When AWS eats dirt, the internet does too

Also: The AI transition is better for private companies

Welcome to Cautious Optimism, a newsletter on tech, business and power.

Monday! After a call with Putin, the United States’ president has once again decided that Ukraine needs to capitulate and let Russia take part of its land. That’s an about-turn from his last position, which was a turn about from whatever he had thought before. It appears that the leader of the free world is susceptible to what we call speech play in the poker world. But, at least the stock market is rising this morning. To work! — Alex

📈 Trending Up: Maths … Starlink, now with 10,000 satellites launched … OK, it’s a bubble … student journalism … product updates (?) at X (?) … AI in the medical world

📉 Trending Down: Data center popularity … U.S.-India relations … the Gaza ceasefire … political violence … the government shutdown?

Things That Matter

AWS ate dirt: Despite concerns that Amazon was falling behind its traditional (Azure, Google Cloud) and upstart (CoreWeave, etc) rivals in the AI compute race, the company’s AWS service remains a pillar of the global Internet. So when AWS hit a wall overnight, everything from Snap to Canva to Delta to Fortnite to banks in the U.K. went down.

What happened? Amazon says it was an issue “related to DNS resolution of the DynamoDB API endpoint in US-EAST-1” at 5:01 AM ET. Something off was first noted at around 3 in the morning, and by eight, Amazon was still working to “fully restore new EC2 launches in US-EAST-1.”

The US-EAST-1 region is kind of a big deal. It was the first AWS region, it’s quick and cheap, and it regularly receives service updates first. If you want the latest from AWS, US-EAST-1 is a pretty good bet. And, as one on Hacker News put it, “Choosing us-east-1 as your primary region is good, because when you’re down, everybody’s down, too. You don’t get this luxury with other US regions!”

The global Internet is, one might say, too reliant on a single AWS region. So when it does, Amazon looks mighty silly. That’s good news for Microsoft, though.

It makes for jokes, too.

Updates from China: It appears that some of the Chinese economy is slowing down more than earlier. Fixed asset investment rose 4.8% in the third quarter (per the CCP’s National Bureau of Statistics), but “unexpectedly contracted 0.5% in the first nine months of the year,” CNBC reports. Property investments are decelerating, too.

Remember when the Dutch government took control of Nexperia? The United States said it was unhappy with the chip manufacturer (with roots in Europe and facilities in China) being owned by a Chinese entity and having a Chinese CEO, and it was at risk of being blacklisted due to recent rule changes stateside.

The company’s now in a mess. Its China operations are either operating as a new, rebel entity, or still part of the larger Nexperia corporate roster. And reports unveil another reason for the row: Nexperia was supposedly set to move its manufacturing to China, depriving the EU of a domestic chip maker.

Chips really are the new oil — at least in their ability to destabilize global relations.

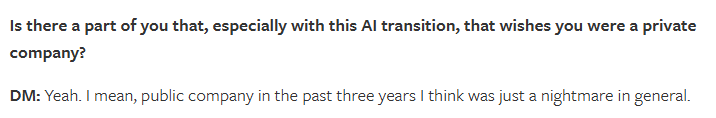

Quote of the Day, from this interview of Dustin Moskovitz (Asana’s co-founder and chairman) with Ben Thompson (Stratechery):

One can understand why Moskovitz is less than enthused with his company’s public life. The productivity software maker saw its shares soar to more than $140 per share in November of 2021, but it’s today trading at $13.94 per share, good for about $3.3 billion worth of market cap. Why the decline? Apart from the overall market’s performance since those rosy days, Asana’s revenue rose just 10% in its most recent quarter, and it forecast about 8% growth in its current quarter. It is rolling out new AI tools, however, which may be able to help get that line going the right way again. (I met Moskovitz once; he seemed rather kind.)

The other data center boom

When Astera Labs last raised a venture round, Fidelity, Sutter Hill Ventures, Intel Capital and others gave it $150 million at a $3.2 billion post-money valuation in 2022. And when it went public in 2024, its first day of trading saw its valuation soar to nearly $9 billion.

Does Astera make foundation models? No. Is it a competitor to Nvidia that could scoop part of the global compute market? No. A vibe-coding service? No. It makes connectivity gear for data centers, and by the time it went public, its finances were on the up.

As I reported for TechCrunch at the time (emphasis mine):

On its 2022 $79.9 million in revenue, it posted a net loss of $58.3 million; on its 2023 $115.8 million in revenue, net loss tallied $26.3 million. […] But when we dig in, its financial success becomes more nuanced. In the third quarter of 2023, Astera Labs’ revenue began growing dramatically: from $10.7 million in Q2 2023 to $36.9 million in Q3, and $50.5 million in Q4.

And while that spike in growth is impressive on its own, the company’s profitability picture also radically improved as 2023 came to a close. After posting a net loss of $20.0 million in Q2 2023, net loss evaporated to a mere $3.1 million in Q3 2023. And for Q4, Astera Labs swung to a profit: $14.3 million worth of net income.

Today, Astera is worth $26.5 billion, and posted revenue of $191.9 million (+150% YoY) along with a fat 21% GAAP operating margin in its most recent quarter. Hell yeah.

But it’s not the only company benefiting from the data center boom. Besides Nvidia, the companies involved in gigawatt buildouts, or the AI giants and their vendors, a host of other companies are stuffing themselves from the same table. And they are goddamn impressive.

CNBC has a profile on Credo, which makes ‘active electrical cables,’ or AECs. These cables have little chips that clean up the signal, enabling data to be transferred further than direct attach cables (DACs). As the publication notes, if you peek at photos of data centers, you will see miles of AEC, and that is sending Credo’s revenues soaring.

Astera’s revenue increased 20% in its most recent quarter compared to the three months that preceded it. Credo, meanwhile, saw its revenue soar 31% from one quarter to the next, and 274% from a year earlier. And like Astera, the company is profitable on GAAP basis.

Arista Networks’ quick Ethernet switches are flying off the shelves thanks partly to increasing data center demand. Before ChatGPT, its stock was trading around $23, rose slightly to the low $30s after the big AI wave struck, and is now at $143 today. PureStorage has also been on a tear in recent years.

Why am I laying all that out? Not to merely make you wish you had backed these companies years ago, I promise. No, I want to underscore that the list of businesses benefiting from the global AI race is a lot longer than many folks think.

And as you and I hold a basket of stocks in our various index funds, we’re exposed to quite a number of companies that are currently trading high on the bet that demand for AI compute will continue to soar.

That’s understating the case. Lots of pooled money in the form of endowments, pension funds and similar has been invested into private-market funds that are also betting on AI. This exposure is not modest in terms of risk to regular folks.

Sure, you or I won’t get cut if Amazon finds a new way to hire even fewer developers. But if the AI train hits a demand pothole, some of the more basic institutions we trust to have money could become a lot poorer. There’s something to keep you up tonight. You’re welcome!