Navan’s IPO is partially AI-predicted

Welcome to Cautious Optimism, a newsletter on tech, business and power.

Today’s newsletter got stuck in the edit queue, but I wanted to make sure it made its way to your inbox regardless. <3

Tuesday! The chances that you and I will get to space are going up, and I can’t think of a more exciting note to start on. To work! — Alex

📈 Trending Up: Papers, please … the shutdown … domestic prices … Broadcom, thanks to two different customers … better late than never … algorithms … Oura … “rare-earth supply chain chaos” … Google Search, which just made a UI change that is pro-user? ...

📉 Trending Down: Solar energy … privacy … the OpenAI-Microsoft relationship … European weakness … US-China trade relations … press freedom …

Things That Matter

Goldman (?) is buying (?) Industry Ventures (?): Yesterday, we covered JPMorgan’s news that it planned a $10 billion venture push into companies building national resilience (defense, advanced manufacturing, energy) and frontier technologies (AI, quantum). Not to be outdone, Goldman Sachs (earnings) announced a deal to buy Industry Ventures for a hair under $1 billion.

Industry Ventures “manages $7 billion of assets under supervision” with more than “1,000 secondary and primary investments since the company’s founding in 2000,” per Goldman.

Industry is an interesting venture firm. It blends secondary investments (purchasing existing shares), LP commits to funds under $250 million, and direct venture capital investments. Goldman buying a traditional venture capital fund that only made primary investments would have been odd, as it wants to work with as many startups as it can (see its accelerator, and ‘10,000 Small Businesses’ program), and it’s too large for venture gains to move the needle much.

But buying a venture fund that operates as a hybrid secondary buyer, LP, and direct investor? Buying that asset will implant Goldman more deeply into the connective tissue of venture-land, providing it with expanded relationships with more firms, funds, and founders. If companies continue to stay private, and if the value of private-market companies continues to grow as a share of total national corporate wealth, then the investment bank needs a new way to earn off the companies it would have once generated IPO fees from when they listed. So, why not buy into what is effectively a startup clearinghouse, with desks set up to serve all participants in the venture game?

You could argue that it feels top-ish that we’re seeing investment banks redouble their venture efforts; historically, large influsions of so-called tourist money in venture tends to arrive when market conditions are overheated. (See: 2021)

Buying a venture firm for 14% of its current assets under supervision puts an interesting valuation on the startup investing game.

Indian startups get fit: Startups based in the UK and India are unlike their US-based competitors in that they have to report their financial performance. Admittedly, with ample lag, the quirk in accounting rules means that companies like Revolut are more willing to share their results than we tend to see here in the States.

This means we can keep closer tabs on startup progress in many cases than we’re accustomed to domestically. Enter Entrackr, a news service that covers the Indian startup industry. It published historical results from Livespace (interior goods shopping), GenieMode (B2B ecommerce), and LeadSquared (CRM), the trio showing that Indian startups are growing (+23%, +21%, +17%, respectively) faster than their expenses are expanding (+6.5%, +14%, -6.4%, respectively), leading to smaller losses with red ink falling by 42%, 35%, and 45%, respectively.

I presume we’d see similar trendlines from US unicorns, especially those minted during the last boom. But it’s fascinating all the same to get hard data on how startups in India, a retreating venture market, are navigating the current moment.

Smashicorns: Fivetran and dbt Labs are merging to create a $600 million ARR entity that can go public. The Information reported that the deal was brewing in September, leading to my prepping a segment for TWiST (original notes here). The gist is that the two companies have perfectly complementary products (Fivetran helps companies ingest information into their data warehouses; dbt Labs helps companies clean and organize data once moved), and complementary cap tables (a16z’s Martin Casado holds a board seat at each).

Merging portfolio companies to create stronger single-entity concerns is not a de novo move; General Catalyst-backed Grammarly and Coda combined earlier this year (TWiST interview with Shishir Mehrotra, Grammarly CEO), and in a looser sense when Grammarly snapped up Superhuman (IVP backed both, my chat with the two companies here). But it does appear to be something we’re seeing more of right now.

Why? Because the stock market is at or near all-time highs, and many companies that have listed this year have seen strong early trading results thanks to public-market interest in their shares. (SaaS multiples for quickly-growing software companies have soared in recent quarters, while slower-growing SaaS shops are stuck in the mud.) Bringing Fivetran and dbt Labs together into a single package makes sense if you think that they will be stronger combined, and you want to convert long-held equity stakes into something liquid.

Fivetran most recently indicated it reached $300 million ARR in September of 2024; dbt Labs reached $100 million ARR earlier this year. That leaves around $200 million worth of ARR from growth since the two reported dates. Or, about 50% shared growth over about a year’s time (blended).

The two companies’ most recent private-market valuations sum to $9.8 billion. I doubt the equity conversion they will undergo will place their worth at so high a mark, but the company would be worth 16.3x ARR at its old valuation marks.

