Look ma, I'm a builder

Welcome to Cautious Optimism, a newsletter on tech, business and power.

📈 Trending Up: Future AI regulation … PCs … X-EU relations … AI in ur Gmail, readin’ ur mailz … the EU … colonialism … the censorious instinct … Indian GDP … Fortress Ukraine … ChatGPT Health? … Ro Khanna’s political opposition … Cyera, of course … Amjad Masad …

📉 Trending Down: Job openings … Russian flagged tankers … domestic layoffs? … Chinese AI companies pursuing foreign exits … Indonesian debt … religious freedom in China … China-Japan relations …

Things That Matter

Are venture capitalists starving? While Lux is right to celebrate raising $1.5 billion, and we’ve seen other massive venture hauls in recent memory, the overall picture is bleak. PitchBook data indicates that U.S. venture capitalists raised $66 billion last year, down more than a third (35%) from 2024, and 70% lower than what they raised in 2022.

Thinner venture coffers and rising capital needs by leading AI companies (see our final story) are a partial cause for the influx of sovereign wealth fund capital into American AI labs (xAI’s latest funding is another good example).

Trump-o-Nomics: POTUS is working to shore up his left flank by “immediately taking steps to ban large institutional investors from buying more single-family homes” and announcing that he will no longer “permit Dividends or Stock Buybacks for Defense Companies” until they can build faster, alongside limits on executive compensation at defense primes (RTX earned a solo rebuke in a follow-up post).

Private investors own a small percentage of the houses in the United States. The solution to the problem of housing scarcity is a supply-side boom, not demand-side meddling by Presidential whim.

I don’t think POTUS can dictate how private companies operate like that? You might think that the arrogation of corporate decision-making to a single, government figure would excite the tech-right, but as any sand thrown into the gears of existing defense primes is good for the neo-primes that they back, well, it’s a little quiet out there.

Add in the state taking so many stakes in private companies, and it really does seem that POTUS thinks he’s the CEO of the United States, which is entirely false.

POTUS then declared that the defense budget should be $1.5 trillion, not $1 trillion. Defense stocks liked that. Even if we manifestly cannot afford it.

So far, I don’t see an SEC filing from Raytheon (RTX) or Northrop Grumman or General Dynamics announcing changes. Perhaps the dividends are safe for now.

Want some good news? TechCrunch’s Tim De Chant’s author archive is effectively a Feel Good feed. Tech companies investing in carbon removal? Yep. How about space-based energy to boost solar farms? Yeah. Investments into geothermal? Of course. Whole Foods teaming up with Mill to boost composting? Right here. Fusion power fundraising? Of course. Heat pumps and their progress? Do you even need to ask?

The Minneapolis shooting: It was murder.

