The tech infighting is bringing the AI doomers back

Also: The sports betting-prediction market crossover

Welcome to Cautious Optimism, a newsletter on tech, business and power.

Wednesday! One way to avoid being the one holding the AI bag is to simply hand the risk to a partner. See Meta’s recent deal with investment firm Blue Owl: The social giant gets $3 billion back from its investment, and 20% equity in the eventual two-gigawatt data center. Blue Owl, in contrast, has to kick in $7 billion in cash. Meta does have long-term commitments, but still, it’s a hell of a deal. To work! — Alex

📈 Trending Up: Crypto consolidation … corporate myopia … the best and brightest … measles … corruption … browser competition … U.S.-India relations … smart glasses … AI model infra

📉 Trending Down: Consumer wealth … common sense … American chip dominance … USA-Russia relations … AI gigs? … GPU dominance?

Things That Matter

What stage of the bubble is this? It’s a great time in bitcoin blockchain web3 crypto. Stablecoins are spurring interest in decentralized finance from traditional financial institutions and digital-first players alike, and enthusiasm for investing in digital assets is so high that companies are racing to follow in the footsteps of Microstrategy.

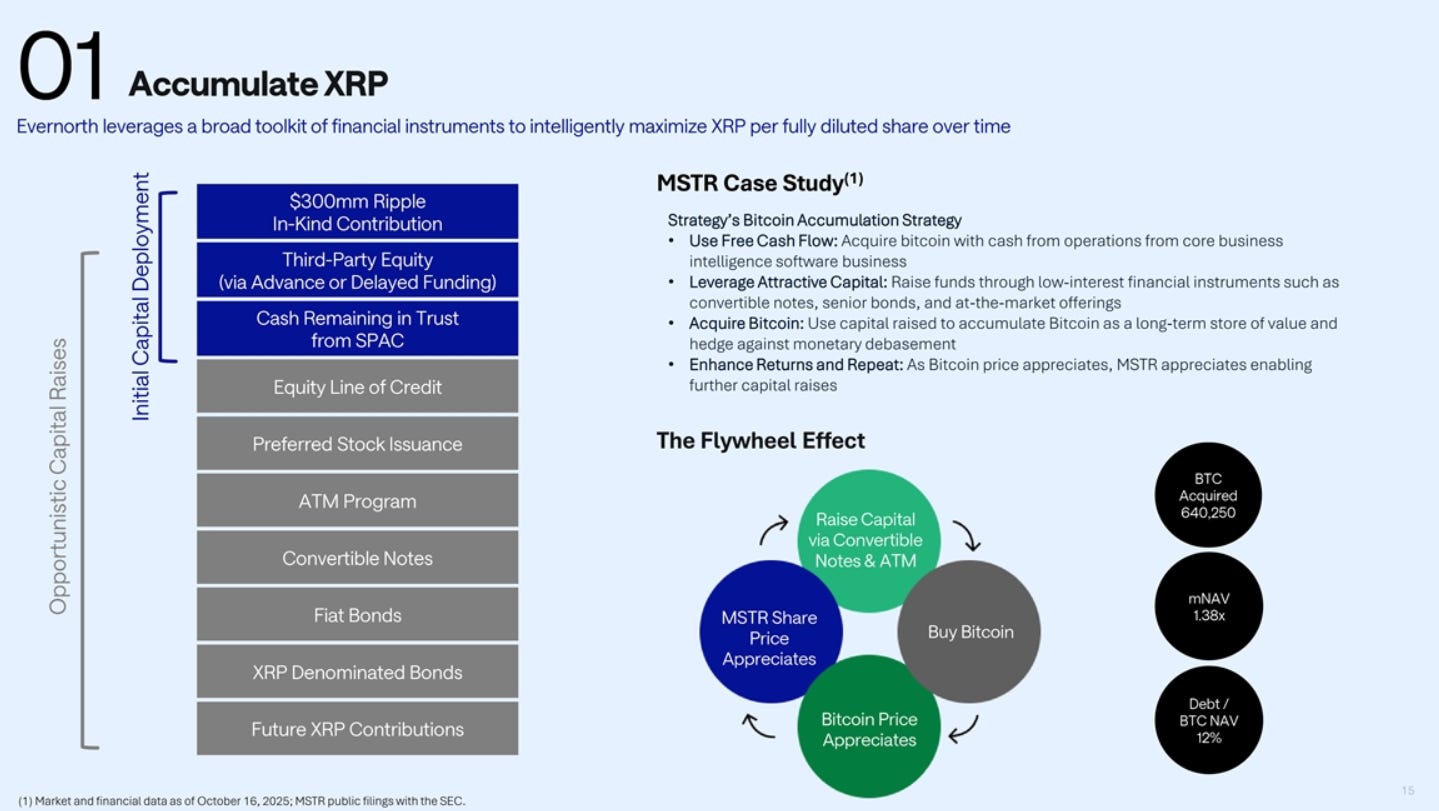

Now known as “Strategy,” Microstrategy is a ‘bitcoin treasury’ company. It raises money, purchases Bitcoin, and repeats the feat as the value of the cryptocurrency rises. It’s not clear what would happen if the value of its selected token falls sharply.

If I squint and tilt my head, I can almost see why some tech companies are adding a little bitcoin to their balance sheets. It’s perhaps good sense to have slight exposure to an asset that may perform well if your other holdings tank, but building entire companies around the concept seems like financial engineering built atop an asset that is very easy to purchase and hold. What’s the point?

Besides bitcoin, there are similar efforts to buy and hold ether (Ethereum’s token), and even sol (Solana’s token). Now a SPAC wants to take an XRP treasury entity public. Evernorth intends to merge with Armada Acquisition Corp II and raise funds to buy a huge amount of the digital token.

