Oligarchy with American Characteristics

And yes, we talk about OpenAI-Nvidia

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Tuesday! CO was off yesterday due to travel, but we’re back and on fire to get back to work this morning. As are the Europeans, it seems — they’re busy launching competitors to the now-ubiquitous TBPN tech chat show.

CNBC was never the tech show, but it now faces two quasi-streaming programs that absorb and show off a far larger portion of the ecosystem without a mandate to spend most of their time discussing public markets.

Of course, the difference between CNBC and related programming from Bloomberg and the Twitter era of business news is that the latter do not exist to do journalism per se. They highlight intra-industry wins, winners and culture. It’s popular. So is corn syrup. Onward! — Alex

📈 Trending Up: Google at court … Polish spine … calls coming from inside the house … Fnality … humanoid robots … public corruption … inverse GDP growth … deflation in China … US-Ukraine relations? … US support for the Argentinian peso …

📉 Trending Down: Free AI access … manned combat … US-India ties? … building in America? (more, more, more) … European tree cover … the EU’s AI rules …

Things That Matter

I’ve finally figured out why the tech elite hate the “professional-managerial class.” I’ve long wanted to crack the mystery of why so many tech leaders hate their own staff. I mean, it’s not hard to find tech folk whinging about the professional-managerial class. The very people who work at the tech companies who help make the wealth that today’s tech leaders wield!

Why? The ur-text to refer on the topic is James Burnham’s “The Managerial Revolution” from 1941 (pdf here, chapter six). Burnham argues that capitalists would lose ground to not the proletariat, but instead a class of economic managers “through their control of the state which in turn will own and control the instruments of production.” You can see why the capital-havers would dislike managers; they are theorized to become their successors!

But I think there’s a simpler explanation for all the hatred. This essay by Ryan Moser defines the professional-managerial class as:

The stratum of society that wielded influence not through ownership of capital, but through the application of credentials and the management of others.

I think you can skip the political theory and frame the capitalists vs. managers mud-slinging as purely a game of wealth. Why should the folks with money (who have ostensibly won capitalism) listen to the folks who do not have money (and thus have lost capitalism)? Winners don’t have to listen to losers! That the folk with the money have to pay those who don’t in many cases (see: Google’s org chart) only compounds the annoyance.

This is partially why when tech shops get busy with the scythe, they jaw about cutting management layers. Concerns about having too many layers of management are real and fair, but cutting the middle out of companies is also a good way to stick it to one’s class competition!

China Rising: Initially, I earmarked this report on the power of Chinese manufacturing in new energy production for discussion. The gist is that a bunch of VCs went to China, and after seeing how far ahead they are in manufacturing products like batteries and solar, were left “wondering how European and North American competitors can even survive.”

There are two other pieces of news you need rattling around in your head.

First, Chinese tech giant Alibaba’s Qwen family of open-ish AI models continues to improve, and new ‘omni-modal’ releases are now in the market. Extra-national competition is speeding ahead to catch up while we wait for whatever Anthropic is cooking, OpenAI’s upcoming releases, and Grok 5.

Second, China is working to help other countries secure their gold stores. You could consider this piece of news as an economic argument about the centrality of the American dollar and finance system, but it’s also a geopolitical point. Would you get into a big fight with the nation that is domiciling your bullion? Probably not.

Meanwhile, here at home, we’re promoting junk science about vaccines and autism while propping up dying industries where we lack a comparative advantage. I do not think that centrally planned economies will win over an extended time-horizon compared to free markets, but we’re not covering our system of political-economic fusion in glory right now.

Oligarchy with American Characteristics: We’re a day late, but the TikTok deal is starting to smell like political capture. The group that looks set to buy the social media service will include several Trump-aligned billionaires and their companies — Larry Ellison’s Oracle, Marc Andreessen’s a16z, the Murdoch family…

The fact that Ellison is involved matters (more here on his support of POTUS) because Oracle is going to “spearhead U.S. oversight of the algorithm and security underlying TikTok’s popular video platform,” per the AP, which also notes:

Under the current terms of the proposal, the new U.S. joint venture would receive a licensed copy of the recommendation algorithm that keeps TikTok users endlessly scrolling through clips on their smartphones. Oracle would review, monitor and secure U.S. data flowing through the service.

American officials have previously warned that ByteDance’s algorithm is vulnerable to manipulation by Chinese authorities, who can use it to shape content on the platform in a way that’s difficult to detect.

Swapping out Xi for Ellison only gets one so far, I think. Remember that Congress earlier this year passed a law banning the service if it was not fully divested. POTUS has since ignored that law and directed the government to waive companies breaking the law in his favor.

Why? At least partly to let him cobble together a deal through which his allies can take over a platform that is often pointed to as a vector of political indoctrination! Of course, when it’s your team doing the scale-tipping, that’s just patriotism.

