Trump hits out at Harvard, might smack VCs instead

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Happy Friday! This morning's biggest news is that job growth in the United States this April was stronger than early ADP numbers indicated. The BLS reported today that April saw +177,000 jobs in the USA, a higher figure than predicted. Stocks in the United States are up on the news, following a day in the green around the world.

Today, despite a massive news deluge, we’re focusing on the impacts of Apple’s court loss, why POTUS is going after higher-ed could harm venture capitalists, and Reddit’s search wager. To work! — Alex

📈 Trending Up: Tariff impacts on tech earnings … legal pollution … tech companies going all in on AI … corruption … Twilio’s stock, after earnings …

📉 Trending Down: My belief that this is real, even if I want it to be … TikTok data security … the era of passwords … digital media … Apple’s stock after earnings … Amazon’s stock after earnings …

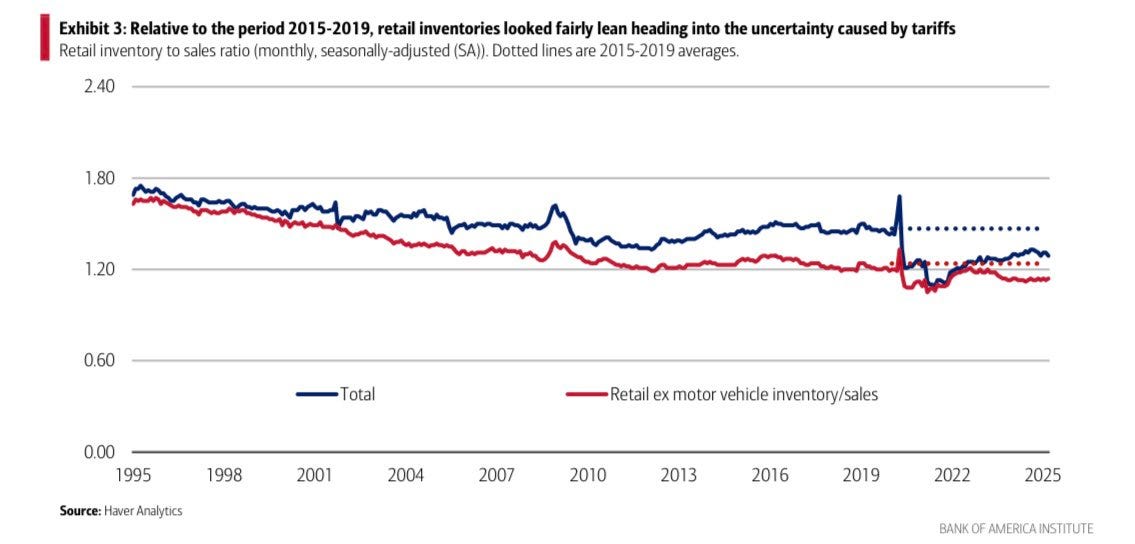

📊 Chart of the Day, via Tolou Capital Management’s Spencer Hakimian:

Apple finally loosens its grip on the App Store

Back in 2024, Apple was told by domestic courts to allow app developers to send customers to the web and use their own payment technology. Apple, in an apparent fit of pique, decided to slap a 27% charge on developers who sent customers to other, non-Apple-controlled payment portals. At the time, I felt that the move was a pretty insincere interpretation of the case at hand, writing the following in a piece entitled “I’m sorry but you owe me 27% because I said so:”

The courts agree, it turns out. Apple got whacked by a judge over its post-injunction behavior:

Hot damn.

As a result of its stinging public rebuke, Apple has turned on its heel and followed the judge’s ruling that “Effective immediately Apple will no longer impede developers’ ability to communicate with users nor will they levy or impose a new commission on off-app purchases.”

It’s a huge win for developers. Now, devs can build an app, promote it on iOS, and, if they choose, avoid paying Apple a 30% or 27% cut of their income. This means that building on iOS is now more profitable than ever. In turn, the change means that startups building apps that distribute on Apple’s mobile application marketplace are now more attractive to build and fund.

We all own Apple shares in our 401ks thanks to index funds and similar investing vehicles, but I think we can all afford a haircut on the implied worth of our slice of Cupertino’s future cash flows to allow a more flourishing, fair, and hopefully lucrative developer landscape here in the States.

Spotify and Patreon are already taking advantage of the change, as is Epic Games, the company that brought the original suit.

Trump hits out at Harvard, might smack VCs instead

Attacks against higher education by POTUS — sitting neatly next to his war on media — has reached a new high watermark, with the President indicating that he intends to strip Harvard of its tax-exempt status.

I don’t pretend to understand the legal nuance here, or even if the President has that authority. But what I do know is that university endowments are important backers of venture capital funds. For example, here’s the Harvard endowment fiscal 2024 asset allocation:

Keep in mind that venture lands under the larger private equity umbrella, meaning that it and its larger PE sibling command a huge portion of Harvard’s more than $50 billion endowment.

So, what happens when higher education finds itself under the boot of a President who views academic freedom and a woke inconvenience? The money tap from universities to private equity shops and venture funds slows. Here’s one venture capitalist:

You have to applaud the venture folks who backed Trump. He’s brought back IPOs, changed the FTC’s posture against big tech power, boosted the stock market, brought new regulatory clarity to key sectors, opened new trade avenues for domestic companies to sell abroad, and worked to ensure that capital flows from savings to investment so that we can continue to invent the future.

I’m kidding, he’s done the opposite of each of those things. Viva la Musk-a16z administration.

Reddit’s search bet

Reddit is a weird company. You can think of it in a few different ways:

Reddit is a social media company, and thus should be valued on the worth of its advertising business.

Reddit is a data company, and thus should be valued on the worth of its stored user interactions which it can sell or rent to other companies like AI foundation model concerns.

Reddit is a search company, and thus should be valued on its ability to monetize search activity that it originates.

The first two perspectives are simple. The first is simply what Reddit has been. The latter a new chapter for the forum collective, thanks to deals with companies to license its data for their use in AI training.

Option three is different. Reddit today makes a lot of money thanks to Google users preferring its links when searching. As a result of humans choosing putatively human-created information over other sources, Reddit gets to sell a lot of ads. And sell a lot of data to other companies.

But search, that’s a weird one. Is Reddit a search company? Yes, if a small one. Recall that Reddit rolled out Reddit Answers last year. At the time, the move felt like a small step towards Reddit getting its users to search inside of its service, instead of using third-party search results to bring people to its platform.

There it is. Reddit, seemingly confident in its own AI-powered search/Q&A service, is expanding its footprint. Good.

The more search competition the better. Google vs. OpenAI vs. Reddit vs. Perplexity sounds like a lot more fun than watching Google decay in front of our eyes while we gnash our teeth and accomplish nothing.