IPO Watch: Ethos and Bitgo edition

And: Some good news!

Welcome to Cautious Optimism, a newsletter on tech, business, and power. Modestly upbeat.

It’s Wednesday. AI helped flip the mobile monetization game in 2025, as consumer demand for AI products dethroned gaming as the largest driver of smartphone app revenue. Call it a sign of the times.

As I write to you, the Supreme Court is debating the Fed’s independence, Netflix’s stock is suffering because it merely posted strong results, and POTUS is wrapping up his Davos rant. To work! — Alex

📈 Trending Up: Can he do that? … Lightning AI + Voltage Park … the inference wars? … Ukrainian startups … mortgage rates … butts, doors … UK-China relations

📉 Trending Down: German stocks … Manus’ customer base? … the value of Thinking Machines Lab … American data privacy … the worth of Japanese debt … US-EU relations … Chinese AI companies

Things That Matter

Some good news: OpenAI is following in Microsoft’s footsteps, pledging to pay its “own way on energy, so that [its] operations don’t increase your electricity prices.” AI giants are running into increasingly sharp criticism from communities about their data center projects, which many worry will consume difficult-to-replace local water resources and spike energy costs.

Meanwhile, AI medical tool OpenEvidence just doubled its valuation to $12 billion. It’s the only AI product that I’ve heard doctors discuss using, and reviews (anecdata!) seem strong.

Notably, the company’s new valuation towers over its last known revenue benchmark ($100 million in 2025, though there’s word that it’s now north of $150 million). Keep in mind that OpenEvidence makes money from advertising its free tool that’s offered to verified healthcare providers.

Perhaps OpenAI is onto something with advertisements? Google is taking cheap shots at Sam, but let’s be honest: we know what pays the majority of bills at Alphabet.

Zipline raised $600 million at a new valuation of $7.6 billion. I interviewed the company for TWiST before my son August was born recently, and that podcast will presumably drop sometime soon.

Elsewhere, demand for AI coding services is so strong at the recently-public Z.ai that the Chinese company is limiting access to its paid plans, token demand is at an all-time high, and Higgsfield AI has reached run-rate revenues of $200 million.

Oh, and we’re maybe two to four quarters from AI models being able to self-improve, per Anthropic CEO Dario Amodei.

Some bad news: The global order is unraveling. Canadian PM Mark Carney put it bluntly at the World Economic Forum at Davos: “We are in the midst of a rupture, not a transition,” and said we’re heading for a “world of fortresses [that] will be poorer, more fragile, and less sustainable.”

There’s movement in Europe to divest (somewhat) from American treasuries. That’s rattling brains here at home, as 30-year treasury notes lose value. POTUS thinks that his allies are his enemies, and his enemies his allies; and we’re throwing away partnerships with an entire set of co-democracies to try and steal Greenland.

Around the world, the birth rate crisis is worsening while we continue to demand that young people move to expensive cities and work longer hours — both known and tested recipes for not boosting birth rates. The good news is that we can drive a goodly amount of growth off our current human capital stock; the bad news is that we’re seeing economically critical nations’ populations contract. That’s not good for long-term economic growth, let alone the flourishing of the human race.