Expect to see more unicorns smushed together as VCs try to clear their books. Call them smashicorns, I guess.

Navan’s IPO is partially AI-predicted

The company once known as TripActions is going public. Rebranded as Navan in 2023, the company, best known for its corporate travel software, added expense management to its product roster back in 2022. Now, Navan is targeting a $24 to $26 per-share IPO, valuing it at $6.9 billion (midpoint), billions under its final post-money, private-market valuation of $9.2 billion.

Navan’s exit will generate massive liquidity for Lightspeed (49.9 million shares), Zeev Ventures (37.3 million shares), a16z (25.4 million shares) and Greenoaks (14.3 million shares), among other investors that failed to clear the 5% ownership reporting minimum.

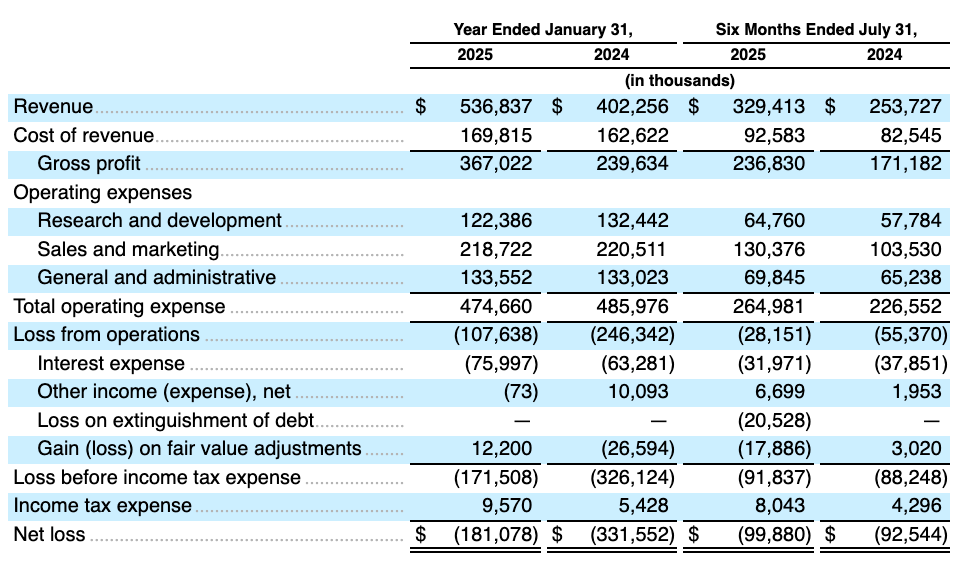

Financially, Navan is performing just fine. Its revenue growth of 30% in its most recent two-quarter period is strong for a public company, but only so impressive for a startup prepping to list:

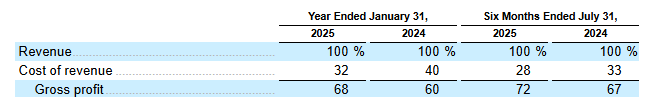

Still, Navan has crested the $500 million annualized revenue threshold, which appears to be today’s minimum viable IPO scale, based on what I hear from investors. And it is both reducing losses — observe its operating deficits across the detailed periods — while boosting its gross margins from 60% in its fiscal year ending January 31, 2024 to 72% in its most recent two quarters.

While Navan’s operating expenses did rise in the six months ending July 31st, 2025, if you observe the company’s year-over-year expense growth in R&D and G&A you’ll see that they are very modest. Slow expansion in non-S&M costs is partially thanks to AI usage at the company:

Our AI workforce’s performance, quality, and accuracy has been rated with a CSAT score of 78% for the six months ended July 31, 2025, which is on par with human agent performance.

An increasing amount of our support services are becoming automated through our AI-powered virtual agent chatbot, Ava, handled approximately 50% of user interactions without live agent intervention during the six months ended July 31, 2025. Our ability to control customer support costs over time, even as customer support volume has increased significantly, has contributed to an increase in gross margin from 60% in fiscal 2024 to 68% in fiscal 2025, and non-GAAP gross margin increased from 62% in fiscal 2024 to 69% in fiscal 2025.

Yeah, human-mediated support is on its way out. Get ready to chat with chatbots all the time. Based on my experience talking to AI bots in customer service contexts, the change will prove miserable. But if you are in the business of making money, swapping flesh-and-blood costs for AI API calls is mana from heaven; who doesn’t want more operating leverage?

Navan’s IPO won’t set the world alight; it’s too niche and too normal to rock the headline waves too much. But it’s another unicorn IPO that will push a mountain of liquid returns into venture coffers, ready to pour back into LP wallets. That will not only delight long-illiquid backers of venture funds, perhaps shaking loose more capital for VCs, which have had a terrible fundraising year as an industry.

More when Navan prices so we can get a better handle on the spend management fintech category’s valuation profile.