Make Europe Great Again

The view that Europe is over, done, dusted, and heading for a future of economic stagnation and declining cultural import is legion.

Welcome to Cautious Optimism, a newsletter on tech, business, and power. Modestly upbeat.

Monday (MLK Day)! Our new baby arrived and is a perfect bundle. Mom is well, and we’re settling into our new three-child reality. CO is returning early as there’s too much going on to stay quiet. Please excuse the odd typo while my sleep schedule gyrates.

Before we get started, just before August was born, my friend Leslie Feinzaig hosted your humble servant for a chat. It was good fun. You can watch the whole thing here. Now, to work! — Alex

📈 Trending Up: China’s population … gunboat capitalism … the Bonatsos-Tsotsis empire … European economic unity … open-source AI … farce … AI investment … AI spend … measles …

📉 Trending Down: Free speech … free-market capitalism … free market capitalism … Thinking Machines Lab … US-EU relations …

Things That Matter

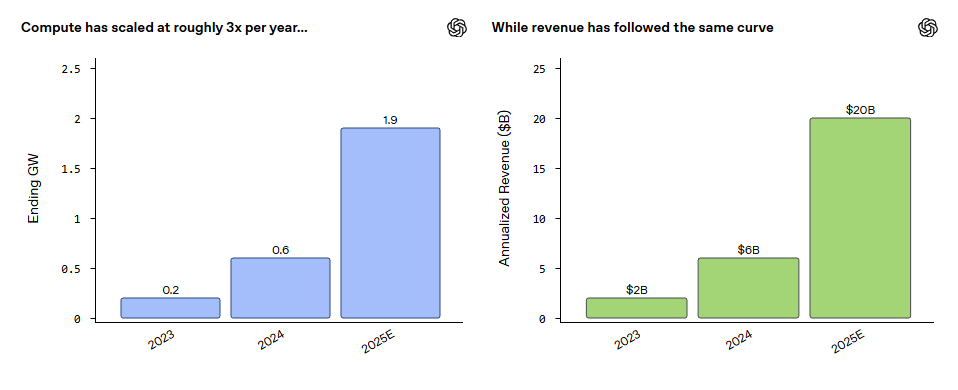

OpenAI’s revenue bet: Over the weekend, OpenAI blogged about its 2025 progress and set expectations for the new year. In a post tying expansion of its compute footprint to revenue growth, the AI lab said that it tripled its compute capacity in 2025 (from 0.6GW to 1.9GW) while its annualized run rate also trebled (from $6 billion to $20 billion).

This should sound familiar. OpenAI made a similar claim in late December that we covered — here — including roughly the same charts describing trailing compute and revenue growth. So, what’s the game with the repeat news? OpenAI probably figured it could get another round of press for the same data (correct), and because it wanted to tell you what’s next (emphasis added):

[The compute-revenue flywheel] requires discipline. Securing world-class compute requires commitments made years in advance, and growth does not move in a perfectly smooth line. […]

That discipline sets up our focus for 2026: practical adoption. The priority is closing the gap between what AI now makes possible and how people, companies, and countries are using it day to day. The opportunity is large and immediate, especially in health, science, and enterprise, where better intelligence translates directly into better outcomes.

That’s a plan we can interrogate as the year proceeds. We will also be able to prod at the compute-revenue growth axiom that OpenAI considers core to its future.

The tying of compute and revenue helps explain why OpenAI is so heavily pledged to fund future compute commitments around the world. If you think that AI revenue and compute rise in tandem, then to grow to massive revenue scale you must invest heavily in compute; and, if you want to ensure your ability to compete in the future, well, have you considered more compute?

OpenAI also made waves recently by announcing that its free and Go (cheapest) plans will see ads in the future. More on this completely expected outcome here. (How do ads fit into the above? Well, you need compute to serve free users, which means ads are the natural compute-revenue axiom strategy?)

The Elon Musk-OpenAI lawsuit continues to smolder. You’ve probably seen screenshots of the case around the Web. So far, I haven’t seen many complaints that a major technology figure is working to collapse one of the most financially critical companies in the world, one that is backed by an ocean of private capital to boot. Perhaps xAI’s sky-high revenue multiple is partially predicated on its investors hedging that OpenAI could get rekt?

What’s software worth? No one seems to know.

AI-first startups like Harvey (legal AI tools, my interview for TWiST), grew to $190 million ARR in 2025 (up from $50 million in “early 2025”). That’s insane, and insanely valuable. Hence, the company raising a Series D ($3.0 billion post-money), a two-part Series E ($5 billion), and a Series F ($8 billion) last year.