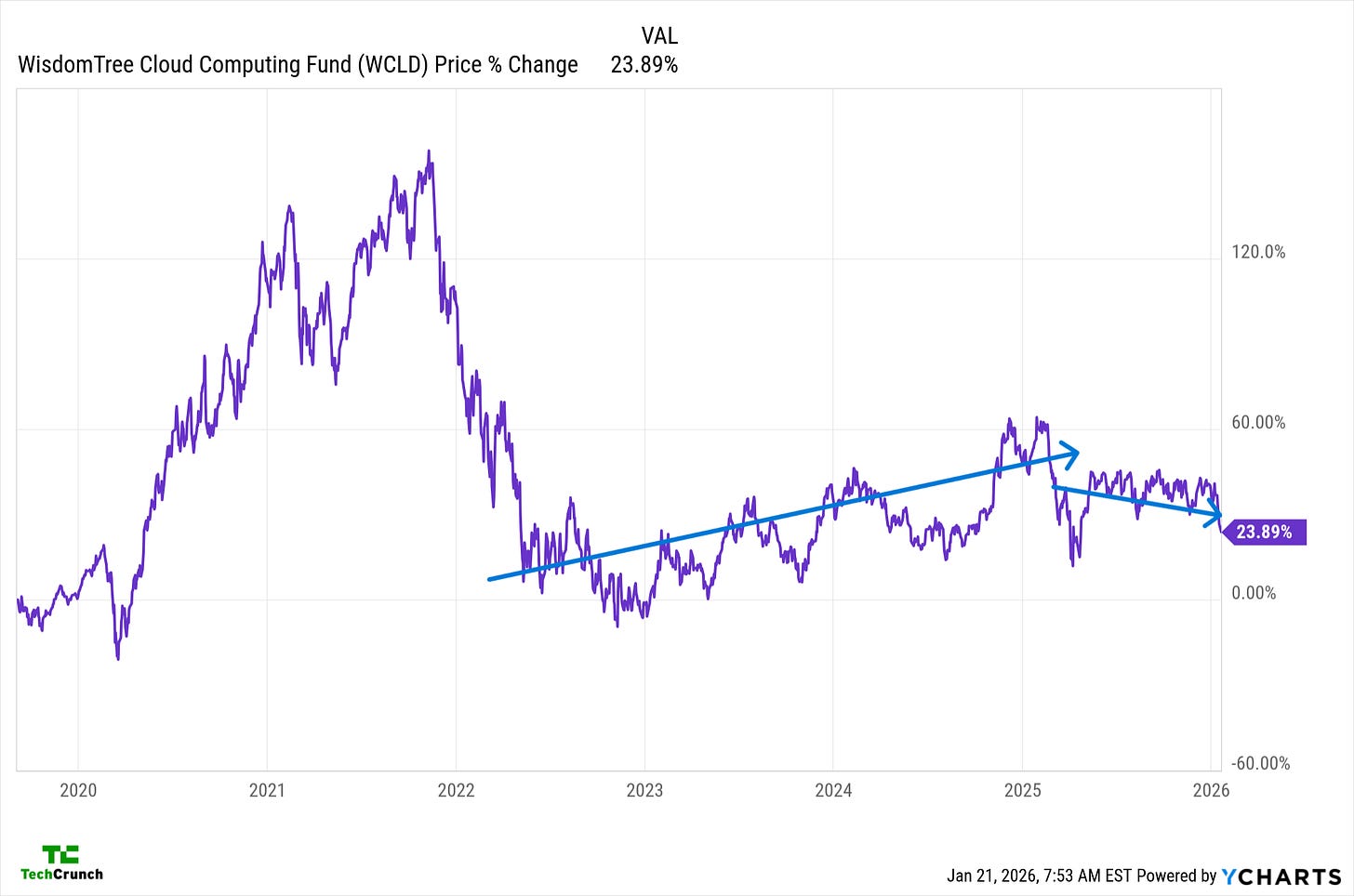

Tech stocks continue to wilt (please applaud my incredible annotation):

Investors appear to see little reason for software (SaaS) revenue multiples to recover, which means that a host of former tech darlings are now treading water on the public markets with modest growth rates and (at best) lukewarm cash generation.

The PitchBook/NVCA report we discussed yesterday indicates that there are hundreds of ‘unicorns’ in the market today that have not raised in years. They’re in a similar boat compared with their public SaaS peers, but these ones are sinking faster. They still need to find an exit. Good luck.

Finally, do you know how to farm IPOs? Winsome stock market valuations and a quiet world is how. Today, we have part of one of those, and none of the other. Alas.

IPO Watch: Ethos and Bitgo edition

Thankfully, news on the IPO front is not all bad. Ethos Technologies, an insurtech company that filed to list last year, is now going public. It’s expected to price this evening and trade on Thursday.

Here’s TechCrunch’s Julie Bort:

If [Ethos] lands in its current price range of $18 to $20 a share, it will enter the day valued at $1.26 billion on the high end — raising $102.6 million for itself and about $108 million for its selling shareholders. Should investor interest be high, it could wind up pricing higher. That means a bigger valuation and more money raised.

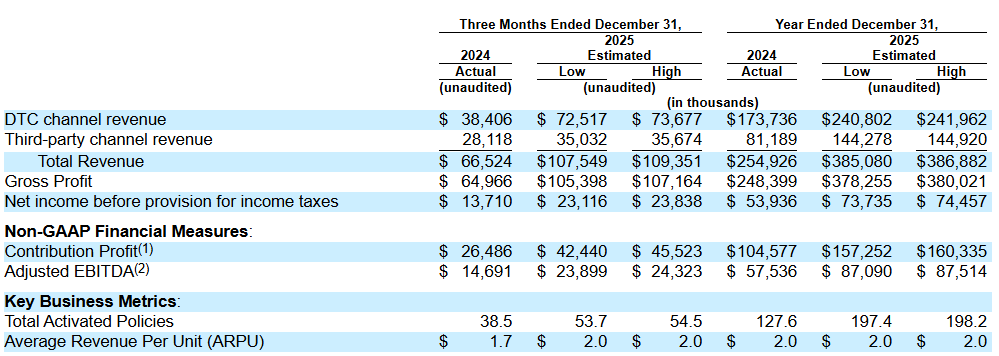

We dug into Ethos’ financials and business model last October, if you want a deeper dive, but let’s peek at its updated numbers:

When we last checked, Ethos was firing on all cylinders. That trend has continued, with revenue increasing more than 50% alongside rising GAAP and adjusted profit. You love to see it.

