Which AI lab is winning the enterprise?

The knives are growing sharp as OpenAI and Anthropic race to go public

Welcome to Cautious Optimism, a newsletter on tech, business, and power. Modestly upbeat.

Monday. In case you were curious, no, the idea that adding more children after you already have two creates no marginal labor is false. I can confirm, especially after how the family slept (or didn’t) this weekend.

But technology waits for no nap, so we’re back at it this morning. Up top, the SpaceX/xAI/Tesla merger meme is becoming more real, perhaps because xAI simply needs the cash. (Viva la personal conglomerate?) Onward! — Alex

📈 Trending Up: Factories in China … Saudi GDP … Spiritbox … Chinese AI spend … Grok in Indonesia … Waymo’s valuation … Palantir

📉 Trending Down: Education … US population … winning … profits at Disney … the value of gold, silver … safety in Ukraine

Things That Matter

Crypto’s bad weekend: The value of popular digital assets like bitcoin and ether is in decline. Bitcoin was off a little over 11% in the last week, while Ethereum’s token was down 20%, and both lost further ground over the weekend.

XRP, Solana, Dogecoin, and other large tokens are also down in the double-digits over the last week. You can now buy a bitcoin for $77,900, or 22.6% less than it was worth a year ago.

Even setting aside the painful price movements, crypto still managed to have a bad weekend. It turns out that Sheikh Tahnoon bin Zayed Al Nahyan, part of the Abu Dhabi royal family, national security advisor of the UAE, and the man in charge of G42 (AI infra and similar) and MGX (AI investment vehicle), secretly bought 49% of the Trump family’s World Liberty Financial for $500 million.

Half of the money was paid up front, good for $187 million to “Trump family entities,” per the WSJ. Eric Trump signed the deal; current Middle East envoy Steve Witkoff got “at least” $31 million from the transaction (Witkoff’s son is a co-founder at WLF).

So much for crypto beating the money-laundering allegations. (MGX also gifted the POTUS crypto empire $2 billion worth of stablecoin deposits.)

If you were trying to sort out why the Trump administration has been so bent on allowing Middle Eastern monarchies access to high-end American AI chips, you may have a brand new idea!

Oracle dinged for spending money, Nvidia hammered for not: Shares of Oracle fell in pre-market trading today after it told investors it intends to raise between $45 billion and $50 billion to “build additional capacity to meet the contracted demand from our largest Oracle Cloud Infrastructure customers, including AMD, Meta, NVIDIA, OpenAI, TikTok, xAI and others.”

Update: The market changed its mind, and Oracle shares rose after I wrote this section. It turns out that spend or not, you get a stock market bump. What a world!

We already knew that Oracle was spending heavily on AI infra — in its most recent quarter, $2.1 billion of operating cash flow turned into -$10 billion of free cash flow thanks to $12 billion worth of capex. So what’s the big deal?

Well, as we learned with Microsoft, if you keep telling the market you are going to spend a bunch of money on AI, it might get mad at you for actually doing so.

Then there’s Nvidia. The WSJ reported last week that Nvidia’s reportedly not investing $100 billion into OpenAI, and that the originally planned deal is “on ice.”

CEO Jensen Hunag denied the report over the weekend, saying Nvidia isn’t about to stop investing in OpenAI, and that it is planning “probably the largest investment” it has ever made into the company. But the full $100 billion? Probably not. Nvidia is said to be a little worried about OpenAI’s competitors and business focus.

Naturally, on the news that it plans to spend less on AI infra, shares of Nvidia are down a few points this morning.

We’re being puckish in our framing. The market is not being inconsistent. Oracle is spending far in advance of its cash flows to support AI demand from customers; the more it needs to spend to meet its commitments, the greater its indebtedness.

In contrast, the less Nvidia invests in OpenAI, the less healthy one of the leading AI labs likely is. Because Nvidia makes its bread selling chips to AI labs and their backers, any reduction in momentum could imply a closer ceiling to its growth.

Which AI lab is winning the enterprise? Here at CO, we’ve noted that while OpenAI enjoys a massive share of the consumer market, it has a real rival in the enterprise space in Anthropic. If you ask a normie about AI, they are probably thinking about ChatGPT, but if you ask a developer what model they prefer for coding, you’re more likely to hear Claude Opus 4.5.

