Palantir crushes expectations, gets crushed in return

And: What ails European startups?

Welcome to Cautious Optimism, a newsletter on tech, business and power.

Tuesday! The newsletter is comically packed today, but before we get into it, what’s going on with Navan? The recent startup IPO had a rough start to public life, falling from its IPO price of $25 to $20. It closed yesterday worth $17.23, and its shares are off again in early trading. Concern that the government shutdown will hamper travel and harm its growth? Or a market that is pulling back from unprofitable tech companies? Whatever the case, the 2025 IPO cycle appears to be losing steam. To work! — Alex

📈 Trending Up: Needed change … gambling … voting in California, New York City, New Jersey, and Virginia … humanoid robotics … China-Russia relations …

nationfake island building…📉 Trending Down: Flying … election security … Shopify stock after earnings … Uber stock after earnings … the free press … Spotify stock after earnings … investment in China …

Things That Matter

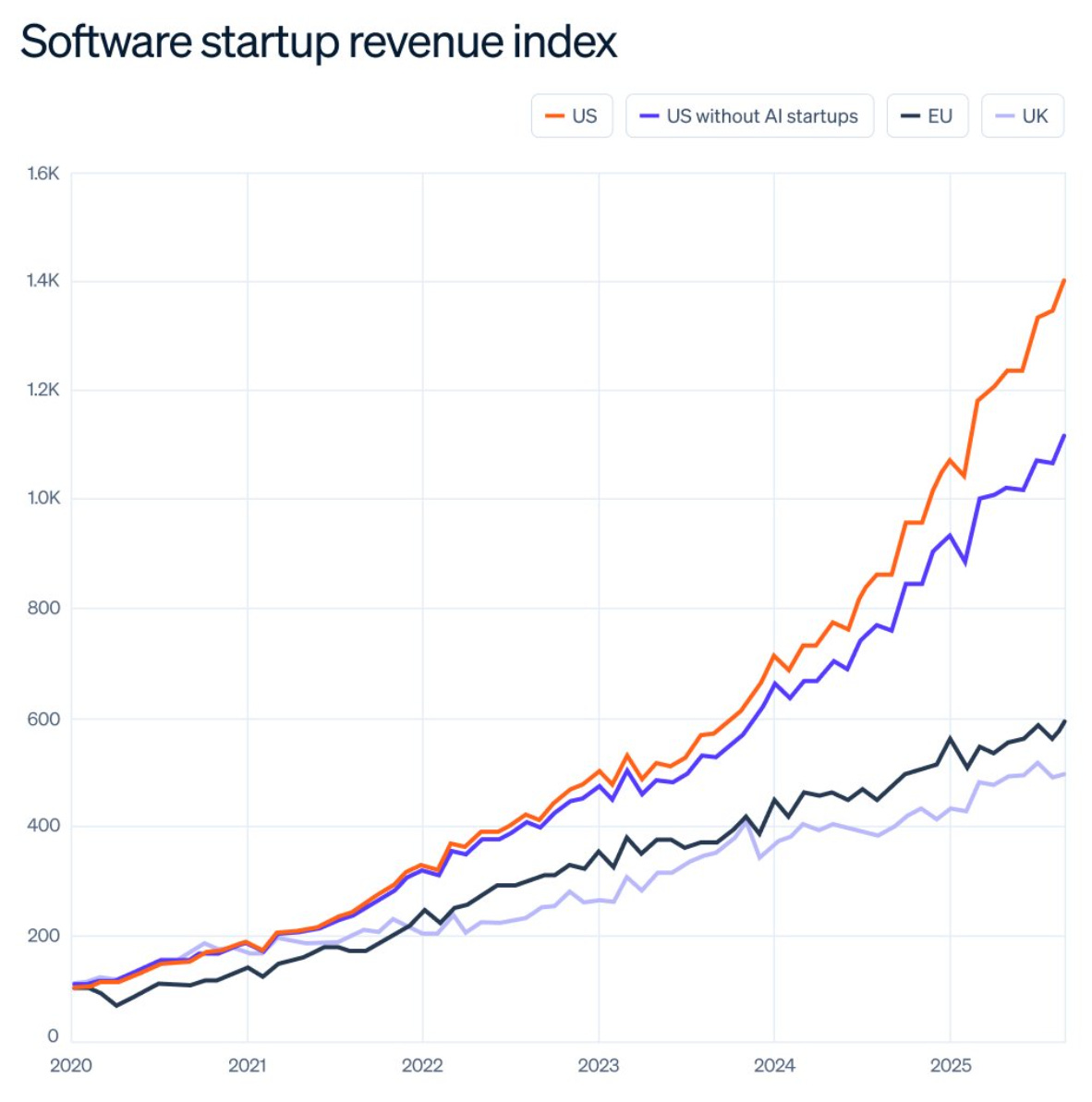

What ails EU startups? Stripe co-founder Patrick Collison shared a brace of charts detailing diverging growth rates between US startups and their rivals in both the UK and the EU. His take on the data? “US startups are pulling ahead of their peers elsewhere,” as they “typically grow somewhat faster than those elsewhere.”

Is the difference AI-predicted? Are a greater share of US startups AI-first than in other markets, reaping outsized growth as payment for quickly adopting and pushing new tech? Yes, and no. Collison shared a second chart, this one breaking out US startups, and US startups sans AI companies, and compared them to the same EU and UK cohorts:

Notably, the US/EU/UK split was somewhat static heading into 2022, at which point US AI startups started to diverge from their domestic non-AI peers. As the AI era continued, US startups pulled away as a group, with those building with AI deviating all the more quickly.

