Figma’s IPO range is a little light

And AI remains a grueling sprint

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Tuesday! It’s my birthday today, which I plan to celebrate by overeating cake after dinner. Don’t call, I’ll be snoozing on the couch. Hell yeah, turning 36.

Today we’re mostly looking at IPOs, but it’s worth keeping an eye on the latest from AI land.

To wit, Anthropic is considering raising capital from the Middle East, which means that a portion of its future valuation gains could accrete to regimes with spotty humans rights records. The company appears more capital hungry than it is concerned with shedding some staff or going back on some of its public statements. And while Anthropic considers its chip needs, OpenAI’s massive Stargate effort with SoftBank is struggling “to get off the ground and has sharply scaled back its near-term plans,” per the Journal. That OpenAI announced a huge partnership with Oracle — 4.5 gigawatts worth of data center — today that it is shuffling under the Stargate moniker says much.

But apart from the intra-corporate wrangling, it appears that the AI race is much as it has been. Models from OpenAI, Anthropic, and Google dominate public leaderboards, more funds are needed, and the race to build ever-larger digital brains remains a grueling endurance sprint. — Alex

📈 Trending Up: Cross-pacific trade … calls for Fed independence … the price of tax cuts … AI policy? … Ashby … Inforcer … math wars … European technology independence …

📉 Trending Down: Economic sentiment? … US-EU relations … African exports … India-EU relations … population trends in Ohio, Oklahoma …

Tariff Watch

After Stellantis reported hundreds of millions of dollars worth of tariff-related costs in the first half of 2025 — referred to as the “early effects of US tariffs” in its release — GM said in its Q2 results that its expectation of a $4 to $5 billion tariff impact remained unchanged, including a “$1.1B net [tariff] impact in Q2, reflecting minimal mitigation offsets.”

Elsewhere reporting is starting to track rising prices on consumer goods at retailers like Amazon. In other words, the recent, mild gain in inflation we saw in June could continue to accelerate in July.

CO has wondered out loud when the impact of tariffs would start to show up more concretely in domestic economic and business results. The answer appears to be increasingly now.

Figma’s IPO range is a little light

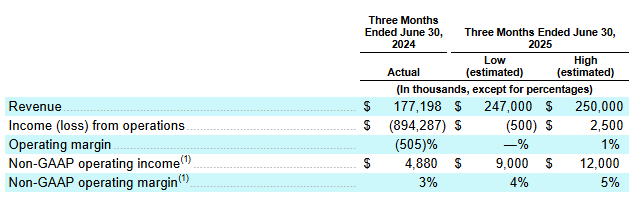

Yesterday Figma dropped an S-1/A filing, indicating a $25 to $28 per-share IPO price range. The first interval gives the company a midpoint valuation (fully-diluted) of $15.9 billion. That’s comfortably ahead of the $12.5 billion price that the company allowed some shareholders to cash at out last year, but below the $20 billion value that Adobe wanted to pay for the company a few years back.

Our deeper look into Figma’s IPO filing is here. TechCrunch’s Julie Bort has a good look at how many shares in the company’s IPO are new, or already held, here.

With Q2 revenue at the online design unicorn coming in at around $250 million per the latest filing, Figma is on a $1.0 billion run rate as of the second quarter. The question before us is whether or not Figma is worth more than 16x its run rate.

From where I sit, looking at both Figma’s results and market comps, it’s not impossible to guess that retail investors will prove willing to pay more for Figma shares. Especially when things like this are going on.

One of my favorite reporters, Anita Ramaswamy has a good analytical run of Figma against a few metric comps that you can read here.

Something not discussed enough in conversations regarding Figma is its AI story; mostly the company is viewed today through the lens of its trailing financial performance. But I wonder if enough folks with smaller accounts will be interested in taking a flyer on Figma because it is busy building out a fleet of AI-powered features. Perhaps.

But no matter precisely how it prices, Figma’s debut will prove that not all post-ZIRP unicorns are feeble. Some, in fact, are the opposite.

For fun, the value of various venture stakes at $28 per share work out to:

Index Ventures: $1,844,234,700

Greylock: $1,721,863,360

Kleiner: $1,543,371,032

Sequoia: $957,226,228

That should make a host of LPs happy, don’t you think?

But wait, there’s more

A few days back we took a look at Ambiq’s IPO filing. The company, recall, designs and sells low-power AI chips that are great for the edge. If you think that AI compute won’t be entirely centralized in massive data centers, Ambiq is a company worth at least your looking into.

When we first looked at the company’s public offering, we noted that it isn’t growing much, a fact due largely to its work to exit the Chinese market where price competition is brutal. Today Ambiq margins are improving as it expands its business in other markets.

The company expects an IPO price range of between $22 and $25 per share, giving it a midpoint worth of around $435 million. If you annualize the midpoint of the company’s Q2 revenue range, Ambiq is being priced at about 3.2x its current run rate. That’s either very expensive — Ambiq won’t be able to grow after working to end its China business — or very cheapo — Ambiq will be able to fully replace its China revenue and more, enjoying margin expansion at the very same time.

Isn’t that uncertainty bad? Sure, to a degree. Figma is clearly a winner in that its numbers are rock solid and you can chart its next few quarters with confidence given its historical data. Ambiq is less certain. Which for investors looking to earn a bit more than the market avearage, could prove interesting.

We’re accustomed today to seeing only fully derisked companies list. Raise a glass for Ambiq offering up a little risk premium to the public markets.

Earnings Watch:

SAP reports today. Alphabet and IBM tomorrow. Intel and MobileEye on Wednesday. Next week we’ll hear from PayPal, Spotify, Microsoft, Meta, Robinhood, ARM, Apple, Amazon, Coinbase, Reddit, Cloudflare and others.

We’re heading into the bazooka of technology earnings that we enjoy every quarter. We’ll have the big numbers for you, and the key earnings call excerpts to boot. Strap in, it’s data time!