Sadly for some of the company’s backers, it’s set to list at a valuation lower than its previous private price tags: $2 billion in May, 2021 and $2.7 billion in July, 2021. Those investors are set to get hammered in the IPO if the stock doesn’t soar after listing.

Venture-backed insurtech companies have a somewhat mixed history as public entities. Lemonade is still kicking, but it ate what was left of MetroMile. Root Insurance has recovered its footing after years in the wilderness.

That’s why Ethos is looking at a revenue multiple (trailing) of around 3.3x.

It’s hard to make venture-level returns past Series B or C if the final exit multiple in the low-single digits. And that’s if you stay private far longer than we saw historically.

Then we have BitGo. Also expected to price this evening and trade tomorrow, the crypto services provider is looking at a valuation of around $2 billion at the midpoint of its $15 to $17 per-share IPO price range. That’s a bit above its most recently known valuation of $1.75 billion set in 2023, so all investors in the company should see at least some upside.

What’s fun about BitGo is that it uses the same accounting setup as Block, which reported revenue of nearly $2 billion from bitcoin trading in its last quarter. Not bad, right? Well, Block also listed costs of $1.9 billion associated with that revenue.

In other words, some companies that help customers purchase digital assets record the whole value of those trades as revenue, and the purchased asset that the customer bought as a cost of revenue. (I am not saying that Block et al. are doing anything wrong; we’re merely discussing the quirks of this kind of accounting.)

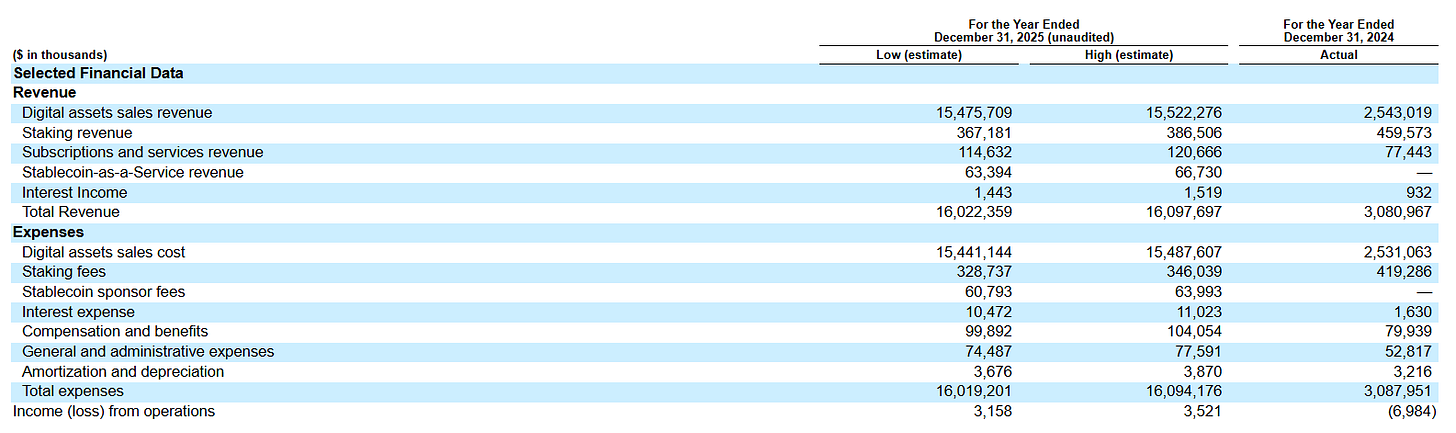

So it goes with BitGo, which has one of the weirdest income statements I’ve ever seen:

Revenue of $16 billion last year? Impressive. But when we back out certain costs of revenue that come with crypto incomes (the costs of delivering digital asset sales, staking revenues, and stablecoin offerings) at the high point of its range, we discover:

Digital assets sales revenue less Digital assets sales cost: $34.7 million

Staking revenue minus staking fees: $40.5 million

Stablecoin-as-a-Service revenue less Stablecoin sponsor fees: $2.7 million

Those figures help explain how BitGo is only worth a few billion and not a few dozen billion. In fact, the company’s subscriptions and services revenue grew 56% in the last year to $120.7 million at the high end of its estimates. Not bad, not bad at all.

Points to both companies for not giving up on going public given the state of the world right now. But let’s not overindex on these two IPOs. Both are relatively small in terms of what the broader tech industry needs, and neither is enough of a potential bellwether for a host of other companies to pull the trigger.

Still, may both these IPOs price and trade well, and may we enjoy a bit of good business news as the political world tries to derail all our collective productivity through sheer lunacy.