The investor deck cites Reddit community subscriber counts for XRP-related forums, which is a sly way of saying, “There are a lot of suckers who might think that buying a holding company to hold the asset they already hold is the best financial innovation since double-entry bookkeeping.” Anyway, the Evernorth folks are not even trying to say that this isn’t a pump scheme. Just look at this chart explaining how Strategy did it:

Naturally, the company behind XRP (Ripple) is putting some cash in, because it would love to see the value of its token rise. But if you really do believe in XRP, maybe just buy it instead of handing your money to a SPAC to buy and hold it for you?

Meanwhile, Coinbase just bought its eighth known company this year, snapping up Echo for $375 million.

I predict competition: Prediction markets Kalshi and Polymarket are explained by sports betting (the fact that folks will wager on any damn thing if they can do it from their phones) and wealth disparity (you’re never going to get rich through your job so you need to gamble your way up). The same trends bolstering sports betting are driving consumer interest in prediction markets (which are effectively binary options).

But because they are marketed as predictions and not options, folks aren’t scared; instead, they’re getting busy with their wallets. So much so that VCs invested $185 million into Kalshi in June, and another $300 million in October. Polymarket raised up to $2 billion from the parent company of the NYSE this month as well.

The sports betting-prediction market crossover is huge; the NHL just signed deals with both Kalshi and Polymarket. So it’s not a surprise that DraftKings, a massive sportsbook, is also getting in on the fun. Yesterday, DraftKings purchased predictions platform Railbird “as it prepares to launch a mobile platform in the coming months to be called DraftKings Predictions.”

Because what we need is more trading, not more economically productive work.

Perhaps post-AGI, UBI will just wager credits from a central vault, with our future GodKingAI as the house?

The infighting is bringing the AI doomers back

While we were discussing how AI model giant Anthropic was being criticized by the Trump administration’s David Sacks, the company was preparing its own response. Anthropic CEO Dario Amodei wrote that despite his company’s “track record of communicating frequently and transparently” about its outlook, there’s been a recent uptick in “inaccurate claims about Anthropic’s policy stances.”