Why OpenAI wants a piece of AMD

Also: The inflation tinnitus is back

Welcome to Cautious Optimism, a newsletter on tech, business and power.

Monday! The U.S. government remains shut down. The stock markets are confused in Europe and Asia, but are rising this morning stateside. Here’s our economic calendar for the week. With that, let’s get to work! — Alex

📈 Trending Up: The impact of tariffs … Chinese energy exports … measles … xAI’s GPU buys … European data centers … Big Brother … the race to snap up talent … US investment into European compute … Anthropic-California relations … Chinese support for the Russian war machine … Polish GDP … CCP meddling in the Philippines

Fundraise of the Day: The brilliant Anna Heim covered Polars’ $21 million fundraise for TechCrunch. The startup was formed around the founders’ Polars open source project, and offers a hosted version of the tool for a fee. Hosted access to open-source code is one of my favorite business models, and the fact that Polars is European makes this even more interesting.

📉 Trending Down: The French government … data security … funding for anything that’s not AI … Apple-EU relations … data center investment in India?

Things That Matter

Picks and shovels: With OpenAI poised to pick up a stake in AMD (details below), Nvidia rocking the world’s largest market cap, and the ChatGPT developer becoming the most valuable private company, it’s a great time to sell AI and the gear that makes it tick.

But there are a host of other companies to keep in mind when we talk about the shovels and picks AI concerns need to do their work. Astera Labs’ (data center connectivity) revenue is still increasing 20% every quarter despite rising 150% from last year. Broadcom (data center networking) saw its AI revenue soar 63% in its most recent quarter, and it is projecting fat revenue gains in the third quarter as well. Marvell (data center networking) posted a 58% rise in revenue its recent quarter thanks to “strong AI demand for [its] custom silicon and electro-optics products.” The list goes on.

Why bring all that up? The number of companies currently eating well off the AI table is pretty damn huge. So if the AI bandwagon hits a pothole, it won’t harm just the companies investing in data centers; the firms the hyperscalers are buying would also eat their own shoes. That means the stock market is currently incredibly responsive to AI demand (as exemplified by AMD’s stock today — see below).

Cross your fingers, because your investment accounts are currently valued as if the AI wagon will simply sail over any and all speed bumps.

It’s getting worse: The Federal government is trying to send the military to cities in states where POTUS did not win. It’s being blocked somewhat, but the administration is trying to find a legal-ish way to enforce more control on the nation.

Senior White House staffer Stephen Miller is fomenting against his political opposition, claiming that they support domestic terrorism (he’s done it twice now). He’s arguing that political and legal opposition to the President is a violation of the Constitution, and calls rulings by judges that he disagrees with “legal insurrection” akin to a “terrorist attack.”

In a recent speech to the military, POTUS called the rival political party “gnats” to be brushed off.

Meanwhile, Elon Musk wants to decapitate the judicial branch of the government, and a judge who ruled against the administration may have had their house bombed.

I bring all this up to point out that we’re less than a year into the second Trump term, and his staff already wants to use the military to debase states that didn’t support him — as part of a wider toolset. We’re also seeing normal political activity reframed as terrorism. Complaints about the use of the term “fascism” are falling in the face of calls by key administration members to crush counterweights to their power and use the military as a cudgel.

This is the bad stuff. Miller’s rhetoric is heating up, and the administration is only becoming bolder in its attempts to use force to criminalize any opposition. (If you haven’t, it’s time to read up on NSPM-7.)

This would be a great moment for business leaders to stand up and provide an extra counterweight to civic groups that are trying to stem the tide. We’re waiting.

