Only the aggrieved thrive

And: Just how much money are we talking about?

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Tuesday. While it could be humorous to watch the nation descend into farce, watching theoretically serious fall in line behind specious invective against professional competence is about as encouraging as discovering all your socks developed faith at the same time. But enough bad news! To work! — Alex

📈 Trending Up: Chip leaks … GEO … from the frying pan into the 996 fire … defensetech consolidation … OpenAI’s business business … Copying Ramp

Brex… BYD in the UK … bundling agitgprop and prop betting … AI music … China in Africa … Patreon! …📉 Trending Down: Chip yields … AI SLAs when it rains … Indian oil imports … price wars in China? … domestic chip affordability …disloyalty … US trade deficit …

The last link in Trending Down today (more here) should prove interesting. If POTUS actually levies large tariffs on chip imports, the cost of building domestic AI infra could massively expand. Watch this space.

The Sorcerer’s Stone

I have always wondered at the power of grievance. The undeniable energy of grudge. The potency of pique. Josh at Lux likes to say that chips on shoulders lead to chips in pockets, and he has a point.

Enter Palantir’s second quarter earnings and related discussions. The company’s numbers trailing impressed — beating revenue expectations of $940 million by $60 million — and it raised its guidance in the same report. Now the enterprise-and-government AI and software company expects revenue of between $4.14 and $4.15 billion this year, and free cash flow between $1.8 billion and $2.0 billion.

Even more, Palantir expects to reduce its headcount as it grows, with CEO Alex Karp telling CNBC that its goal is to “10x revenue and have 3,600 people,” down from a self-reported 4,100 today.

The market rewarded Palantir with a valuation bump, adding to its more than 113% gain year-to-date. Palantir has ripped more than 560% higher in the last twelve months. But listen to the company talk about itself and you would think that it was being treated poorly. Instead of, you know, sporting the highest enterprise value/revenue multiple amongst public cloud companies by nearly a factor of three.

Investors call Palantir special every minute of every trading session, and yet reading the company’s CEO letter and earnings call transcript yields:

The skeptics are admittedly fewer now, having been defanged and bent into a kind of submission. Yet we see no reason to pause, to relent, here. — CEO Letter

A reticence or perhaps incapacity to pronounce and to prefer, beyond the shallow and ritualistic shaming of others in the public sphere that masquerades as thought, has had costs. — CEO Letter

There are almost no parasitic elements to this company. We have a small sales force. We have very little BS internally. We have a flat hierarchy. We have the most qualified and interesting people, heterodox in their beliefs. We have an orchestration engine that deploys for deployed engineers everywhere, a model that everyone despised and disdained until literally a quarter ago and thought would lead to a low multiple. Guess you’re wrong. — Earnings call

Only the paranoid survive? Probably — in competitive markets at least. But for Palantir, perhaps we should amend the phrase to only the aggrieved thrive.

Just how much money are we talking about?

Yesterday’s the AI sky is not falling piece missed a key point: That spending is only expected to rise.

The capital expended by hyperscalers today is understandable, given revenue growth (trailing signal) and contracted capacity (leading signal) for AI compute capacity. But while there’s enough proof to undergird today’s AI infra investment, what do we think of this:

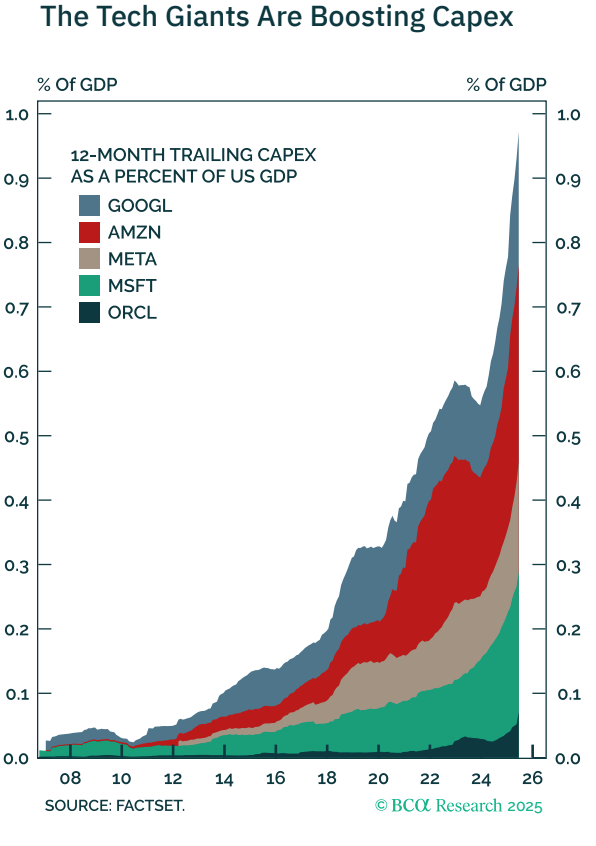

This chart shows 2024’s rapid historical growth in hyperscaler (and Meta) capex. It also shows that after a $90 billion increase in capex in 2024, just four American companies are staring down the barrell of adding another $132 billion to their outlays this year alone. The pace of growth slows, but the dollar amounts just keep getting bigger.

