Signs of life in unicorn-land

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Tuesday! Tired of endless AI handwringing? Good news, we’re not doing that today.

Instead, we’re talking startups. Netskope’s effective IPO revenue multiple at both extremes of its price range? Yep. Supabase getting all the more super? Yessir. Databricks’ latest statistical deluge? Of course.

Call it a heat-check, call it whatever you want. We’re collecting dollar signs from all over the private technology market today. And to close, one more note on the fight for European economic and technological relevance. Tomorrow we'll cover Klarna’s final IPO pricing and dig into the latest SPAC rush. To work! — Alex

📈 Trending Up: Calls from inside the house … Irish GDP … BRICS unity … consumer tariffs … Aven, after a $110M round … trying again … lmao … shakeups … Techmeme …

Round of the Day: Mazlo announced $4.6 million worth of fundraising this week (Crunchbase News reporting here). The startup is building financial tools for nonprofits. Mazlo makes money along trad-neobanking lines, but its customer focus is unique. But reasonable, as there are nearly two million non-profits in the United States.

📉 Trending Down: US-SK relations (really) … fighting disinformation (and fighting its source) … Israel-Qatar relations … freedom in China thanks to US technology … that Anthropic settlement … safe driving …

Nebius gets a Microsoft bump

Following Moscow’s invasion of Ukraine, Yandex’s Nasdaq listing was suspended. So, the Russian search giant divested its domestic assets and rebranded itself as Nebius Group. That allowed the now-slimmer company to emerge trading on the Nasdaq, eventually raising a $700 million round from Accel (venture capital) and Nvidia (chips). The $700 million infusion was later augmented by another $1 billion worth of convertible notes in June of this year.

Why are investors pouring capital into Nebius? When it split with its Russian assets, what was left was a cloud computing provider, which, you may have heard, is in demand these days.

That leads us to this week: Nebius announcing a deal that will see it “provide Microsoft access to dedicated GPU infrastructure capacity in tranches at its new data center in Vineland, New Jersey, over a five-year term.” The tie-up is worth $17.4 billion through 2031, potentially rising to $19.4 billion in revenue thanks to an added-capacity option for Microsoft.

The result? Apart from Microsoft securing additional home-field GPU capacity, shares of Nebius are up 50% this morning. Investors are cheering that Nebius said publicly that the agreement “enables significantly more aggressive growth of Nebius’s AI cloud business in 2026.”

No shit. The company’s Q2 revenue was just over $100 million, up a stonking 625% year-over-year. Before the Microsoft deal, Nebius projected closing the year with ARR of $900 million to $1.1 billion. Depending on when the newly contracted Microsoft revenue starts to flow, expect Nebius’ growth rate to accelerate even further.

Signs of life in unicorn-land

Crunchbase counts some 1,609 unicorns around the world. If each unicorn was worth just the bare minimum qualifying valuation of $1.0 billion, the cohort would be worth a staggering $1.61 trillion. Naturally, that’s not the case, and the same source pegs total funding raised by today’s unicorns at $1 trillion and the total resulting worth of those companies at $6.2 trillion.

But while we’re seeing some movement amongst unicorns to list this year — often crypto, fintech, and neocloud concerns — most billion-dollar startups are sitting pat in the private markets, recently booming public debuts be damned.

Databricks is one such company. The data and AI company (lakehouses, governance, and agents, oh my!) announced a Series K this week worth $1 billion. That sum pales in comparison to its revenues and worth. Raised at a valuation of more than $100 billion, Databricks just sold under 100 bips of its shares for ten-figures. Not a bad trade.

But the company also detailed its financial performance, including:

Reaching a $4.0 billion annualized run rate in the second quarter, with aggregate revenue up more than 50% year-over-year.

Net retention of more than 140% helped power its growth, a staggering figure on par with Snowflake earlier in its own growth journey.

Databricks disclosed that its “AI products” have reached a $1 billion run rate, and that it counts more than 650 customers spending $1 million or more today.

Wait, you are saying, that looks like a public company! Correct, and a big one to boot. Companies also worth around $100 billion or more include Robinhood ($104 billion), DoorDash ($107 billion), Lockheed Martin ($107 billion), CrowdStrike ($107 billion), and Nike ($109 billion). Why is it worth so much if its revenue ranks it around the 750th largest company in the world? Because of its growth, and the fact that it’s expanding so quickly while generating free cash flow over the last twelve months.

Databricks is a whip-ass company. And it’s conserving an ever-greater percentage of its terminal worth for private-market backers instead of the investing public.

Netskope, in contrast, is a unicorn willing to go public. At the upper end of its IPO price range of $15 to $17 per share, the cybersecurity company would be worth around $6.5 billion. Venture capital firms own a lot of the company, including Lightspeed with 65.4 million shares (X), ICONIQ with 64.3 million shares (Y), and Accel with 29.6 million shares (Z). Netskope — which sells ‘secure access service edge’ (SASE) services, a method of combining security and networking offerings — is set to list under its final private price of $7.5 billion. Still, we’ve seen many an IPO raise its range and then price above that interval this year.

