightly edited):

Toshit Panigrahi, CEO and co-founder of TollBit:

It’s about time others start thinking about this space. The [Cloudflare] marketing certainly cemented the TollBit thesis in every publisher’s mind — that the path forward is indeed to charge a toll to every AI visitor. Every pub has heard the problem and solution from us for over a year. However, this marks the first time someone other than TollBit has put serious thought into how to implement a toll for AI traffic. It went from a fringe idea to “this is the way.”

TollBit — which just announced a partnership with Cloudflare competitor Fastly — says, however, that it knows the tech stacks of more than 2,000 publishers on its platform, and that “few” use Cloudflare. Therefore, even if Cloudflare’s offering does well amongst its customer base, it will not represent a pan-Internet consensus. That means, I reckon, lots of room for TollBit to build.

Jen Singerman, co-founder and COO of Created by Humans:

At first glance, we're supportive of [Pay Per Crawl] and think it's complementary to the [Created by Humans model], as it sets the expectation that control and compensation belong in the hands of rights holders.

Unlike some of its rivals that are focused on monetizing digital content, Singerman pointed out in her missive that her company is focused on academic and professional books, “whose contents aren't typically found online.” Given multi-party rights holdings, those texts are “difficult for a publisher to do a one-to-one deal,” which means that the startup won’t rub up against what Cloudflare is building for now.

And after we finished typing up yesterday’s newsletter, Grammarly announced that it intends to buy Superhuman. Why is a company best known for its writing tools buying an email startup beloved by technology power users? Because Grammarly — which recently bought Coda — has a vision of creating an agentic AI system for work that follows users wherever they go. Part of that mission is owning where work occurs most frequently, places like docs and email, while integrating with other software providers.

I got to chat with both the CEO of Grammarly (Shishir Mehrotra), and CEO of Superhuman (Rahul Vora) about the deal. Enjoy, starting from 14:30: