IPO: Z.ai intends to raise $560M at a valuation of $6.5 billion.

Welcome to Cautious Optimism, a newsletter on tech, business and power.

📈 Trending Up: Threatening Taiwan … metal volatility … Satya Nadella … journalistic independence … China-EU relations? … AI in China … US support for Russian propaganda … terrible legislation …

📉 Trending Down: Tesla sales? … Ro Khanna’s future fundraising prospects … Steam dominance? …

Things That Matter

The current thing: There was once a meme amongst the then-nascent tech-right about ‘the current thing.’ The gist was that liberals were fond of virtue signaling (posting) about a shared concern (the current thing), while enlightened folks outside their bubble found the activity tiresome. (An example. Another, mocking support for queer rights and Ukrainian sovereignty.)

I can’t help notice that today, the same folks once vehemently opposed to the current thing are pretty big on the current thing. In this case, fraud in Minnesota. Fraud is bad, and may everyone who cheated the system get the book thrown at them. But it is interesting to see the tech-right virtue signal (post) about a shared concern (the current thing) without contrition.

I believe the correct thing to say at this juncture is concerning. (I mean c’mon. C’mon. C’monnnn.)

Good news for OpenAI: SoftBank has come up with the (rest of the) money! CNBC reports that the Japanese telecom company and investing powerhouse has sent Sam Altman and company the $22 billion it had left to wire, after previously sending $18 billion. Recall that SoftBank is investing in OpenAI at a $260 billion pre-money valuation, which means that it’s getting one hell of an instant markup given that the AI company was most recently valued at $500 billion thanks to a secondary sale (that SoftBank also participated in). And OpenAI is gearing up to raise another mountain of cash at a valuation that could reach $750 billion. An IPO could further juice the value of OpenAI.

OpenAI has massive infra spending commits to meet. It also needs lots of money to continue training new models to hold onto its consumer market share while growing its enterprise business. I suspect now that capital risk at OpenAI has been allayed for some time, while implied execution risk is now at an all-time high at the AI lab.

A small point: Yesterday, we explored the potential for California voters to excise 5% from local billionaire wealth to help pay for state healthcare costs, among other priorities. While riffing on the current tax code, we wrote that capital gains are taxed differently from normal income, which is true on at the federal level. Adam Nash (LinkedIn, Wealthfront, Greylock, Daffy Giving) pointed out that “California does not charge a different tax rate on capital gains and income.” Our language could have been more precise.

Meta-Manus only makes sense if Meta intends to challenge the world: Why is Meta spending tens of billions on AI? To improve its advertising services, for one. But with so many strong models available for commercial use, precisely why Meta needs to be at the cutting edge of the AI game is slightly hard to parse given the cost; perhaps the risk is that another company will invent a fusion of AI and social that turns Facebook into MySpace, and Instagram into Facebook?

Fitting Meta’s purchase of Manus, an AI startup (started in China, now domiciled in Singapore) with a focus on AI agents into the building internal tools model is difficult. But if we note that Meta:

Hired a material percentage of the world’s leading AI talent to build world-class AI models (true).

Intends to pursue a closed-source release approach in the future (reportedly under consideration).

Will use some of its AI infra to offer its AI products to other companies (already being tested).

Then buying Manus makes sense.

If you want companies to pay to use your artificial intelligence and compute, offering as much tooling to incent adoption of your services makes sense. And Manus was stupidly cheap. Reporting indicates a price of $2 billion or more, pennies for the incredibly wealthy Meta. And Manus brings with it a reported $125 million worth of agentic AI ARR to the Zuckerberg mothership. Cheap at twice the price, given Manus’ growth rate. (Why did Manus sell at the price it was targeting for a raise? Weird.)

AI in China is the inverse of what we see at home

While the United States government works to beat back AI regulation bubbling up from the states, the CCP is prepping sweeping rules for its own domestic AI economy. China’s government intends to require AI providers to “assume safety responsibilities throughout the product lifecycle and establish systems for algorithm review, data security” (Reuters), require consent to train off user data (Insider), limitations on generated content (CNBC), and route chats that touch on certain topics to human handlers (BBC).

At the same time, Chinese AI labs are churning out ever-better ~open models that come close to SOTA offerings from closed-source American and European AI laboratories. To cap off the divergence between the two nations, Chinese AI labs are going public.

One place where the US and China are AI-aligned? Empowering their local chip industries.

Yes, the IPO filing from Z.ai (filing name: Knowledge Atlas Technology Joint Stock Company Limited), makers of the GLM family of AI models, is out, and we can interrogate it.

Before we do, recall that Z.ai (also known as Zhipu AI) recently shipped GLM-4.7, an AI model that ranks sixth on the LMArena WebDev arena, for example, and is seeing notable adoption on OpenRouter.

So we’re talking a real competitor from China’s AI market filing to list. What can we learn, looking at its books?

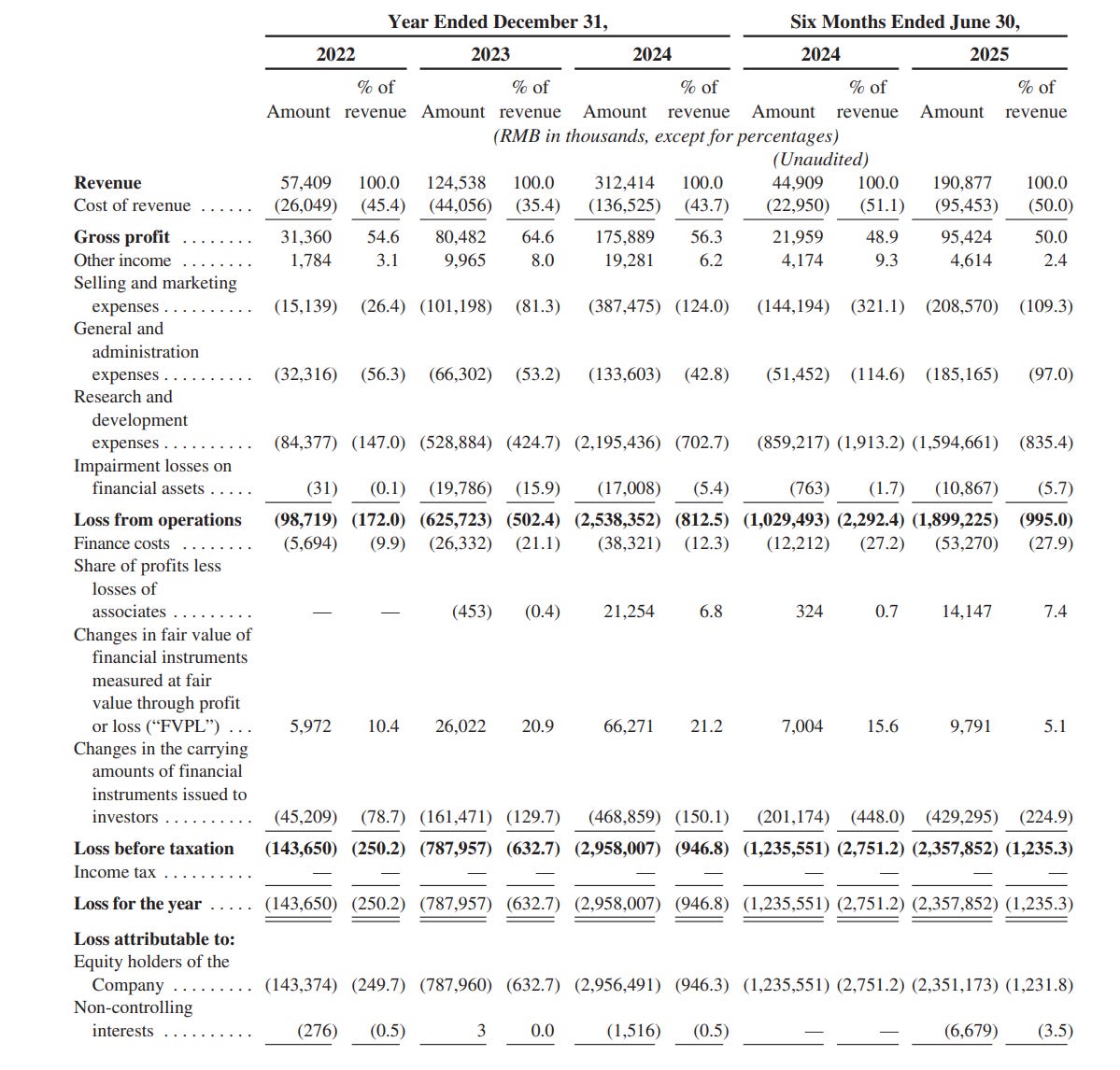

That building cutting-edge AI models is incredibly expensive (currency conversions via Google):

In H1 2024, Z.ai generated revenues of $6.4 million, gross margin of 49%, and an operating loss of $146.9 million.

In H1 2025, Z.ai generated revenues of $27.2 million, gross margin of 50%, and an operating loss of $271.1 million.

Z.ai intends to use 70% of its IPO proceeds to bolster its R&D capabilities, 10% to improve its commercial offerings, 10% to increase its partner footprint, and another 10% set aside for “working capital and other general corporate purposes.”

Notably, while OpenAI is expected to reach $20 billion ARR this year, mostly on the back of subscriptions to its ChatGPT product, Z.ai argues that the Chinese AI market will be incredibly enterprise-weighted in the coming years (page 86):

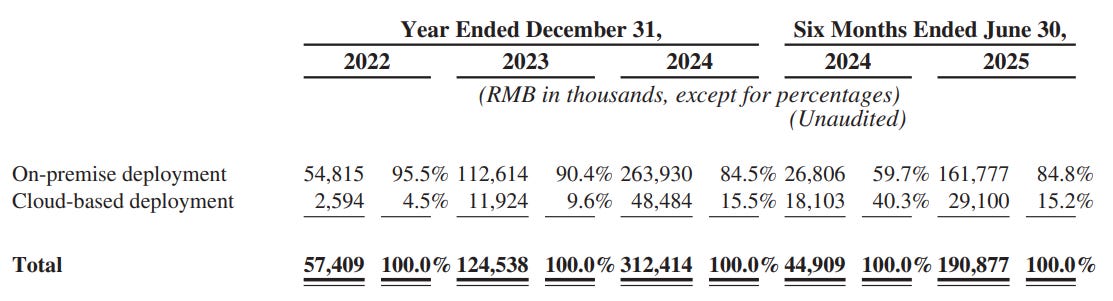

Perhaps because Z.ai anticipates so much of the AI market in China to pool at the feet of large corporations instead of consumers (in revenue terms, at least), it’s not surprising that the company also projects that on-prem AI revenues (compared to cloud-based) will drive the majority of AI incomes in the nation through at least 2030 (page 88).

That’s great news for Z.ai, which has seen the percentage of its revenues it derives from cloud-based AI deployment rise as a percentage of its overall revenues in 2025:

What drove the gains in on-prem AI revenues at Z.ai in the first half of 2025? Here’s the verbiage offered:

Our revenue derived from on-premise deployment increased by 503.5%, from RMB26.8 million for the six months ended June 30, 2024 to RMB161.8 million for the six months ended June 30, 2025 as we continued to provide more complex large model services to our customers and to extend our large model services to additional customers.

How does Z.ai make money from on-prem usage of its AI technologies if they feature an open-ish license compared to closed-source models from American AI labs? Here’s the breakdown (page 4):

For on-premise deployment, our models are hosted within the customer’s own infrastructure. This approach allows organizations to utilize their proprietary or sensitive data to tailor AI models to their specific domains. On-premise deployment offers greater control over performance optimization and infrastructure configuration, making it suitable for complex or highly specialized application scenarios. […]

For on-premise deployment, we recognize revenue at the point in time when the large model and related services are delivered to the customer’s designated location and accepted by the customer

Fair enough.

Z.ai intends to raise $560 million in its IPO at a valuation of around $6.5 billion. That’s a steep revenue multiple to be clear, but given the success of recent Chinese IPOs I doubt that there’s a lack of demand at the considered price point.

I reckon that Z.ai is similar in form to many AI labs: Quickly expanding revenues, quickly rising costs, steep losses and sharp cash burn. For example, Z.ai writes that its

R&D expenses increased from RMB84.4 million in 2022 to RMB528.9 million in 2023 and further to RMB2,195.4 million in 2024. [And its] R&D expenses increased by 85.6% from RMB859.2 million in the six months ended June 30, 2024 to RMB1,594.7 million in June 30, 2025.

As you might expect, Z.ai’s cash burn is going up, rising from just under one billion RMB in H1 2024 to 1.32 billion RMB in the first half of 2025.

The difference between Z.ai and its American rivals is that it’s going public while still small. The company is, presuming $60 million 2025 revenues (implying 20% growth in H1 2025 to H2), Z.ai is less than half a percent the size of OpenAI in revenue terms.

If Z.ai continues to grow quickly while improving operating leverage (page 200), its worth could explode, and regular folks in China could benefit from its growth. Not so the case with OpenAI and its ilk (though LP commitments from pension funds and similar to venture funds that back those companies could do well by their success).

A big thanks to Z.ai for having the courage to go out first while still drowning in red ink. Its IPO filing is a treasure trove of information about AI in China. I strongly suggest you at least skim the document. Perhaps over some holiday coffee?

More tomorrow!