The OpenAI-consumer, Anthropic-enterprise split has become all the more notable in recent weeks, thanks to the rise of OpenClaw (previously ClawdBot), which most folks that I have spoken to are using Opus to power.

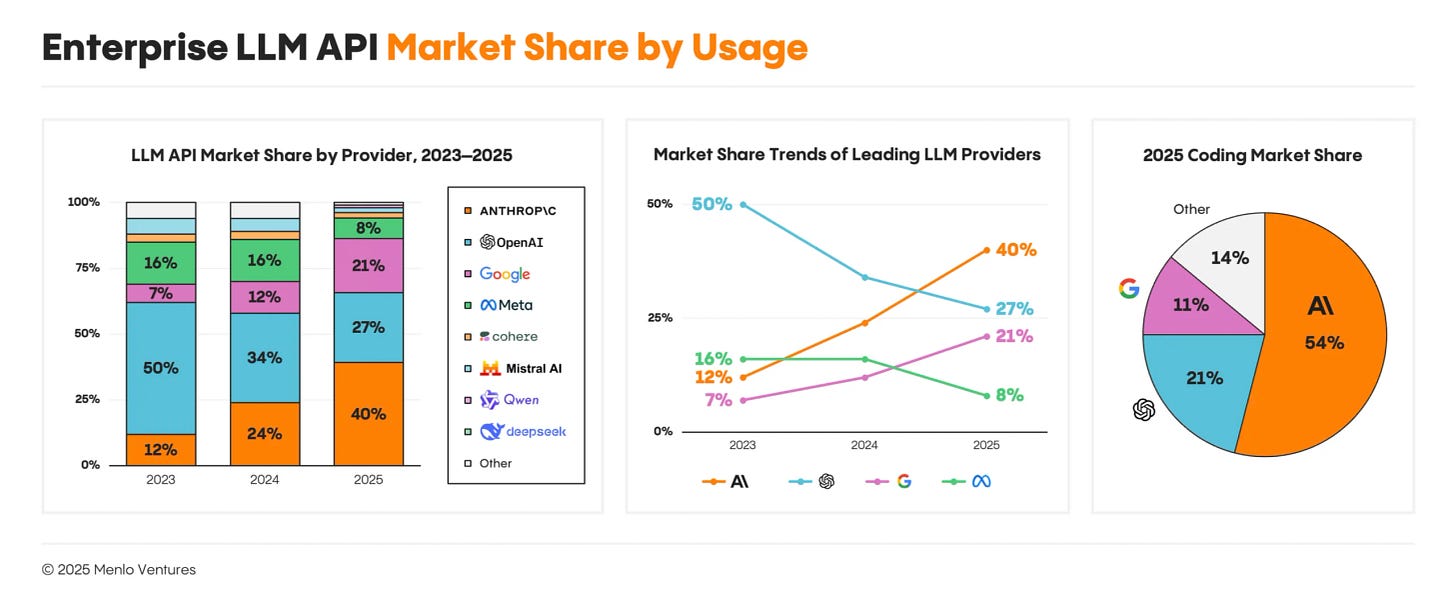

If you thought we cared about Anthropic’s strong position in the enterprise market viz OpenAI, you should hear ChatGPT’s backers talk. After Menlo Ventures (a major Anthropic backer) published an AI report with the following chart, a scuffle of words broke out:

Khosla Ventures’ Ethan Choi was irked by the middle chart showing OpenAI bleeding enterprise share. Khosla is a longtime backer of OpenAI, so seeing a rival venture firm slag their apex investment presumably didn’t go well. Choi wanted to know more about the study and how its data was calculated; Menlo’s Matt Murphy responded with a yawning emoji.

So is this normal venture sniping? Actually, for the venture market in public this counts as high drama.