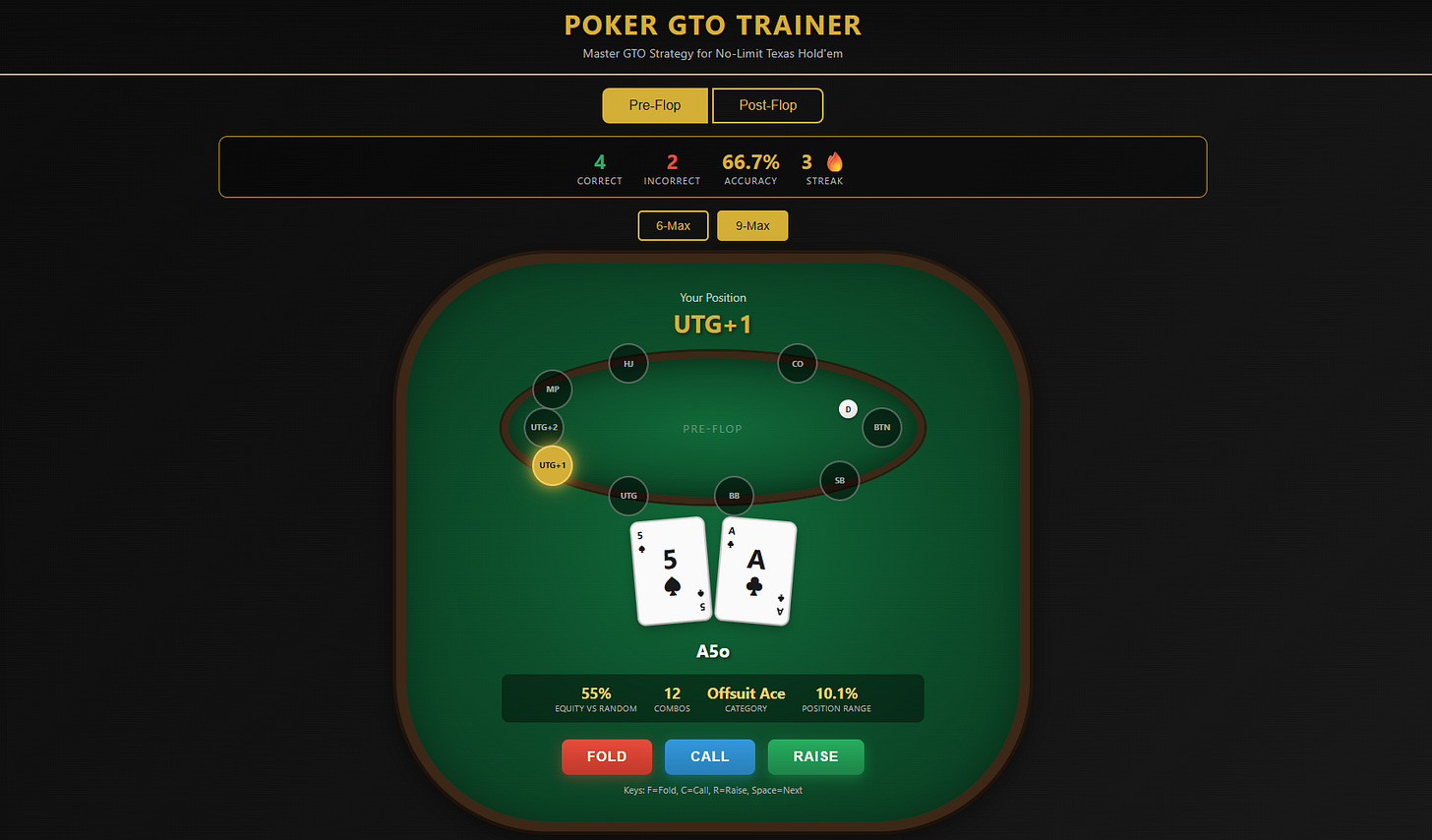

Claude Code is good fun, part III: After I got out of credit jail, I spent time tasking Claude Code with building a GTO poker trainer app. It did a pretty incredible job? Instead of paying a bundle of money for access to existing GTO tools, I spun up this bad boy:

I added post-flop training with a command, and tasked Claude Code with adding a table and positions to make post-flop training a bit easier. Incredible, easy, and so fun.

What the Internet needs now is a super-durable, completely secure Idiot Hosting Site.

A place where I can one-click publish my Claude Code apps, and use them myself when on the go. I could set up my own hosting, but I just want to fuck around. Someone charge me $10 a month to host my personal app store, please?

The global venture capital market is increasingly red, white, and blue: I was contentedly reading Crunchbase News’s Q4 2025 venture capital roundup this morning when the following paragraph made me sit up:

The U.S. also gained market share last year. Around $274 billion in startup capital was invested in U.S.-based companies in 2025, per Crunchbase data, representing 64% of global startup funding. That’s up from 56% of global venture investment in 2024. Contrast that with 2019 through 2023, when the U.S. market represented around 47% to 48% of global venture capital.

64% is very close to 66%, which is the two-thirds mark. You can therefore think of the global venture capital market last year as follows:

American startups raised two-thirds of the money

Global AI startups raised “roughly 50%” of all funding last year.

Therefore, the easiest way to raise money is to be an American AI startup, while the hardest path to raising money is to be a non-American, non-AI startup.

There’s probably a lot of alpha in the latter category for anyone with the stones to go against herd wisdom.

Does Anthropic’s new valuation make sense?

Anthropic, the company behind Claude Code, is raising a fresh $10 billion at a new, higher valuation of $350 billion. The totals could change before closing, but it’s clear that private-market funding sources remain enraptured with backing domestic AI labs.

This capital is distinct from the $5 billion pledged by Microsoft and $10 billion pledged by Nvidia.

The sovereign wealth fund of Singapore is expected to co-lead the round.

So, does Anthropic at $350 billion make sense? Are those numbers that we can interrogate?

Yes, and yes. Here’s a mix of Anthropic revenue and valuation milestones, over time:

December, 2023: ~$100 million run rate

January, 2024: Anthropic raises $750 million at an $18.5 billion valuation.

November, 2024: Anthropic raises $4 billion from Amazon; no new valuation disclosed.

December, 2024: ~$1 billion run rate

January, 2025: Anthropic raises $1 billion from Google; no new valuation disclosed.

March, 2025: ~$2 billion run rate

March, 2025: Anthropic raises $3.5 billion at a $61.5 billion valuation

May, 2025: ~$3 billion run rate

August, 2025: ~$5 billion run rate

September, 2025: Anthropic raises $13 billion at a $183 billion valuation

December, 2025: ~$9 billion run rate

December, 2025: Claude Code reaches $1 billion run rate in six months

January 2025 proposed fundraise: $10 billion at a $350 billion valuation

December 2025 projected run rate: ~$20 billion to ~$26 billion

We can do a little math, provided we all agree that the revenue figures we have above are too round, implying imprecision. As are some of the dates above. Rounds close at a different time from their announcement date, and run rate calculations can be a little fraught. Still:

Anthropic run rate multiple in January 2024: 185x

Antropic run rate multiple in March 2025: 31x

Anthropic run rate multiple in September 2025: 37x

Anthropic run rate multiple December 2025: 20x

Implied Anthropic multiple at a $350 billion valuation and ~$10 billion run rate (allowing for a bit of growth before the round closes): 35x

Implied Anthropic multiple at $350 billion valuation and ~$20 billion run rate (the lower bound of its targets): 17.5x

Uh, yeah, I’d cut that check. Not that I was invited to chip in a basis point’s basis point of the company’s new worth, but you get what I mean.

You could argue that OpenAI has too many compute commitments, and is losing share to Google and Anthropic. You could argue that xAI is spending too much money chasing the same LLM gains that its rivals are also picking over. You could argue that Chinese AI companies are giving away too much tech to gain share. Pick your complaint. But so long as Anthropic continues to make AI models par excellence, I don’t see a reason to doubt them.

I’ll go even further: If Anthropic decelerates to just 100% growth in 2026, I still think that they are all but impossible to kill.