Is that too much? It’s hard to say without some context. One more chart, if you’ll indulge me:

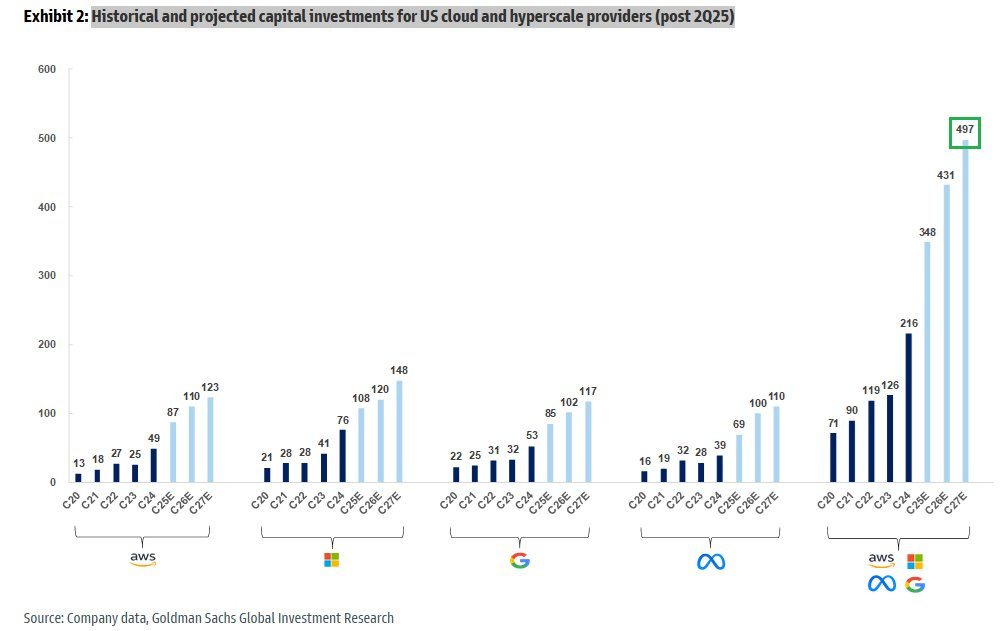

This chart shows the value, in percent of GDP, that the same four companies as before (plus Oracle) are expected to spend on capial expenditures in the coming few quarters. As youy can see, the chart total reaches nearly to 1% by its end, putting it close to the 1.2% figure we discussed yesterday.

Now the question becomes not ‘is current AI infra spend too much and doomed to fail,’ but ‘is near-future AI infra spend too much, especially when viewed through the lens of GDP?’ This is a much clearer question, I think, because it allows us a succint answer: No.

Consider the domestic economy as a company for a moment. If you were CEO of the Great American Corporation, would you allocate 1% of your revenue to building out enough AI infra to support the world’s leading AI industry? Sure, and you’d probably pay twice and still find the deal nice.

When one company buys another, it’s a useful exercise to frame the transaction in terms of market cap scale. So, if Billy Inc. buys Bob Corp. for 25% of its market cap, it’s making a far larger bet than it would be if the deal was just 5% of its worth, whatever the actual dollar-amount is. Big deals in tech-land are 10% of market cap.

We can afford 1% of GDP in 2026 to empower the future digital intelligence of our civilization.

Wait, I’m starting to sound like Alex Karp.

IP-Oh-Yeah

Firefly Aerospace — our initial look at its numbers can be found here — raised its IPO range from $35 to $39 per share to $41 to $43 per share. Given its modest revenues, an anticipated midpoint valuation of around $6.6 billion is insanely bullish. Perhaps Firefly is benefiting from investor interest in SpaceX frustrated by a lack of available shares. Or investors simply see much potential in Firefly’s future. Either way, it’s looking hot for space startups.

Bullish, a crypto exchange that owns the CoinDesk media brand, is targeting a midpoint valuation of $4.3 billion in its own IPO. Again, the number is higher than I might have anticipated given the company’s recent financial performance. But if IPOs are a measure of both past results and investor optimism, Bullish, like Firefly, is telling private companies that they might want to drop their S-1s sooner rater than later.

One More Thing

The Cloudflare-Perplexity brouhaha from yesterday — Cloudflare claims that Perplexity is ignoring website terms that block AI usage of hosted information, Perplexity claims that Cloudflare’s view of its technology is flawed — boils down to one question:

Do websites have a moral requirement to serve, at scale, AI queries for information that began at the behest of humans as they would if that same human arrived via its own browser?

Some folks think that they do, since they serve humans visiting their websites; having an AI intermediary doesn’t change the equation, in their view. Some folks, in contrast, think that an AI service pinging a host of websites en masse on behalf of its customers is, in fact, different than serving humans ad hoc as they arrive under their own steam at the website in question.

Food is the correct analogy here. And friendship. If you come to my house, you are welcome to eat. Anything you want. Raid the freezer. Terrorize the pantry. The refrigerator is your domain. Pig out. Go hog wild.

But if someone said to me ‘you allow people who show up at your house to eat, why can’t I centralize local food demand and send robotic couriers to collect your food and then distribute it to my paying customers while not paying you,’ I would tell them to piss off.

So it goes with websites, online content, allowing humans to browse, but blocking Perplexity.