Similarly, Replit is in talks to raise at $9 billion while Temporal is eyeing a $5 billion valuation. And in recent days, we’ve seen Clickhouse raise at a $15 billion valuation and buy Langfuse.

From one perspective, software is worth a lot! A cohort of startups either built entirely on top of, or accelerated by the AI wave is growing quickly while attracting mountains of capital. Good!

But what about tech companies that are not growing at the speed of the best-of-bunch AI startups? That’s where things get sticky. Public multiples for many former venture darlings are in the single-digits, leading to some VCs arguing that “venture doesn’t work” unless post-IPO tech companies can attract more value per dollar of revenue generated (it’s hard to back a company through its red-ink era only for it to be worth, say, 4x ARR).

The tension between high values of AI-first startups and low values of post-IPO SaaS companies is not apples::apples. But it does underscore that we live in a multi-track software valuation landscape today. You could split the software market in two by putting AI-first companies in one bucket AI-second companies in another. But that’s not entirely right.

Instead, we’re seeing the rise of startups (new unicorns, mostly) growing at hundreds of percent per year far deeper into maturity than preceding generations of software companies. So what? Well, if you want an outlier valuation — and no one wants a median public-market SaaS multiple today — you need to be an outlier company, and the bar for that is very high indeed. How about 300% growth while private? If even that is enough.

The software/startup market is, therefore, a growth game masquerading as an AI game; ten points to the nothing-ever-changes crew. (And as one of my favorite investors, Notable Capital’s Jeff Richards notes, if you have a growth rate that starts with a one or a two, you are going to have a single-digit revenue multiple after you list.)

But wait, if the startup race is the same growth game as ever, then why are we even discussing the state of startup valuations and software valuations more generally? What has changed? What was once an amazing growth curve is now a pedestrian pace of revenue accretion. Therefore, a host of startups that you could build today with yesterday’s growth expectations are effectively unbackable. You could actually argue that there’s less space in the market for building startups than ever — you need to storm out of launch at a growth rate that is competitive with say, Harvey, and not something so boring and mundane as Slack.

After all, the messaging service was growing at <100% heading into its own IPO, and had trailing-year revenue of just $400.6 million! OpenAI added that much revenue in what, December alone if not more?

What was once insanely impressive is now not. Adjust your fundraising expectations accordingly.

RIP T2D3. (Unless you spy an arbitrage opportunity?)

Make Europe Great Again

It’s fashionable amongst the Silicon Valley set to mock Europe. Echoing the agitation I heard from the conservative Christian milieu I grew up around, the view that Europe is over, done, dusted, and heading for a future of economic stagnation and declining cultural import is legion.

There’s some credit to the argument. Europe has struggled to create new economic titans in recent decades, the United States raises far more venture capital, and per-capita GDP has swung even further in favor of America in recent years.

Russia's invasion of Ukraine and the election of Trump to a second term stirred European animal spirits. Calls for lower regulatory burdens, streamlined corporate registration, state-level AI investment, and a new set of defense-focused startups cropped up. But until the last few days, I was unsure if Europe would truly be able to retain enough of its entrepreneurial human capital to compete with my native country.

Sure, Mistral and Black Forest Labs are impressive, but are they truly world class? You get the idea. (The answer is yes, by the by.) Then, in recent days, the United States all but declared war on our allies in Europe (more).

While taking a soft approach to authoritarian regimes, POTUS is demanding that Denmark (a NATO member and long-time American ally) hand over Greenland to the States. New tariffs were put into place that will rise over time until Denmark cedes territory (it won’t). Even more, it appears that POTUS is so irked over not receiving the same prize as his predecessor Obama that he’s willing to tear down the transatlantic partnership.

While the Greenland saga is bad for international relations, the West as a whole, and a unified democratic front in the face of rising global authoritarianism, it’s great news for European technology companies! If you are worried that the United States could start a hot war after an economic conflict with your nation or bloc, would you want to use American technology products? I wouldn’t!

This means that European cloud computing, European AI models, European defense startups, European energy projects, and European software and hardware of all sorts are now more attractive to their native market than ever. And, if you are worried that your erstwhile ally is now effectively a rogue nation, would you go there to build your startup? Maybe, but then again, maybe not. (Don’t dismiss EU patriotism as a zero; it isn’t).

Trust takes a long time to build, and it can be collapsed in a fraction of the time. I think I learned that axiom in a business context, ironically. Here the United States is telling Europe that we are no longer their allies or even their friends. Instead, we view them as a misbehaving vassal. Well, don’t be too shocked if our national posture does more to make Europe great again than boost our domestic fortunes.