Is that an investment, or are you just happy to see me swapping shares for chips?

Nvidia has long had a relationship with OpenAI. From the chip giant’s CEO hand-delivering “his company’s first DGX supercomputer to OpenAI’s office in 2016,” to the GPU maker investing in the AI firm last year when it raised $6.6 billion at a $157 billion valuation — the two companies have long been friends.

More importantly, OpenAI’s rise since the debut of ChatGPT and the genAI race it sparked have transformed Nvidia from a leading technology company to the world’s most valuable corporation. And increasingly, also a venture capital powerhouse: Crunchbase’s running list of Nvidia’s private-market investments counts eight known deals in September alone. So far.

So it’s not that shocking to see Nvidia investing in OpenAI’s massive infrastructure project. But the news that Jensen’s company will put up to $100 billion into OpenAI to help it build 10 gigawatts of compute capacity is slightly misleading — the capital will be doled out in $10 billion increments as capacity comes online. And per Reuters:

“The deal will involve two separate but intertwined transactions, according to a person close to OpenAI. Nvidia will start investing in OpenAI for non-voting shares once the deal is finalized, then OpenAI can use the cash to buy Nvidia’s chips, the person said.”

So it’s an investment, but it’s mostly an in-kind investment on Nvidia’s part. Other compute buyers just saw their future order fulfillment from Nvidia suffer, but a healthy OpenAI means a healthy Nvidia, so the deal makes some sense.

The FT gently discounts the risk of “the kind of vendor financing common during the early 2000s telecom frenzy,” noting that OpenAI isn’t taking on debt, which is fair. The article frames the deal as a way to cement the “impression that the AI race is stepping up a gear.” Hardly a ringing endorsement.

Confused? No worries. The Nvidia-OpenAI deal was not part of the original ‘Stargate’ deal that will see truckloads of cash from SoftBank. Nor, I believe, is it related to OpenAI’s deal with Oracle for compute, or the AI company’s long-standing relationship with Microsoft for data crunching. It’s also not related to the recent Nvidia-CoreWeave deal that will see the chipmaker absorb any excess capacity from the neocloud, which also happens to be a large customer. (Nvidia is also a shareholder in CoreWeave.)

The best way to think about the situation is that OpenAI has a massive problem: it’s compute-limited. This is a rate issue — the pace at which new compute is coming online without its first-party efforts is too slow. It’s also a financing dilemma, as OpenAI is in need of more money than any private company in history.

The solution to those problems was never going to end up unicameral. No, OpenAI was going to need to cobble together compute and dollars from a host of sources. And given the amount of resources it needs, the number of possible pockets it could reach into was limited.

Enter Nvidia.

Worried? I get it. After all, if AI demand falters, or the tech becomes so efficient that we need far fewer GPUs than anticipated, or a startup building contra-GPU chips wins, we could find ourselves looking at hundreds of billions of dollars worth of GPUs slowly depreciating on the vine rack.

We talked about this very issue here.

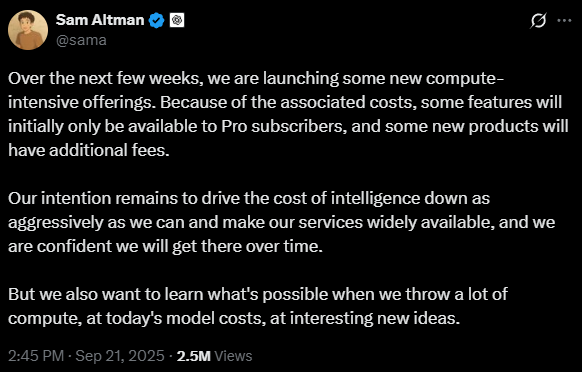

The only way we do not end up in that world is if AI demand continues to rise — be it through more model training and inferencing, or AI gobbling up more tokens to answer a static number of queries. That’s why I keep coming back to this tweet from Altman:

Whatever OpenAI is baking, it’s compute intensive. And if it turns out to be so good that people want to use it, we could see a step-function change in how much compute we need. Then the OpenAI-Microsoft-Oracle-Nvidia combo would see everyone making a lot of money, and your ChatGPT experience won’t get rate-limited. Or not.

It’s easy to become cynical at times like these, but it’s worth remembering that OpenAI’s competitors see the world through the same lens: xAI is building out a second, even larger data center at the cost of billions; AWS is bulking up to support Anthropic, and so on. The people who can see usage data more clearly than we can, and have far greater insight into future compute demands (and when they will arrive) are scrambling like their hair is on fire to secure more power.

In more techno-optimist terms: either you think OpenAI is nuts and Elon is wrong (about this tech issue, not his politics), or a lot of wealthy companies are going to take some big lumps in a few years.