Methinks the chip-god doth protest too much

Welcome to Cautious Optimism, a newsletter on tech, business and power.

Wednesday. CO is off tomorrow for its regularly scheduled food coma. Now, to work! — Alex

📈 Trending Up: Self-driving … self-driving … recycled Russian talking points … Indian GDP growth … buying political power … AI music … rural pushback on data centers …

📉 Trending Down: Rule of law … the United States … intelligent investing … paying for data …

Things That Matter

Chart of the Day, via my former employer Apollo: The crypto selloff did more than take the wind out of the sails of crypto-treasury companies. It also decoupled the value of bitcoin and the Nasdaq Composite:

Bitcoin is a weird beast. Precisely why bitcoin has value is a matter of debate, with schools of thought ranging from its hard circulation cap (21 million), the massive compute network that secures its transactions (1.147 zettahashes per second), or its status as the original token and blockchain in crypto-terms. Another reason some favor putting their fiat into bitcoin instead of, say, a zero-cost index fund is that bitcoin can perform as an uncorrelated asset. That is, when stocks go down, bitcoin’s value doesn’t fall in sync with other assets.

Not to be mean, but I didn’t expect that uncorrelation would be so bloody. Yes, bitcoin is not tracking the Nasdaq today; it’s actually performing worse. (Recall that my family invests a small fraction of our regular investment purchases into a bitcoin ETF as a, sigh, hedge.) Happy Thanksgiving!

Startup of the Day: Valstad. American shipbuilding is a mess. We don’t build commercial ships, and our naval shipbuilding programs are picayune in volume terms when compared to China’s own.

Not building ships has worked out for the United States for some time, thanks to transnational flagging and Asian shipbuilding might allowing for global cargo to flow in a steady stream, sans the need for American steel hulls. Today, however, with the global economic order under threat, many believe the United States should re-enter the shipbuilding industry.

Put another way: Market forces are demanding more domestic ship construction, and Valstad has a plan to accelerate just that.

With a stated goal of “100x[ing] America’s shipbuilding output” from five to five hundred ships per year, the company raised a Seed round in July and is working on designs for both nuclear-powered tankers and the “first software-defined ship factory” that will be labor-efficient compared to current American ship manufacturing norms.

The ‘startups making boats’ game is busy. Vatn Systems, Saronic, Regent (to a degree), Seatsats, and Blue Water Autonomy are all battling for a share of the future watercraft market, and I fucking love it.

Doth the chip god protest too much?

Nvidia is a powerhouse company with a multi-decade history as a public company and proven survivability between market cycles. Recently, Nvidia has posted some of the most impressive revenue growth of any company in history.

Here’s Nvidia’s quarterly results for the third quarter — Nvidia runs a fiscal calendar that is a month offset from traditional quarters, and a year ahead; its most recent quarter is Q3 of its fiscal 2026 — starting with Q3 fiscal 2023, or the three months ending October 30, 2022, a month before ChatGPT launched through its most recently reported quarterly results:

Q3 F23: Revenue of $5.9 billion, net income of $680 million

Q3 F24: Revenue of $18.1 billion, net income of $9.2 billion

Q3 F25: Revenue of $35.1 billion, net income of $19.3 billion

Q3 F26 (MRQ): Revenue of $57.0 billion, net income of $31.9 billion

Given that growth, you might think that Nvidia would be riding high. Instead, market sentiment has turned on the company, casting its future growth into doubt despite strong guidance. More extreme detractors are accusing the company and its major customers of something akin to accounting fraud (more here).

We discussed the company’s memo sent to Wall Street, which pushed back against activist investor discontent, yesterday. More recently, in light of Anthropic’s recent deal with Google to use the latter company’s GPU-competing TPUs was underlined by news that Meta is considering renting Alphabet chips itself.

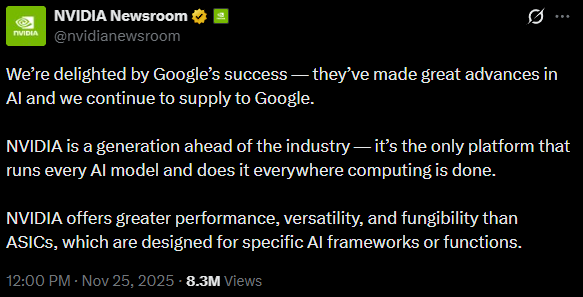

The market asked: Is Nvidia in danger of losing its place atop the AI profit game Nvidia responded:

As with the investment memo detailing the company’s response to public criticism, Nvidia is getting whacked for saying something about the news that everyone is talking about. Damned if you do, damned if you don’t. And Nvida is not wrong; GPUs are more flexible than ASICs. But if the market really needs chips that only do one thing, and ASICs are, almost by definition, very good at that task then you have to wonder.

On the accounting front, I doubt that Nvidia is doing anything untoward; at least I have yet to see conclusive argument that the company is doing anything other than shitting gold. At the same time, ASIC companies, from Google to startups like Etched, believe that single-use chips have merit. They do. And that means Nvidia’s more general GPUs have to be much better to stay ahead of the AI workload game. Good luck, Nvidia kida, it’s only the entire stock market on your shoulders.

Giving Thanks

Tomorrow is Thanksgiving, a feast day here in the United States. Through the rest of the week, many of us Stateside will take a moment to sit back and reflect on our lives. I intend to do so with nothing but gratitude in my heart.

There’s too much that I am thankful for to list completely, but apart from the core building blocks of my life (family, not drinking, factory-building video games, heavy metal), I wanted to thank you.

Cautious Optimism is an odd duck of a project. It would have been far smarter to focus on a single business niche or hammer a single argumentative perspective. Instead, you afford me the chance to gyrate coverage based on the news cycle and what I think matters; your consistent readership — CO’s open rate has remained healthily static as it has grown — has given me stable perch to yap from. Thank you.

I am happy to report that there’s much going on behind the scenes here at the newsletter and its parent company, Lunch Hacks. We recently brought on more editing support (thank you Ram!), and are in the process of getting our future digital home in order. Next month, if all goes according to plan, CO is moving away from its current domicile onto its very own website. Once moved to its new online residence, CO can get weird and pursue writing of all lengths and types.

So, there’s much more to come. Hugs, love, and may the rest of your week be nothing short of a delight.