Netskope revenue grew from $251.3 million in H1 2024 to $328.95 million in H1 2025 for a gain of 31%. The company pegged its ARR at $707 million (+33%) elsewhere in its IPO filing. The company also features positive operating cash flow, if stiff GAAP losses in its most recent quarters.

Those figures put Netskope at a roughly 10x revenue multiple if we annualize its H1 2025 calendar revenue or use its ARR as the denominator.

Expect more cybersecurity offerings if Netskope’s own performs well.

Klarna will list tomorrow after pricing this evening. It’s a unicorn, too, but we’re conserving space to dig into that more tomorrow when we get a final valuation.

Supabase is on a heater. The company offers a backend-as-a-service akin to Google’s proprietary Firebase product, but open-source. As with most open-source companies, Supabase’s core product is free, and it makes money selling a hosted version of the code. To great success, I hasten to add. After raising an $80 million Series C in September of 2024, the company quickly added $200 million more to its coffers in April of 2025, at a valuation of $2 billion (up from ~900 million previously).

Now, according to two of my favorite humans, Katie Roof and Natasha Mascarenhas, Supabase is in talks to raise more, this time at a $5 billion valuation. Why? Revenue growth from $20 million (run rate) a year ago to around $70 million today. Zoom!

Then there’s ElevenLabs, the text-to-speech AI concern, which is running a tender offer for its employees at a $6.6 billion valuation. How did it manage to double its Series C valuation from nine months ago? By surpassing $200 million ARR earlier this year, and forecasting that it will reach $300 million ARR by the end of the year. ElevenLabs also reported that its revenue is split “50/50" between its “enterprise and self-serve customers,” meaning that a good chunk of its top-line is coming in with minimal S&A costs (operating leverage!).

ElevenLabs is becoming more enterprise-heavy over time, with its business selling software to larger companies growing “more than 200% in the last year.”

That’s bonkers growth, and is — ducks — another example of generative AI performing well.

Mix in big growth numers from OpenAI, Anthropic, and others and there’s a moutain of revenue growth underpinning unicorns today. Sadly, not all of them are doing well.

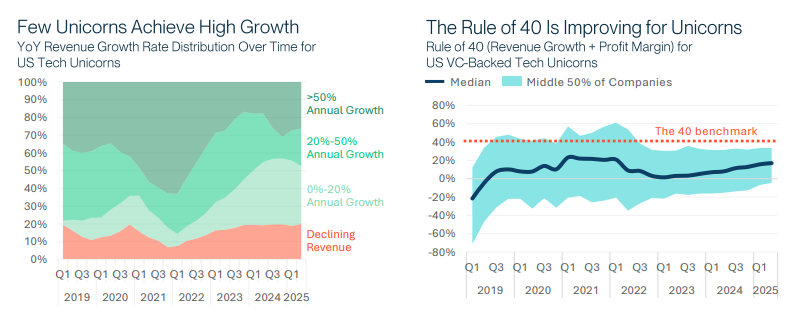

SVB reports that 28% of unicorns are not growing. Cross that datapoint with 79% of unicorns being unprofitable and 75% of unicorns sporting $300 million or less of annual revenue, and we have hundreds of unicorns in the market today that are worth scrap.

Perhaps worse, an even larger percentage of unicorns are growing so slowly as to be worth just a few times their top line, and more than 50% of unicorns currently fail the Rule of 40:

One last note on Europe

This morning, Mistral closed its €1.7 billion round at a €11.7 billion valuation (€10.0 billion pre-money), led as expected by Dutch lithography company ASML. American money made up the balance, it appears.

I presume that European startup founders don’t enjoy being called europoors, or having American venture capitalists mock their ability to build big companies. America innovates, Europe regulates, the quip goes.

I mean, what would you call this? Failure?

So, they are agitating for change, despite the opprobium being slightly unfair. Currently the EU is considering the ‘28th regime,’ a supra-national framework atop the 27 member nations of the bloc designed to create a “new corporate legal framework covering a wide range of key issues for companies, building on online procedures and digital tools in EU company law” to provide “companies, especially innovative ones, with a single set of rules to invest more easily and operate in the Single Market.”

Hell yeah, right? Imagine building in the United States but with only state-based regs to operate against. Yuck. Investors dig the idea. Passion Capital wrote an amicus brief of sorts, arguing that:

The lack of an attractive EU legal entity directly leads to more European founders incorporating in the US and opens the door to talent + ambition being drained away from Europe - critically undermining Europe's ability to grow its tech & startup ecosystem

Founders agree, coming together under the ‘EU-INC’ moniker to ensure that the 28th Regime includes “one new pan-European legal entity,” a single “central EU-level registry,” along with things like standardized investment docs and “standardized EU-wide stock options.”

Good. The stronger Europe is, the safer democracy will prove. Go get it, EU founders.