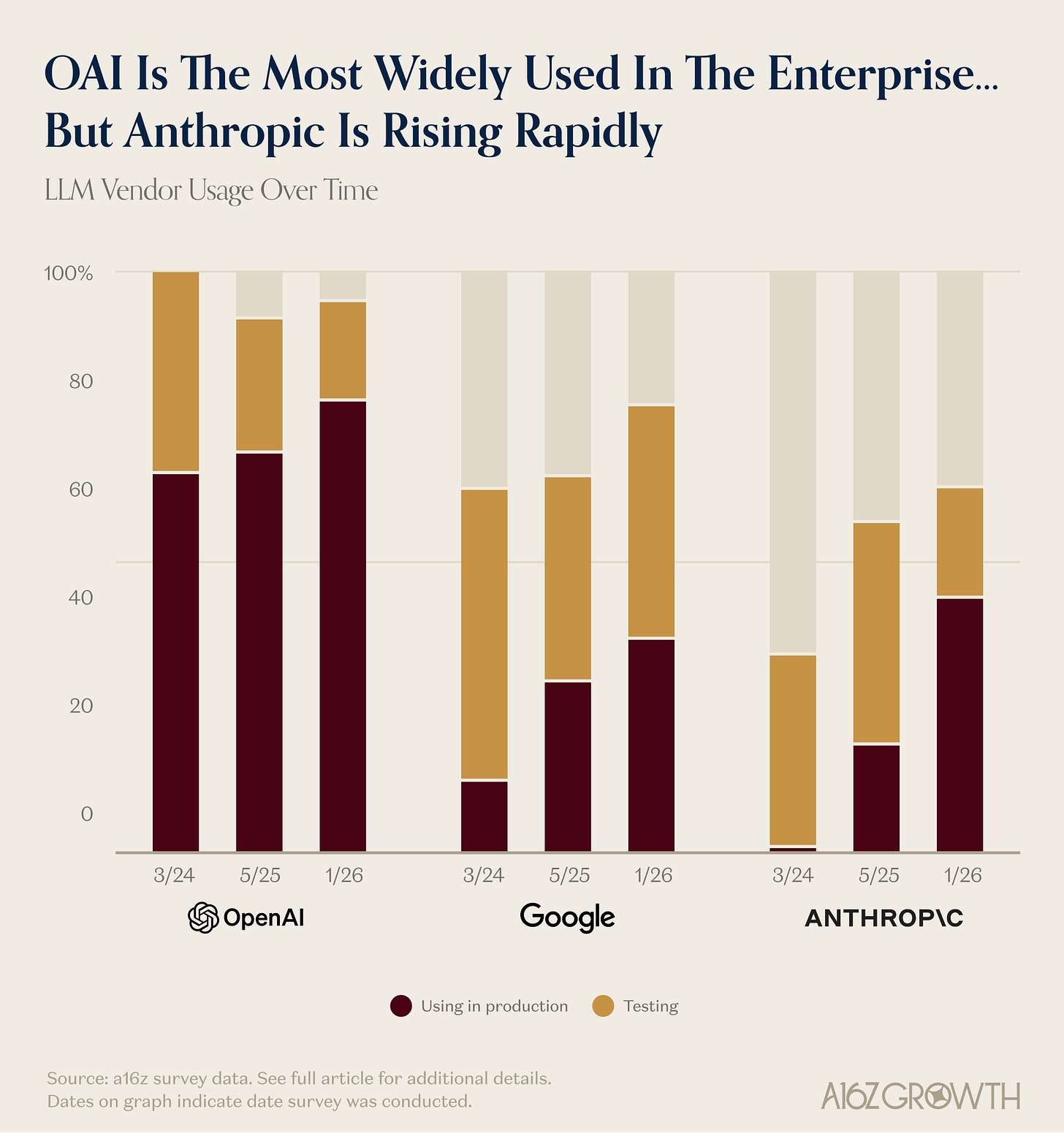

Anyway, the latest is that a16z — an OpenAI backer — dropped its own enterprise AI data with the following chart:

Well, well, well. It seems that both companies are doing well with enterprises. What a shock.

Another chart in a16z’s report indicates that Anthropic is slowly gaining wallet share as OpenAI bleeds the same, but as the pie is growing, I suspect that both companies are doing just fine.

Why bring this up? Do you care about intra-venture beefing over brightly-colored charts? Likely not. But the saga does show how sharp the knives will be as the two American AI labs race to go public; OpenAI wants to go first, recall.

As 2026 rolls along, I fully anticipate that the blood between the two companies will run as cold as it ever has, and we could see the tech world become tribal over the two companies even more than we saw with Ramp and Brex.

I, for one, am here for the food fight.