Why software is melting down

And a few notes on VCs going hard-right

Welcome back to Cautious Optimism. Today is May 31st, 2024. Today we’re looking at a selloff in software shares, a hot AI round and why it (kinda) makes sense, and the rightward drift of many venture investors.

You can also now support Cautious Optimism with money if you want. I’ve had people ask when that would happen. Now, if you are so inclined. To work! — Alex

Trending Up: Scrutiny of Temu in the EU … shares of Trump Media and Technology Group … sales of anti-obesity drugs … wealthy folks investing in future tax cuts … the chance of a rate cut before the heat death of the universe

Trending Down: Stripe’s ambitions in India … former presidents not being felons … venture capital inflows … software (more below) … Intuit, at last .. the idea that ByteDance can’t create a separate algo for TikTok … free speech

The software meltdown

A host of software companies got whacked by the public markets this week. Salesforce is off 24% in the last five trading days, UiPath down some 40%, and MongoDB was just 16% lower over the same timeframe, but is off another 24% in pre-market trading this morning.

What is going on? Poor guidance. Here’s what you need to know:

MongoDB: “MongoDB stock sank as much as 26% in extended trading on Thursday after the database software maker issued light guidance for the quarter and reduced its forecast for the full fiscal year.” The company beat Q1 expectations.

UiPath: “The company lowered its guidance for full-year revenue. It now expects revenue to fall between $1.405 billion and $1.41 billion, compared to its prior-quarter guidance of $1.55 billion to $1.56 billion.” The company beat Q1 expectations.

Salesforce: “Salesforce shares plummeted as much as 17% in extended trading on Wednesday after the cloud software vendor reported weaker-than-expected revenue and issued guidance that trailed Wall Street’s expectations.” Salesforce beat profit expectations in Q1, but missed revenue estimates.

Wall Street cares a lot more about what tech shops see in the future than what they are reporting from their recent past. The companies were headline material for Twitter — Jason Lemkin here — but not the full story. Bank of America noted that yesterday “software had worst move vs $QQQ in 10 years,” which is not so good.

In fact, it’s worse than not good. Things are bleak. Here’s Altimeter’s Jamin Ball this morning:

Software sentiment is incredibly low at the moment - and rightfully so. Q1 earnings have been a disaster, and they’ve gotten worse as companies with April quarters started reporting. Nearly 70% of software companies who reported Q1 with an April quarter end guided Q2 below consensus!

What is going on? Views vary. Inevitability Research’s Sophie joked that it “only took public markets 18 months to realize technology that reduces the marginal cost of creating code to almost zero isn’t great for software companies.” That’s a 10/10 tweet.

More seriously, it seems that companies trimming staff and looking to keep costs low have kneecapped software growth. With many public software companies not precisely kicking off the sort of cash that slow top-line expansion requires for value preservation, well, it’s bad out there.

Cautious Optimism: Software will continue to be valuable and offer the bulk of private-market investment opportunities. In fact, venture investors can now likely get into non-AI deals at lower price points. So long as the value of software companies regains some of its vigor in time, things will turn out just fine. For now, however, the dive in the value of many tech companies probably means the IPO window is inching down and is closing. Not that many tech companies made it out while it was clearly open. Whoops.

There’s no ceiling for AI companies

The Information’s Kate Clark reports that Perplexity AI, a search startup, is chatting with investors to raise new capital at a ~$3 billion valuation after crossing $20 million worth of annual recurring revenue. That’s a 150x ARR multiple, which is rich, but not entirely insane.

The logic goes as follows: Search is a massive market that creates trillion-dollar companies; Google search was getting worse pre-AI, and now post-AI appears wounded, so there is a real chance for a startup to secure material search share; Perplexity has demonstrated an ability to execute and monetize its own AI search product. Ergo, fire capital into it and hope it becomes the next Google, and everyone forgets that you paid triple-digit multiples for shares in a startup when the public markets are valuing cloud companies at 6.5x revenue.

As far as adventurous bets go, this is certainly venture capital.

This will end poorly

Former President Trump was convicted on 34 felony counts this week. As Hannah Gais said, “you just can't falsify multiple business documents anymore due to woke.”

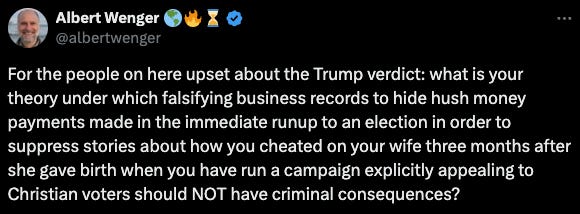

A lot of venture capital folks are annoyed by the unanimous jury verdict. Mike Solana, Shaun Maguire, David Sacks, to pick a few examples. Not all venture investors are publicly attacking the justice system, and defending fraud. Here’s Union Square’s Albert Wenger:

And Ryan Floyd from Storm Ventures:

As we’ve noted, the rightward lurch of many wealthy folks in technology circles is real. It’s also accelerating. Ackman is going Trump, Musk is going Trump, and so forth.

Call me crazy, but I remain firmly in favor of things like equal rights for our gay brothers and sisters, access to abortion, free speech, a secular government, having a functional set of policy actions on climate change, and so forth. A quick perusal of Project 2025 — the conservative group project that promulgated a roadmap designed to help Trump kick off his second term — makes it clear that those things are anathema to the current Republican party. Which many VCs are investing in.

Let’s hone in on a single issue for fun. Free speech. Everyone likes to talk about it. Few actually support it. Trump and his party do not. For example, during the campus protests concerning the Israel-Hamas war, Trump told donors that “one thing I do is, any student that protests, I throw them out of the country.” That’s not very free speech-y. Trump also wants to weaken the free press by making it easier for wealthy antagonists to drain their financial resources.

And Project 2025 imagines a very different Internet. It wants to ban porn, for example, leading to a lot of fun questions regarding what would count and what doesn’t. Surely, allowing the federal government to make that decision will be unproblematic.

With the next president expected to get a few Supreme Court nominees and Trump’s history of nominations thereof, we should expect a far more censored Internet than what we are accustomed to today if he returns to the White House.

Project 2025 also takes shots at Section 230 of the Communications Decency Act. Which, recall, allows online platforms to moderate speech on their own platforms. Something that a great host of tech companies — and their backers! — depend on for normal business operations. It’s their own speech, and Trump’s backers are salivating at the chance to limit it.

Throw in the fact that Trump is openly willing to reverse modest energy and climate policies in exchange for donations, you have to wonder why the folks busy investing in the future are tripping over themselves to support a regressive, wannabe autocrat who has no interest in democracy past it being a path to power. And who doesn’t like electric cars or windmills.

What has fueled historically American dynamism? Democracy, immigration, capitalism, a secular government, and lots of room to tinker. You don’t get those things by backing the chosen acolyte of Christian nationalists who want to roll back the clock and center their religion and religious views in personal and public life at the expense — and detriment — of the rest of us.