OpenAI wants you to know it’s a B2B company, too

When in doubt, whitepaper

Welcome to Cautious Optimism, a newsletter on tech, business and power.

Monday. Wealthfront should price its IPO on Thursday and trade on Friday. As we await what should be the last tech IPO of note in 2025, we’ll get quarterly reports from Yext today, Braze tomorrow, Oracle, Adobe and Chewy on Wednesday, and Broadcom and Netskope on Thursday. Ready for a full week? Then let’s get to it! — Alex

📈 Trending Up: American commitment to European security … politicized regulation … the Executive branch … Russian aggression in Ukraine … China’s trade

📉 Trending Down: Paying Meta in Europe? … support for our European allies … car sales in China … no shit …

Things That Matter

L’affaire Airwallex, redux: In the wake of American venture capitalist Keith Rabois accusing Airwallex of being a “Chinese backdoor,” the corporate payments and banking startup has raised funding, reduced Chinese investor Tencent’s stake, and now plans to expand its operations in the United States.

Airwallex’s fresh $330 million Series G values it at $8 billion, 30% more than the price tag it earned in its Series F half a year ago. Addition led this new round, and Robinhood Ventures, T. Rowe Price, Activant, Lingotto and others participated .

The company said it has reached annualized revenue of $1 billion (+90% YoY).

Airwallex will soon have a large presence in China, Singapore and the United States. How well it can penetrate the US market with its significant Chinese employee base is not yet clear — the FT writes that “Airwallex has a large presence in mainland China and Hong Kong, where it employs hundreds of staff.”

If the move to limit its exposure to Chinese ownership will have the desired impact is not clear. American venture capitalists were forced by divest their Chinese operations, and when it comes to data security there’s little love lost across the Pacific.

IBM + Confluent: IBM is ready to shell out $11 billion for Confluent, which sells data streaming software that helps companies ingest, store, process and distribute their information at scale. Confluent was founded by the folks who built Apache Kafka (open-source data streaming software) as a way to commercialize the project.

When Confluent went public in 2021 (I covered the deal for TechCrunch), it priced its IPO at $36 per share and opened at $44 per share for a market cap of $10 billion. The company was worth $23.14 per share, (valued at $8 billion) before news of the deal sent its shares soaring in pre-market trading. Not a barn-burner of a life as a public company, then, but Confluent now generates cash from run-rate revenue north of $1 billion.

None of that explains why IBM wants it, however. Confluent helps companies move and manage their data. In the AI era, corporations want to better utilize their data to refine AI models and automate workflows, and IBM stressed in its most recent quarterly report that its “AI book of business now stands at more than $9.5 billion,” while its automation-tagged software revenues rose 24% from a year earlier.

IBM spending $11 billion on Confluent works out to just 3.8% of its market cap. The deal is therefore modest in scale for the tech behemoth, but it’ll likely add to both growth and cash. It also gets IBM closer to the flow of data at major corporations, which is a fine place for its software and consulting services to perch.

If I were a Confluent shareholder, I would demand another billion or two.

Why only complain about the EU’s rules? Last week, CO noted that the EU had fined X ~$140 million for breaches of the Digital Services Act (DSA), and as expected, political allies of X and its owner, Elon Musk, spent the weekend shouting about the shebang.

X’s head of product Nikita Bier went on to accuse the EU of trying to get around the platform’s advertising rules, and terminated the Commission’ ads account in response.

Why do American politicians care about a relatively small fine by the EU against a multi-hundred-billion-dollar business? Because the GOP wants to ensure that Musk’s political machine is in top gear during the 2026 and 2028 election cycles. Supporting Musk and haranguing the EU is the safe move.

We expected companies to comport with American rules when they do business here. The same goes, well, everywhere else. This is what venture capitalists call “the game on the field.”

China blocks American social media companies, and Russia is busy cracking down on Western tech companies, but complaints on those fronts are comparatively few and modest.

