The LLM paper wars continue

And: Stablecoin watch

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Happy Friday! While we’re watching the Chime IPO soar 37% in its first-day as a public company — and a bit more in pre-market trading — the world is on alert after Israel hit Iranian nuclear facilities, and some staff in residential areas. Regional powers — Qatar, Saudi Arabia — have condemned the strikes. Global stocks fell around the world, with the Nikkei dropping 0.9%, the DAX lost 1.3%, and the Nasdaq off 1.1% in pre-market trading. Oil prices and the dollar gained.

📈 Trending Up: Secondary liquidity … Felicis … military tensions in Asia … AI scraping … TechCrunch in Boston …

📉 Trending Down: Cloud 9s … consumer privacy … the popularity of chip export restrictions … speaking of which … Alex looking stylish around town …

Before we get into our real work today, recall that Gamestop’s plan to issue convertible debt to purchase more bitcoin was met with raspberries from investors? There’s even more corporate work forming along similar lines. Now Pomp could be put at the head of a company pursuing a SPAC-led public debut with a goal of buying up lots of bitcoin.

The idea remains the same here: Use trad corporate financial techniques to create levered public equity pools that can be used to buy bitcoin today, with future dilution and other costs to be sorted out later. When, presumably, the value of bitcoin will have appreciated enough to make the transaction profitable for both lenders and borrowers. We’ll see. Diversification this is not, but there remains enough appetite today for more of the same.

Chart of the Day

We’re pretty far from a free market world at the moment, as the largest single economy works to raise global trade barriers. Mix in geopolitical tensions, and an AI race that is further balkanizing nations known for their trading ties, and it’s a mess out there.

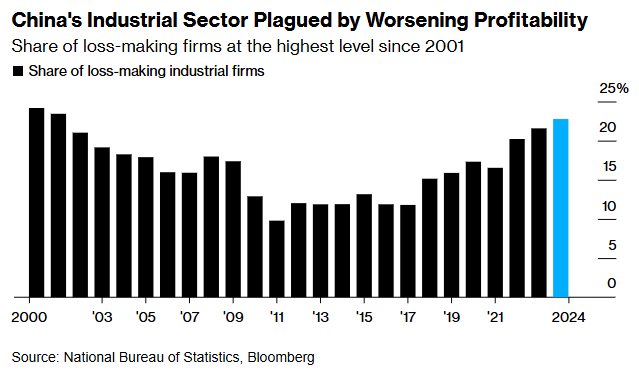

CO is still waiting for the impacts of newly erected import taxes to resolve in domestic data, but there are longer-running datasets that can help us track economic stress in China. One such method is to track the portion of Chinese companies that are losing money.

Bloomberg reports that local governments in China are currently stuck between keeping some companies alive with state incentives to avoid unemployment and lost tax revenue — figure that one out — leading to more than a fifth of firms in the industrial sector afloat long after they would have otherwise likely survived:

There are other fun indicators to track. The newly-reformed youth unemployment rate, energy production, local government debt levels, property prices in second, and third-tier markets. You get the idea. What’s great about the above chart from our friends at the ‘Berg is it indicates that rising state intervention in the economy by the Chinese state in the Xi era is not creating a more efficient economy. Or at least in all sectors. Something to keep in mind as we watch China, Japan, the United States, and other powers in the region step closer and closer to one another.

The LLM paper wars continue

Remember that Apple AI paper showing that ‘reasoning’ LLMs failed simple logic tests past a certain point of complexity? The gist of the document was that while LLMs that think more were better than their non-reasoning peers at medium-complexity puzzles, they showed a similar ‘collapse’ in solving abilities past a certain threshold.

A new paper argues that Apple’s

central finding—that model accuracy ”collapses” to zero beyond certain complexity thresholds—has significant implications for AI reasoning research. However, our analysis reveals that these apparent failures stem from experimental/design choices rather than inherent model limitations.

The document is short, so I encourage you to read it yourself. I am not certain that it answers all of Apple’s points; but it is worth noting that testing LLMs — something that Cupertino pointed out is an issue by raising the risk of contaminated measurement of LLMs — is proving tricky to do. Keep that in mind when you check the stat sheet of the marginal foundation AI model that claims top marks across every known benchmark.

MetaScale

As expected, the massive Meta-Scale deal has been consummated. The $14.3 billion transaction will earn Meta a 49% stake in Scale itself, and the social media giant will absorb Scale AI CEO Alexandr Wang as part of the transaction. Notably, Scale AI will now feature neither of its founders in operational roles, after co-founder Lucy Guo was reportedly fired from the company back in 2018.

According to Wang, he’s not the only personnel transfer constituent to the megadeal. He’s leaving, Wang said in a note to his team that he shared publicly, along with “a few other Scaliens.”

The New York Times points out that the Scale deal is the first time Meta made a large minority investment in another company; the deal, however, appears to be more takeover than strategic check. The 49% ownership threshold and CEO nabbing appear designed to avoid regulatory oversight. Given that Meta remains unpopular with many legislators in both major American political parties, you get why.

For Meta, the question is now what it can get out of the deal. The company’s official verbiage is that he deal will “deepen the work [Meta and Scale do] together producing data for A.I. models, and Alexandr Wang will join Meta to work on our superintelligence efforts.” The contextual overlay here is Meta’s current efforts to greatly bolster its internal human AI talent at huge cash cost to help it — ahem — scale its internal operations.

After the somewhat public flop of Meta’s early Llama 4 AI model cohort, the company had to rejigger its approach. After all, if you spend tens of billions on chips, and billions more on people and training costs to build an open-source model only to fall behind commercial competition, well, you might have spent a lot of money doing little.

Now Meta has spent even more money, wagering that it can in fact keep up. Godspeed, Zuck and company. I’m pulling for you to do well as competition leads to better products and faster development. But not everyone is stoked about the deal. Meta shares are off about as much as the Nasdaq this morning, implying either public market neutrality or simply comprehension that nothing Meta is doing at present will impact its near-term operating results. Too much, at least.

Stablecoin watch

Closing out 2024, these pages argued that we’re heading into a boom-era for stablecoins. Little did we know just how true point would prove, and how quickly. The latest from the Journal:

Walmart, Amazon.com and other multinational giants have recently explored whether to issue their own stablecoins in the U.S., according to people familiar with the matter.

Expedia Group and other large companies such as airlines have also discussed potential efforts to issue stablecoins, some of the people said.

Those names matter, thanks to their incredible revenue base. In their last reported quarters, Amazon had revenues of $155.7 billion, Walmart $165.6 billion, and about $3 billion more. North of $1.2 trillion in annualized revenue exploring stables is incredibly cool.

I would be surprised if Amazon launched a consumer-friendly AmazonUSD coin, or anything similar from the other companies in question. But wallets that are non-crypto branded and hold stables for super low-cost consumer purchases? Yeah, I can see that.

Meta just bought 49% of Scale AI.

Alexandr Wang is building Superintelligence – but for who?

I wrote a warning piece on this. No fear, no hype. Just clarity.

👉 https://substack.com/@marcokindermann/note/c-125713768?r=5srf8x&utm_medium=ios&utm_source=notes-share-action

#Superintelligence #Meta #ScaleAI #WeAreNotData