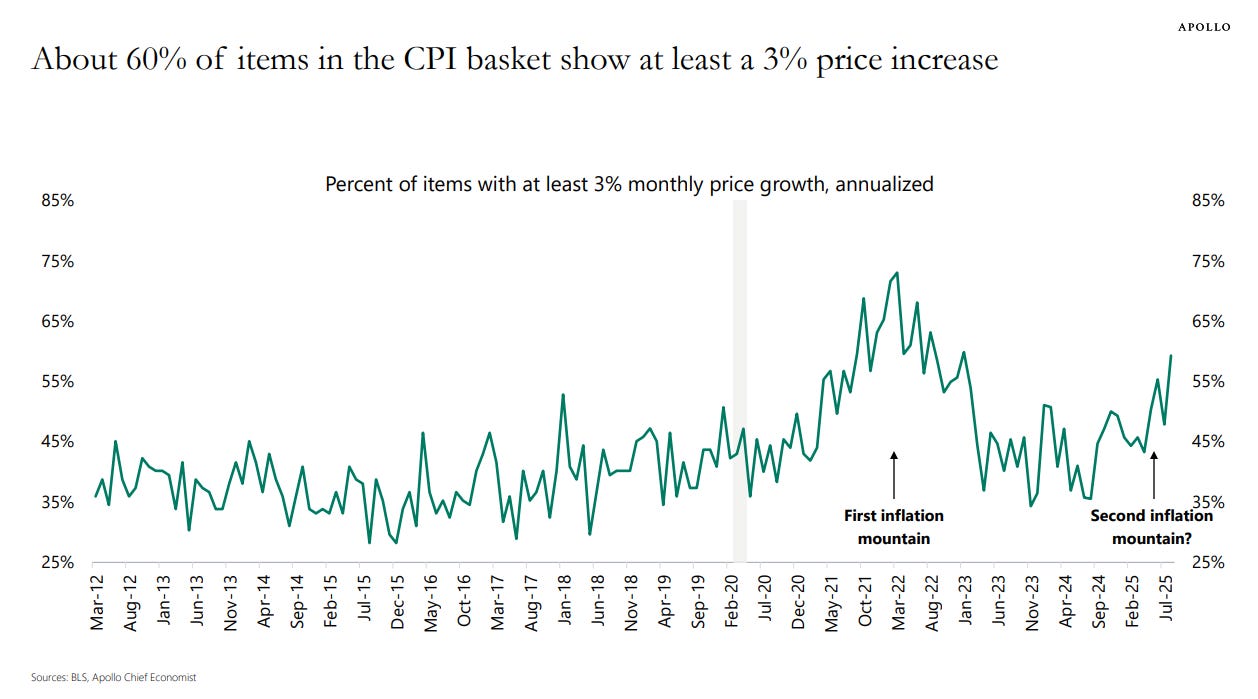

An inflation warning: From Apollo Global Management’s economics department, the following chart:

As we might expect to see in a world with rising import taxes, prices in the States are climbing. If you were hoping for a series of dramatic interest rate cuts, sit down until inflation does the same.

Why OpenAI wants a piece of AMD

Back on happier shores, the new OpenAI-AMD partnership is today’s biggest story in both the business and technology spaces.

The deal will work like this:

AMD will supply OpenAI with up to six gigawatts worth of GPUs, and the first gigawatt “deployment of AMD Instinct MI450 GPUs” is set to commence in the second half of 2026.

To make the build work, AMD and OpenAI will share “technical expertise to optimize their product roadmaps” and deepen the two companies’ “multi-generational hardware and software collaboration.”

AMD name-checked OpenAI and claimed a “close partnership” back in June; this is not a new relationship.

As part of deal, the chip giant has given OpenAI a warrant for up to 160 million shares of its common stock that will vest in steps:

The first tranche will vest “with the initial 1 gigawatt deployment”

Later tranches will vest as “purchases scale up to 6 gigawatts”

If our read of the relevant SEC filings is correct, OpenAI will be able to purchase AMD stock for around $0.01 per share.

There are other terms, and the vesting is partially tied to “AMD achieving certain share-price targets and to OpenAI achieving the technical and commercial milestones required to enable AMD deployments at scale.”

If everything goes as planned, OpenAI may eventually own around 10% of AMD.

To sum, OpenAI is tapping AMD for generations of GPU purchases, working with it on a technical level and earning the chance to purchase shares for nearly zero dollars. Shares of AMD were up more than 37% this morning.

The deal is a win for OpenAI — provided it does need all the GPUs it’s buying. The company’s Stargate project is trying to build a global compute base of unprecedented scale, and understandably includes partners from across the board: Oracle, SoftBank, Arm, Microsoft, Nvidia, Samsung and even SK Group. The AI giant has marshaled much of the tech world to support its work and is only roping in more partners.

But why AMD? Why not try to get more allocation, and perhaps equity, from Nvidia?

Every tech company wants Nvidia chips. It’s probably easier to get a big order from the much smaller AMD (its share of the data center GPU market was in the single digits early this year).

AMD’s upcoming MI450 GPU is supposed to be very good. The chip company is claiming it will best what Nvidia has on offer.

Nvidia is too costly to acquire a meaningful stake in via GPU purchases, whereas AMD is worth a few hundred billion (about half of OpenAI itself). That means OpenAI’s GPU purchases matter more to AMD than they would to Nvidia, which lets the AI company get cheap warrants.

Mix in the fact that OpenAI is supposed to be working on its own chips (how that effort is progressing isn’t entirely clear), and you can see how having a good share of AMD just makes sense. Why not own part of a GPU company if you depend on GPUs?

The flip side of all the above is that a lot of the AI demand that OpenAI is racing to fill doesn’t currently make money. In a personal blog post discussing the launch of OpenAI’s Sora app and the company’s moves to sort out IP issues, Sam Altman wrote:

[W]e are going to have to somehow make money for video generation. People are generating much more than we expected per user, and a lot of videos are being generated for very small audiences. We are going to try sharing some of this revenue with rightsholders who want their characters generated by users. The exact model will take some trial and error to figure out, but we plan to start very soon. Our hope is that the new kind of engagement is even more valuable than the revenue share, but of course we we want both to be valuable.

In English: OpenAI’s GPUs are straining under massive demand as people create content that doesn’t make the AI company much money. That’s a recipe for losses and burn, which makes more multi-gigawatt GPU purchases seem somewhat risky. Why spend money you don’t have to meet demand that loses you money?

Lots of smart folks are betting that OpenAI will figure out how to monetize video (see: the recent investor group that snapped up $6.6 billion worth of OpenAI shares at a $500 billion valuation) and much more to boot. AMD is also hoping its future major shareholder could prove a life-changing customer.

Yes, OpenAI has so far managed to wow the world with its tech and revenue growth, but we’re only so far along into the firm’s master plan to build the business it will need to grow into its cost and compute footprint.

It’s getting a little tedious worrying about AI excess while the market continues to lever up. Someone is right; someone is wrong. And since, I presume, Dear Reader, that we are both index fund types, we’re along for the ride. I just don’t want to break out the vomit baggies before we’re done going up, and perhaps down, too.