In a way, American tech’s pique with the EU is simply the companies in question working the refs. Many in tech and venture simply think Europe is a fading power, so how dare the Europeans tell us what to do!

OpenAI wants you to know it’s a B2B company, too

When in doubt, white paper.

OpenAI is best known for ChatGPT, which is primarily a consumer tool; maybe prosumer if you count those who use it for everything. But OpenAI also sells AI products to large companies, a space where it competes with Anthropic and other major AI labs.

While ChatGPT has proved a mega-hit with more than 800 million weekly active users, only around 5% currently pay for the service. OpenAI expects that upgrade rate to improve to 8.5% by 2030 against a far larger user base.

But the company also has big plans to sell to corporations. It currently offers a business-friendly version of ChatGPT, API access to its models, tools like its Codex coding service, and AI agent support.

It seems its work to find purchase in the corporate world is going pretty well. In a data digest, the company reported that it now supports “more than 7 million ChatGPT workplace seats,” and “ChatGPT Enterprise seats have increased approximately 9x year-over-year.” That’s high growth, even in the AI era.

But are the business customers getting enough bang for their buck? Or does the viral MIT study about AI in the enterprise being a bust still hold?

OpenAI says it’s winning:

Seventy-five percent of surveyed workers report that using AI at work has improved either the speed or quality of their output. On average, ChatGPT Enterprise users attribute 40–60 minutes of time saved per active day to their use of AI, with data science, engineering, and communications workers saving more than average (60–80 minutes per day).

If those estimates are correct, OpenAI may have plenty of growth ahead. An hour of employee time per day is likely worth more than a month of enterprise OpenAI access, which means that the AI firm is indeed offering good value to its corporate customers.

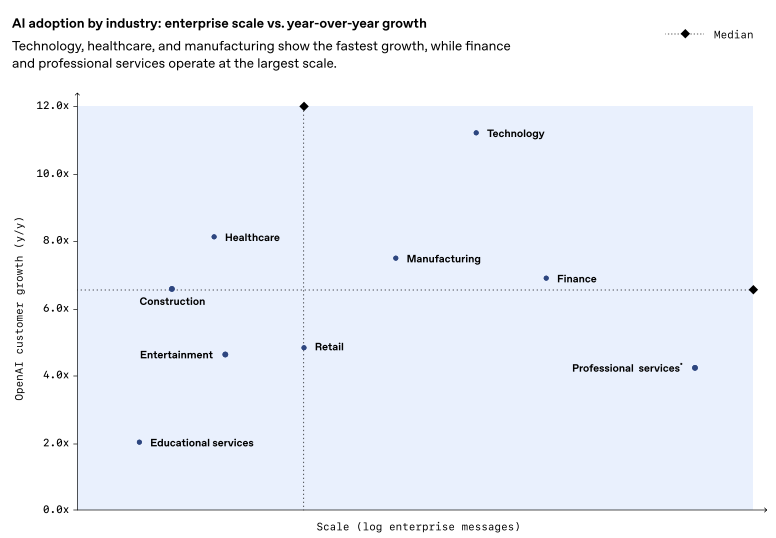

Also, OpenAI found that while adoption varies by industry, it is still high:

This chart is why I don’t think we’re going to see the AI market collapse. Could we be in for a de-frothing? Sure. But there is enough uptake across industries at the current level of the tech to support lots of investment, and AI models are improving fast, as recent releases from Anthropic, xAI and Google make clear.

I don’t know if OpenAI should be valued at $250 billion, $500 billion or a trillion dollars today, but it’s worth a tower of cash regardless. And, it has more than enough revenue flowing to stay alive even if the market turns.

Finally, the report indicates OpenAI’s products are being adopted the fastest by companies in Australia, Brazil, the Netherlands and France. Meanwhile, Germany and the United Kingdom are the company’s “largest ChatGPT Enterprise markets outside the U.S. by number of customers.”

Europe, it seems, is making a huge bet on AI. It will be interesting to see if the uptake can boost the bloc’s productivity and GDP numbers.