It would be fun to see the UK and EU lines split between AI and non-AI startups, but I think the data is clear enough as-is. So, what’s driving the rising divide? Capital, I reckon. Maybe a bit of regulation, too, but in the United States, there’s so much more capital available for startups that you can’t help but wonder if it’s the ur-issue.

In Q3, global startups raised $120.7 billion. United States-based startups raised $80.9 billion of that total (3,175 deals, or $25.5 million on average), with Europe managing just $17.5 billion (1,625 deals, or $10.8 million on average). Why do startups raise funds? To invest in growth. If you are raising forty cents on the dollar, can you afford to keep up? Can you afford not to?

The compute deals will continue until cash flow improves: After the hyperscalers told the market that they remain compute-constrained, a fresh deluge of data center dealmaking has occurred:

OpenAI tapped AWS for compute worth $38 billion: The multi-year deal includes “hundreds of thousands” of Nvidia GPUs, and the “ability to expand to tens of millions of CPUs” for agentic workloads.

Microsoft tapped IREN for compute worth $9.7 billion: Redmond is not shy about contracting plugged-in GPUs from neoclouds, and the IREN deal is no different. Recall that we framed this transaction as power-predicated yesterday.

Microsoft tapped Lambda for compute worth billions: Redmond is not shy about contracting with neoclouds, this time asking Lambda for “AI infrastructure powered by tens of thousands of NVIDIA GPUs.”

IREN started life as a crypto mining operation, while Lambda was born selling deep-learning workstations. Both pivoted to support third-party AI workloads, which are growing around the world — including India.

OpenAI is serious about India: The American AI company announced plans for an Indian office in August, quickly after it launched ChatGPT Go in the country, a lower-cost subscription plan that came with generous usage limits. India has long been an active consumer of OpenAI products, making it an obvious location for expansion and monetization.

But India, now OpenAI’s second-largest market, is linguistically diverse. So OpenAI has built a new benchmark — IndQA — to “evaluate how well AI models understand and reason about questions that matter in Indian languages, across a wide range of cultural domains.” Per the company’s data, house model GPT-5 Thinking High just pips Gemini 2.5 Pro Thinking for first place on IndQA.

Market pull is one hell of a magnet.

China wants to break from Nvidia: The FT reports that China is halving power bills for some data centers so long as they use domestic chips instead of Nvidia GPUs. The United States only wants to sell lower-tier Nvidia gear to China — the chip company, naturally, resents being told it can’t make more money — and China doesn’t want to operate under Uncle Sam’s whim.

Subsidizing data center electricity costs, higher due to less efficient homegrown silicon, is an expensive way to get Chinese companies to use local chips. But if you frame the cost under a national security banner, it’s cheap! Speaking of which:

If you can’t beat ‘em, join ‘em: The United States’ adventures in state capitalism continue this week, with the government injecting capital into ReElement and Vulcan, two rare earth companies. The terms of the deal include debt, but the taxpayer will soon own $50 million worth of Vulcan and warrants in ReElement.

The list of state interventions into normal business, already long, continues to grow. Why are the same people terrified of a few city-run grocery stores content to let the government seize the means of production?

The market is worried about Palantir’s growth

Two things can be true at once: Palantir’s business results in recent quarters have been incredibly impressive; Palantir’s stock is overvalued.

The market seems to have reached synthesis on the two points in the wake of Palantir’s Q3 2025 earnings. The data analytics company trashed market expectations, but saw its shares fall. Let’s dig in a little.

Palantir Q3 revenue: $1.18 billion, +63% and above expectations of $1.09 billion

Q3 EPS: $0.21 (adjusted), above expectations of $0.17 per share

Powering those results, Palantir’s revenue from the United States grew 77% ($883 million), inside of which its domestic commercial sales rose 121% ($397 million), while its U.S. government revenues grew 52% ($496 million).

The impressive metrics keep coming: Palantir “closed a record-setting $2.76 billion of total contract value” in the quarter, grew its customer count by 45% compared to the year-ago period, and it reported GAAP net income of $476 million, good for a 40% net margin. Hell, Palantir had operating cash flow worth $508 million in the quarter.

So, why are Palantir shares down in the wake of its bonkers earnings? Commentary points to a general risk-off vibe in the market — see: cryptocurrency prices — or a lack of 2026 guidance from Palantir. Maybe. Another good hypothesis is that not only was the Palantir beat priced in, but an even larger beat was priced in. Call it a whisper number if you will. But investors see less upside from Palantir today than they did before, despite raising its full-year revenue, adjusted income, and free cash flow guidance for the year.

The simplest explanation for Palantir’s decline is that even with its outperformance, the company is expensive. Before the open today, Yahoo Finance pegged Palantir’s prices/sales ratio at 137x, up from 25x at the end of Q2 2024, and 36x at the end of Q3 2024. If you valued OpenAI at Palantir’s current multiple (using OpenAI’s $13 billion run rate as a revenue equivalent), it would be worth $1.78 trillion. Anthropic at its current $7 billion run rate? $959 billion, or just shy of a flat trilly.

Two things can be true at once: Palantir’s business results in recent quarters have been incredibly impressive; Palantir’s stock is overvalued.

A great company, seeing its worth soar above its fundamentals, is not to blame any more than a company enduring a worth below the aggregate value of its fundamentals is to blame for the market misunderstanding it in the other direction. However, retail investors affixing a trailing price-to-earnings ratio of more than 600x to a stock had only a single possible outcome, even if Palantir continues to impress.

What other companies do you think have Palantir-like characteristics?